-

European markets recover from overnight losses

-

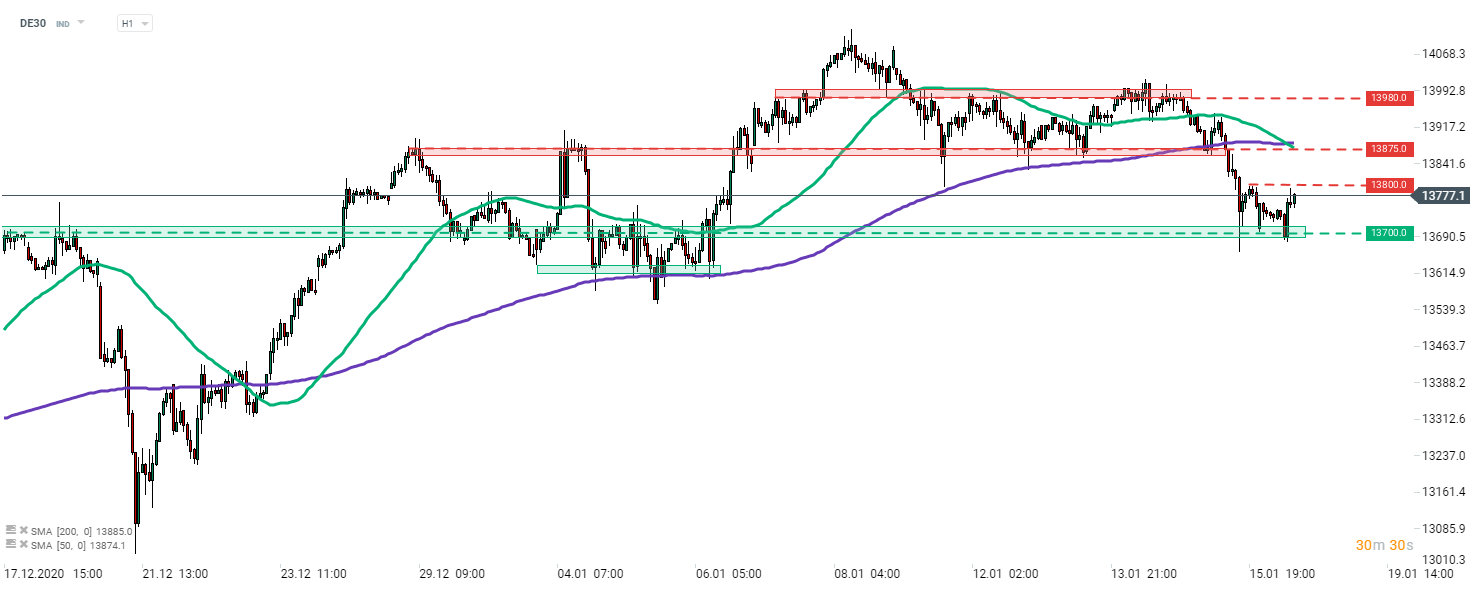

DE30 defended 13,700 pts support zone

-

Bayer explores whether to help CureVac with vaccine manufacturing

European stock markets launched today's trading lower but have managed to recover a bulk of losses and now are trading more or less flat. French CAC40 and UK FTSE 100 trade around 0.2% lower while Italian FTSE MIB (ITA40) trades 0.2% higher. DAX trades flat. Economic calendar is empty today and given holiday in the United States, trading is expected to be muted throughout the day.

Source: xStation5

Source: xStation5

DE30 took a hit at the end of the last week as data from the United States turned out to be disappointing. Declines were halted at the support zone at 13,700 pts and a retest occurred today. However, just as it was the case on Friday, bears were unable to break below. Recovery has been halted near 13,800 pts mark and this is the resistance level to watch in the short-term. A point to note is that the 50-hour moving average (green line) broke below the 200-hour moving average (purple line) painting a pattern known as the 'death cross'. While this is a pattern heralding declines, it should be noted that it is very often a lagging pattern therefore traders should be cautious trying to trade on it.

