US crude inventories have been very stable recently, which is also due to year-end seasonality. However, the decline in inventories at 240,000 bbl is smaller than the expected 1.7 million bbl, but larger than the previous decline of 0.91 million bbl.

Besides, gasoline stocks are up by as much as 3.88 million bbl against an expected increase of 1.8 million bbl, with the previous increase at 4.03 million bbl.

Distillate stocks are up by 2.73 million, expected to rise by 1.6 million bbl with a previous increase of 2.16 million bbl.

Of course, the increase in petroleum products stocks may suggest reduced demand, but on the other hand, refinery capacity utilization increased by as much as 1 pp against expectations of a 0.4 pp increase.

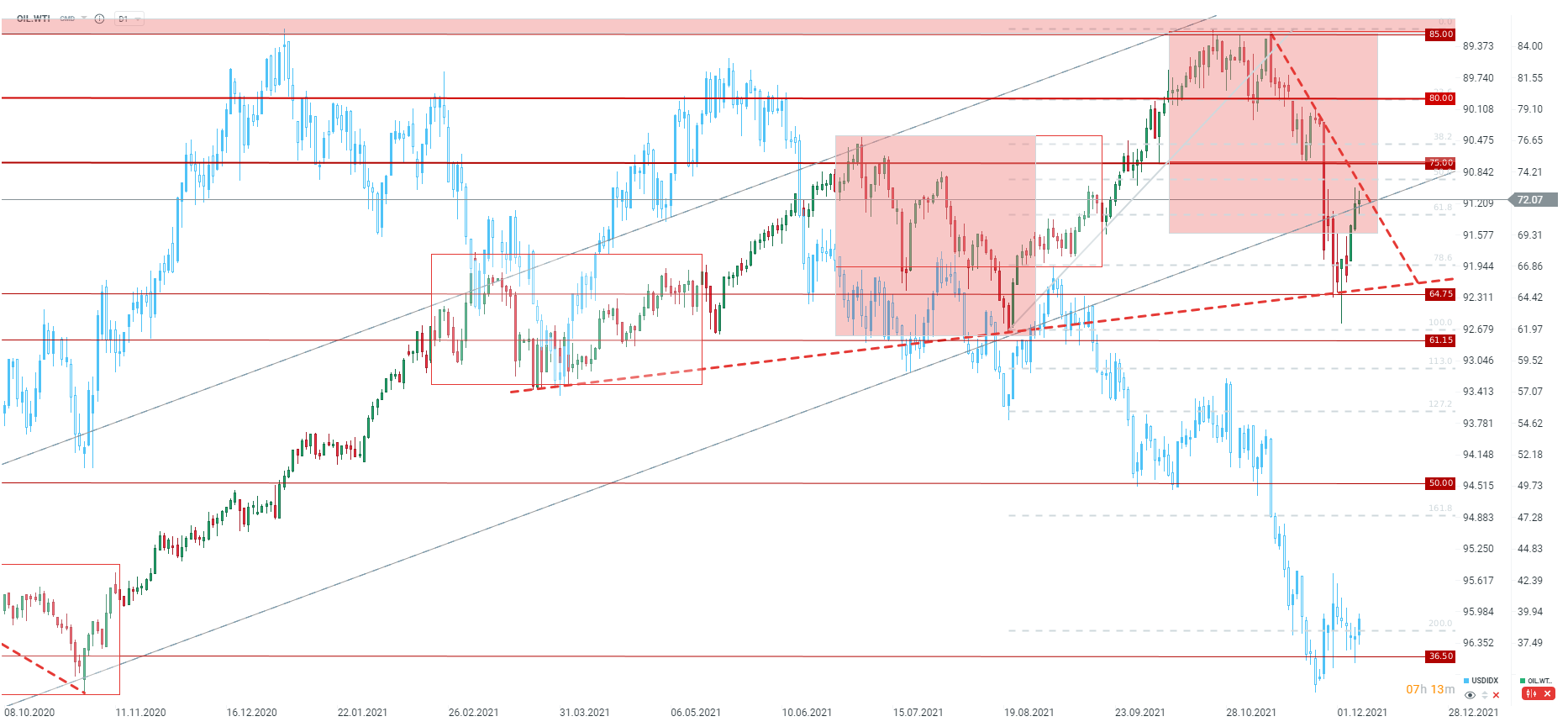

Oil remains high today, although today's report is not one of the bullish ones. Oil faces an important resistance zone in the form of a downtrend line and then the 50.0 retracement along with the 75 level. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?