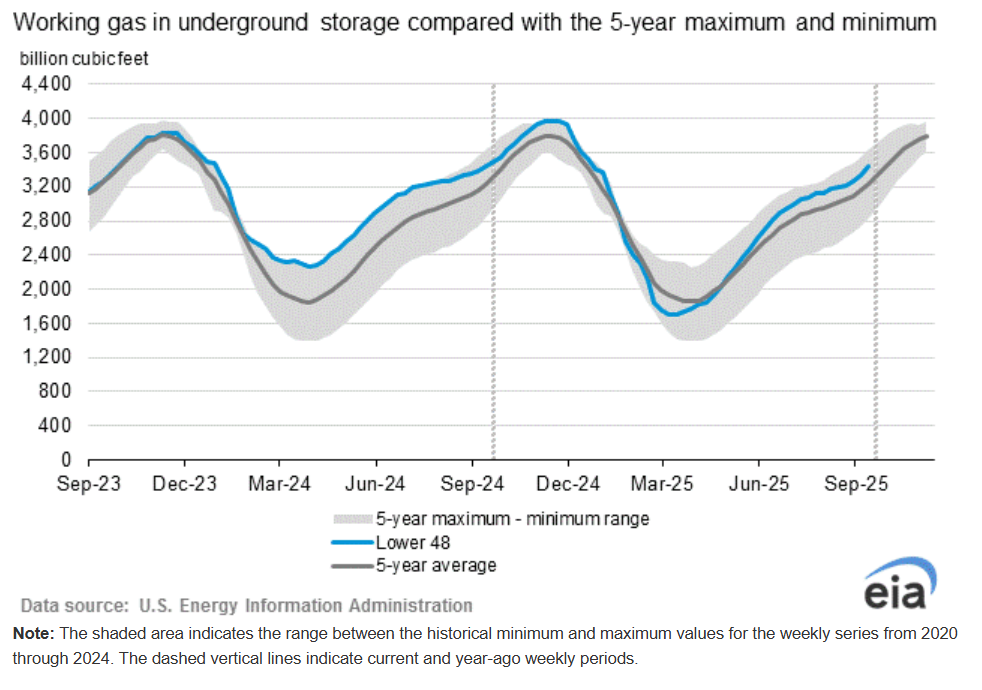

- EIA Natural Gas Storage: 90bn (Expected: 80bn, Previous: 71bn)

Today’s EIA Natural Gas Storage report showed a net injection of 90 Bcf for the week ending. Compared with expectations of around 80 Bcf. This reading is also well above the previous week’s build of 71 Bcf, highlighting stronger-than-anticipated inventory growth. The larger injection reflects continued mild weather conditions that limited demand for both cooling and heating, alongside steady domestic production and firm Canadian imports, which kept supply ample relative to consumption.

Source: US E.I.A

The market reaction is likely to be bearish for natural gas prices, since injections consistently outpacing forecasts point to comfortable storage levels heading into winter. Traders will remain focused on short-term temperature forecasts, as only sustained heat or early cold snaps could offset the current bearish storage trend.

NATGAS Futures decline 2,8% after the publication.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report