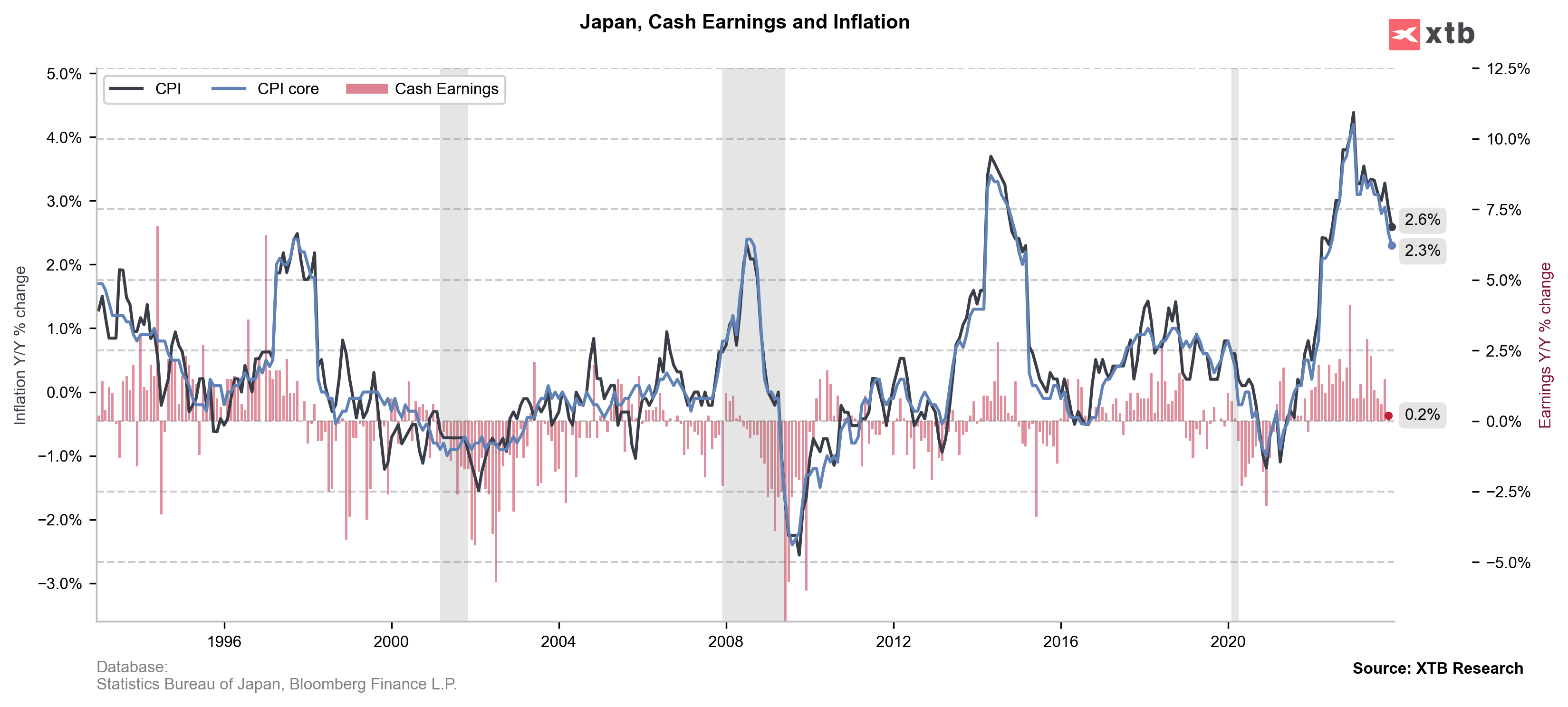

Japan's core inflation in December remained above the Bank of Japan's (BOJ) 2% target but showed a slowdown for the second consecutive month, reinforcing expectations that the BOJ will not rush to end its massive monetary stimulus. The core consumer price index (CPI) rose 2.3% year-over-year, the slowest since June 2022, primarily due to a 11.6% decrease in energy costs and government subsidies. The core CPI index, excluding both fresh food and energy, fell to 3.7% from 3.8% in the previous month, now well below the 40-year peak hit in 2023.

Japan - inflation data for December:

- Core CPI: current 2.3% y/y; forecast 2.3% y/y; previously 2.5% y/y;

- Headline CPI: current 2.6% y/y; previously 2.8% y/y;

The report supports the view that there is no urgent need for the BOJ to make its first rate hike since 2007 at its January meeting, with many economists pointing to April as a more likely time. Cost-push inflation in Japan is easing, as predicted by the BOJ, with consumer price gains in Tokyo also slowing.

Easing inflation, coupled with recent signs of sluggish wage growth, suggests the BOJ will maintain its ultra-dovish policy in the upcoming meeting, despite potential near-term inflationary pressures from increased fiscal stimulus and yen weakness.

Looking at the USDJPY chart, we see that the pair has returned to an upward trend since the beginning of this year. The current upward movement is likely to encounter its first resistance at the 150.000 level, where there is a psychological resistance zone and the lower limit of the last upward trend. Source: xStation 5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes