-

European stock markets plummet on travel ban

-

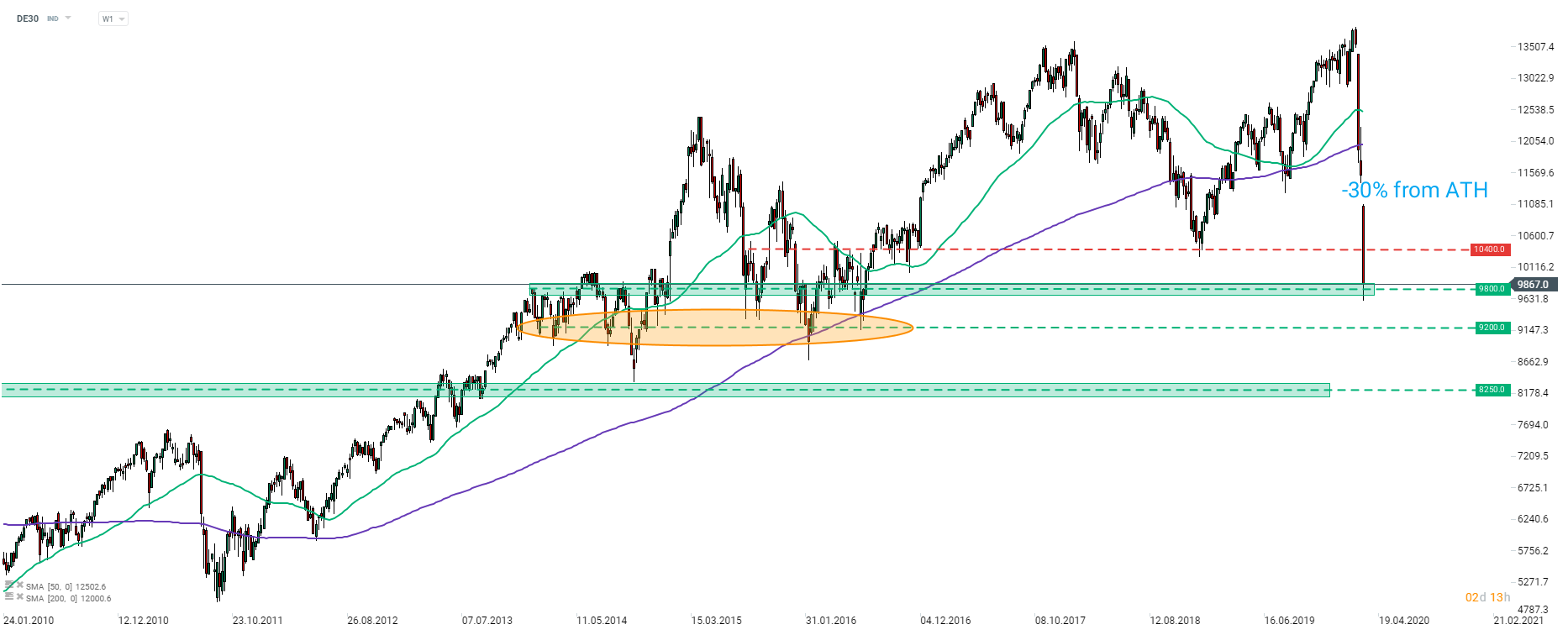

DE30 breaks below 10,000 pts

-

Lufthansa (LHA.DE) tests 2016 low

European markets are in freefall mode after Donald Trump banned Europeans from travelling to the United States. Investors are becoming increasingly nervous as the likelihood of the recession in the global economy keeps rising. Travel sector takes the biggest hit today. ECB rate decision at 12:45pm GMT has the potential to be a market moving event.

Source: xStation5

Source: xStation5

DE30 slumps today and attempts to break below the support zone at 9800 pts handle. Note that the German index has extended a drop from the all-time high to around 30% today! Whether the index breaks below the aforementioned zone or not may depend on what ECB does today. However, the Bank has little room to maneuver therefore scope for a disappointment is huge. Breaking lower would pave the way towards the swing zone at 9200 pts, that often limited downward moves in 2014-2016 period. On the other hand, defending the zone may hint at a rebound towards the resistance at 10400 pts.

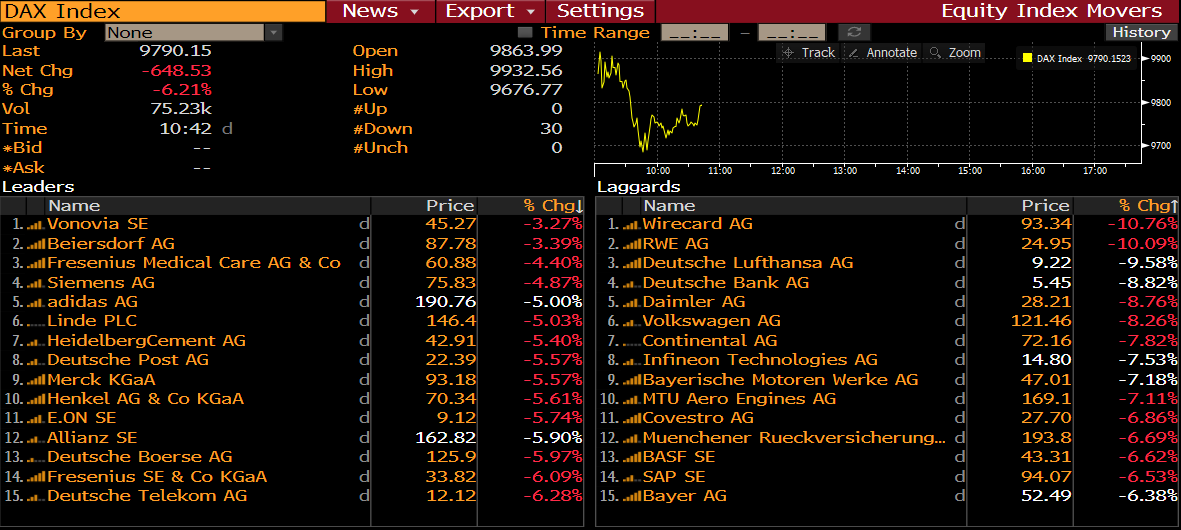

DAX members at 9:42 am GMT. Source: Bloomberg

DAX members at 9:42 am GMT. Source: Bloomberg

Trump’s decision to ban travel from Europe to the United States has exerted enormous pressure on the European travel sector. Travel agencies and airlines see their shares plummet today. Deutsche Lufthansa (LHA.DE) drops around 10% today and tests 2016 low. Fraport (FRA.DE), operator of Frankfurt airport, drops 7%.

RWE (RWE.DE) published 2019 full-year results today. The German utility company generated Ebitda of €2.1 billion in 2019, against expected €2.03 billion. Adjusted net profit stood at €1.2 billion. Company plans to raise dividend from €0.80 to €0.85 in 2020 and aims to record earnings growth of 7-10% from 2020 to 2022. Solid profit in 2019 can be ascribed to gains on commodity trading.

Analyst actions

-

Deutsche Post (DPW.DE) raised to “overweight” at JPMorgan. Price target set at €28.44

-

Bayer (BAYN.DE) raised to “buy” at LBBW. Price target set at €71

-

Beiersdorf (BEI.DE) raised to “buy” at LBBW. Price target at €112

In spite of utilities being labelled defensive stocks, RWE (RWE.DE) does not seem to be favoured by investors. The stock is trading over 25% below late-February peak. Solid full-year results were overshadowed by poor earnings growth guidance. However, share price started to recover after a test of €24 handle. Two resistance levels to watch, should the rebound continue, are €25.75 and €27.30. Source: xStation5

In spite of utilities being labelled defensive stocks, RWE (RWE.DE) does not seem to be favoured by investors. The stock is trading over 25% below late-February peak. Solid full-year results were overshadowed by poor earnings growth guidance. However, share price started to recover after a test of €24 handle. Two resistance levels to watch, should the rebound continue, are €25.75 and €27.30. Source: xStation5

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!