-

Risk-on moods at the beginning of European session

-

DAX (DE30) jumps above the 13000 pts mark

-

German carmakers trade higher as Ross hints US may not need to impose car tariffs

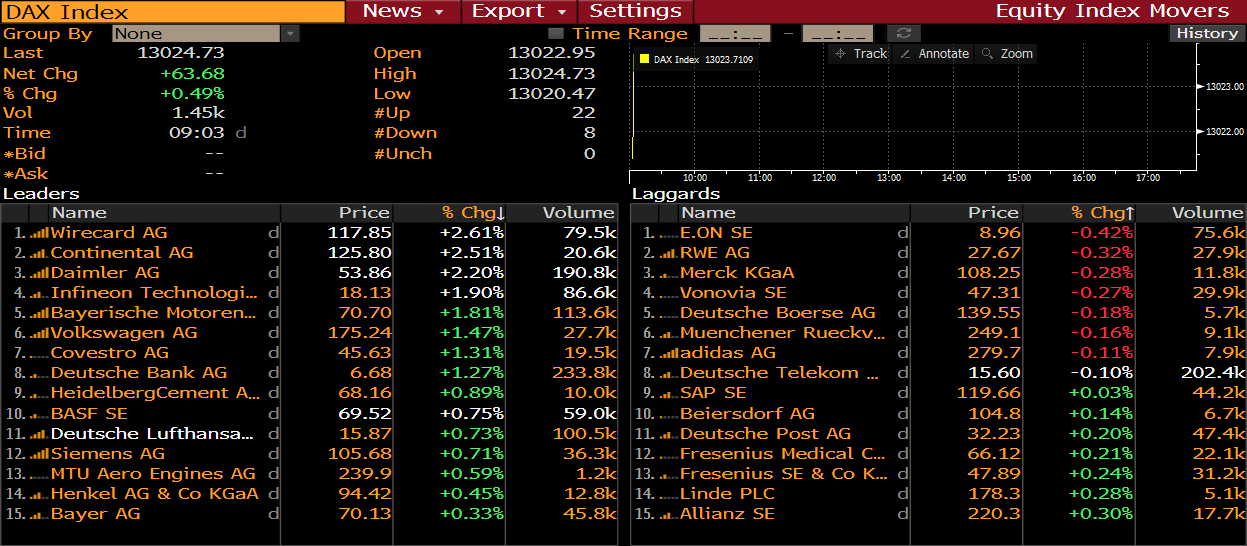

European investors followed into footsteps of their Asian counterparts and showed bigger risk appetite at the beginning of a new week. Stock market indices all across the Old Continent launched Monday’s trade significantly higher with DAX jumping above 13000 pts mark. The biggest gains can be spotted on the Polish and Beligan stock exchanges.

Source: xStation5

Source: xStation5

Rally on DE30 looked to be at risk on Tuesday and Wednesday last week when the index was declining significantly. Nevertheless, bulls showed strength as neither of these dips managed to bring the benchmark below 12825 pts for longer. Run higher was restarted on Friday and after higher opening today, the index is trading above 13000 pts mark for the first time since mid-June 2018. The area in between 12825 and 12870 pts handles can be considered a support zone while bulls’ attention now shifts to the resistance at the double top from May-June 2018 period (13160 pts).

DAX members shortly after session opened. Source: Bloomberg

DAX members shortly after session opened. Source: Bloomberg

Shares of the German carmakers are trading higher at the beginning of a new week. Improvement in moods is a response to the words of the US Commerce Secretary, Wilbur Ross. Ross said that his country held “good conversations” with Japan and the European Union and may not need to impose car tariffs. Let us recall that US agreed in May to delay car tariffs by six months. Stocks to watch: Daimler (DAI.DE), Volkswagen (VOW3.DE), BMW (BMW.DE) and Continental (CON.DE).

Wirecard (WDI.DE) is surging on Monday. Markus Braun, CEO of the German payments company, said that his firm will provide more transparency over its partners during presentation of Q3 earnings by disclosing additional figures. The move is a response to allegations from Financial Times saying that Wirecard inflated sales and earnings. Wirecard is scheduled to publish earnings report on Wednesday.

Karl von Rohr, Deputy CEO of Deutsche Bank (DBK.DE), said that the Bank will start passing negative interest rates on larger corporate clients and deposits of wealthy individuals. Deutsche Bank is another major bank that decided to partially pass burden of sub-zero interest rates on customers. In other news, the Financial Times reported that ECB and BaFin want Christian Sewing to stop serving dual role of CEO and chief of investment bank.

Share price of Deutsche Bank (DBK.DE) plummeted on Wednesday after the company released earnings report for Q3 2019. Sell-off extended to Thursday and was halted in the vicinity of €6.50 handle. The German lender is benefiting from increased risk appetite at the beginning of a new week and is trading higher. However, the first resistance to watch - zone ranging around €7.20 - is still quite far away. Source: xStation5

Share price of Deutsche Bank (DBK.DE) plummeted on Wednesday after the company released earnings report for Q3 2019. Sell-off extended to Thursday and was halted in the vicinity of €6.50 handle. The German lender is benefiting from increased risk appetite at the beginning of a new week and is trading higher. However, the first resistance to watch - zone ranging around €7.20 - is still quite far away. Source: xStation5

Daily Summary: CPI down, Markets Up

3 markets to watch next week (24.10.2024)

US OPEN: Macroeconomic data sends markets to new heights

BREAKING: US PMI above expectations! 📈🔥EURUSD declines!