-

European markets trade slightly higher

-

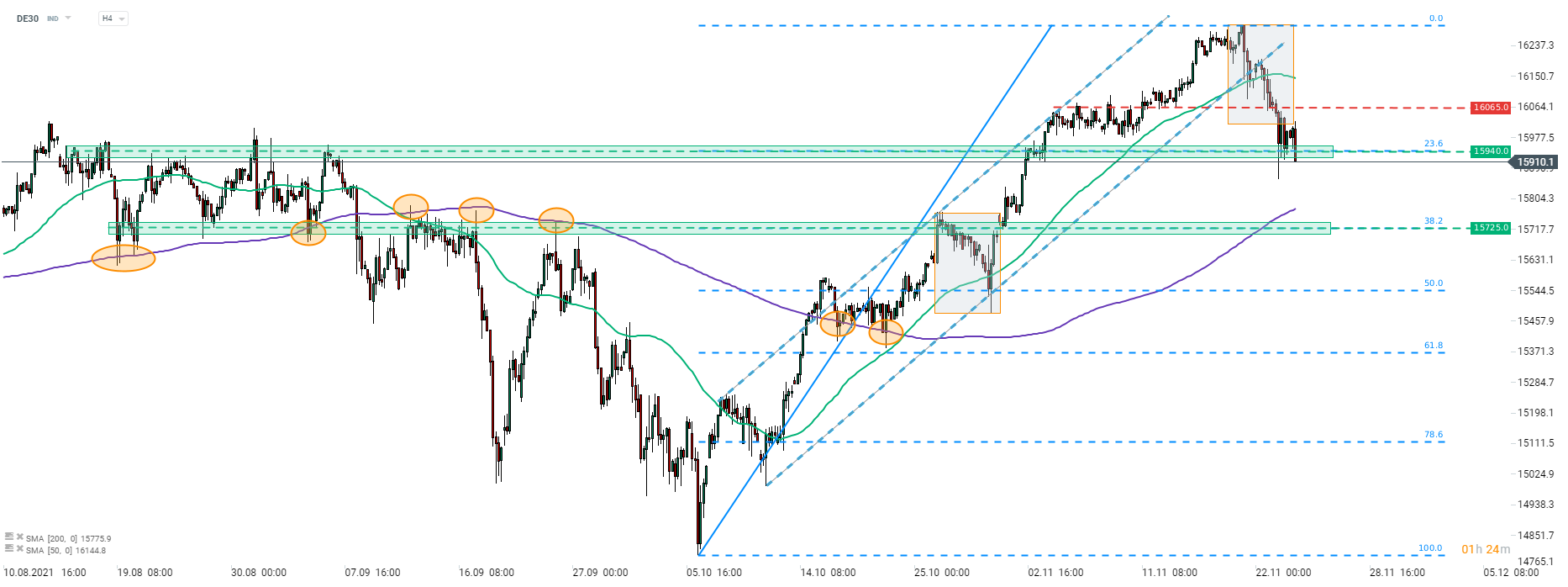

DE30 attempts to break below support at 15,940

-

Draegerwerk slumps on lacklustre 2022 guidance

European stock markets are trading slightly higher on Wednesday. However, DE30 is a laggard among blue chips indices from the Old Continent trading around 0.1% lower at press time. According to media reports, German coalition talks between SPD, FDP and Greens have concluded and an agreement was reached. SPD leader Olag Scholz will succeed Angela Merkel as the next German chancellor. Reuters reports that an official announcement will be made today at 2:00 pm GMT

German IFO indices were released at 9:00 am GMT today. Headline business climate index dropped from 97.7 to 96.5 pts, in-line with expectations. Business expectations sub-index dropped from 95.4 to 94.2 (exp. 95.0) while the current assessment subindex dropped from 100.2 to 99.0 (exp. 99.0). While the data was mostly in-line with market estimates, IFO economists say that it gives a cause for concern. Companies are feeling real pressure from supply bottlenecks and, so far, there are no signs of them abating. They also said that a stagflation is now expected in Germany in Q4 2021.

Source: xStation5

Source: xStation5

Downward correction on the DE30 was halted at the 15,940 pts support yesterday, marked with the 23.6% retracement of the recent upward impulse. However, the index makes another attempt of breaking below the zone today. Should it succeed, declines could deepen. In such a scenario, the first major support to watch will be the 200-period moving average on H4 interval (purple line) that currently runs in the 15,775 pts area. This moving average was tested a few times over the past 3 months (orange circles). Index broke below the lower limit of the local market geometry yesterday suggesting that continuation of the downward move is the base case scenario.

Company News

Shares of Draegerwerk (DRW3.DE) plunged today, following the release of 2022 guidance. Net sales volume is expected to be lower next year, at €3.0-3.1 billion. Company said that it also expects deterioration of gross margins that will negatively impact earnings in 2022. Draegerwerk said that demand for its pandemic-related products have weakened recently and it expects the situation to continue into 2022.

BASF (BAS.DE) boosted prices for palm oil, palm kernel oil and its derivatives in the EMEA region (Europe, Middle East, Africa). Company said that a significant increase in costs is the reason behind the price boost.

Vonovia (VNA.DE) is slumping today as the subscription period for capital increase began today.

EEX, a power and gas exchange operating as a subsidiary of the Deutsche Boerse (DB1.DE), will launch a hydrogen price index in 2022. This will be the first publicly-traded index that tracks the price of hydrogen. Decision comes as the world shifts towards green energy sources. Price data will be derived from the OTC market as well as export/import agreements.

Draegerwerk (DRW3.DE) slumped today at the launch of a cash session, being pressured by lacklustre guidance for 2022. Stock dropped to the lowest level since mid-March 2020 and tested support zone at €57.50, that saw numerous price reactions ahead of the pandemic. Stock started to recover but struggles with breaking above local lows December 2020 and March 2021 (€60.60 area). Source: xStation5

Draegerwerk (DRW3.DE) slumped today at the launch of a cash session, being pressured by lacklustre guidance for 2022. Stock dropped to the lowest level since mid-March 2020 and tested support zone at €57.50, that saw numerous price reactions ahead of the pandemic. Stock started to recover but struggles with breaking above local lows December 2020 and March 2021 (€60.60 area). Source: xStation5

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!