Company News

According to Werner Baumann, CEO of Bayer (BAYN.DE), his company is exploring options to help CureVac produce a Covid-19 vaccine. Bayer is considering whether to expand partnership with CureVac so it can help the company manufacture a vaccine. Earlier this year, Bayer announced a partnership with CureVac to help develop and distribute the vaccine.

Aareal Bank (ARL.DE) said it expects double-digit million operating loss in 2020 on the back of higher provisions for loan losses.

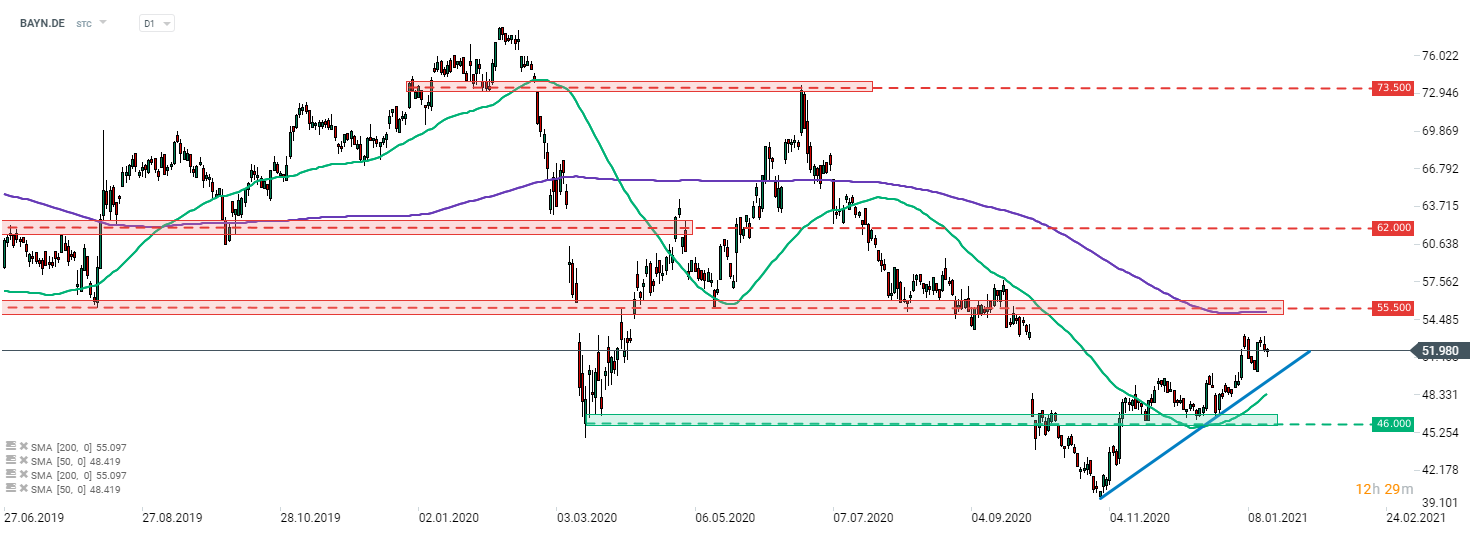

Bayer (BAYN.DE) is trading slightly lower today. However, the stock still remains above the short-term upward trendline. Two levels to watch should we see a resumption of the upward move are a local peak at around €53.15 and the mid-term resistance zone ranging around €55.50, that is additionally being strengthened by the 200-session moving average (purple line). Source: xStation5

Bayer (BAYN.DE) is trading slightly lower today. However, the stock still remains above the short-term upward trendline. Two levels to watch should we see a resumption of the upward move are a local peak at around €53.15 and the mid-term resistance zone ranging around €55.50, that is additionally being strengthened by the 200-session moving average (purple line). Source: xStation5

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!