-

European stocks drop

-

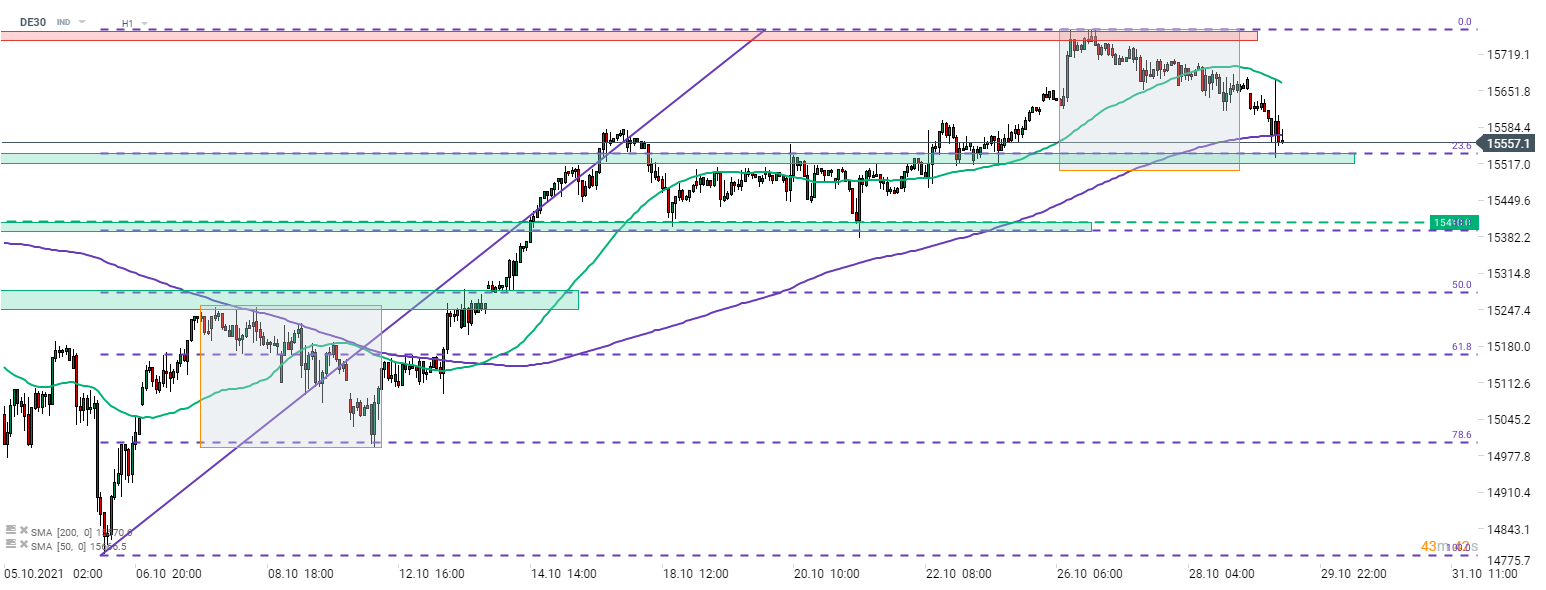

DE30 tests 15,550 pts support

-

Earnings from Daimler, Salzgitter and MTU Aero Engines

Stocks in Europe are trading lower following the downbeat Asian session and weak earnings of US tech companies. Indices from the Old Continent managed to bounce off the daily lows but continue to trade lower. Dutch AEX (NED25) is a top laggard from Western Europe, dropping almost 1%. Polish WIG20 (W20), trading 1% higher, is one of the few blue chips indices that gain.

Source: xStation5

Source: xStation5

DE30 tested the support zone at 15,550 pts this morning but failed to break below. This zone is marked with the 23.6% retracement of recent upward impulse as well as the lower limit of the market geometry and previous price reactions. Index managed to climb back to the 200-hour moving average but struggles to break above. Positive reaction to the 15,550 pts zone suggest that correction may be losing steam and is about to end. It also confirms that the uptrend is still in play. Index saw little reaction to Q3 GDP release from Europe and data scheduled for the later part of the day (US PCE) is expected to have limited impact. 15,550 pts zone is key to watch as break below could hint at potential short-term trend reversal.

Company News

Daimler (DAI.DE) reported 0.5% YoY drop in Q3 revenue, to €40.08 billion (exp. €38.78 billion). Net income 20.4% YoY to €2.47 billion, with EPS reaching €2.31 (exp. €2.36). EBIT increased 17% to €3.58 billion. Company said that it expects supply chain issues to continue to impact output in the Q4 2021 but still expects full-year sales and EBIT to be significantly above 2020 levels.

MTU Aero Engines (MTX.DE) reported a 10% YoY jump in Q3 revenue, to €1 billion, while net income increased from €16 million in Q3 2020 to €87 million now. EPS jumped from €0.28 to €1.62. Adjusted EBIT increased from €87 million a year ago to €117 million now. Company expects a full-year adjusted EBIT margin around 10.5%, up from 10-10.5% in the previous forecast.

Salzgitter (SZG.DE) reported preliminary results for Q1-Q3 2021. Company reported a 32% year-over-year increase in January-September 2021 sales, to €7.0 billion. Pre-tax profit during the period reached €604.5 million, up from a €224.4 million loss last year. Salzgitter expects full-year sales above €9 billion and pre-tax profit of €600-700 million. Full 9-month results will be released on November 12, 2021.

TUI (TUI.DE) completed a €1.1 billion equity offering and will use proceeds to pay down part of government loans.

MTU Aero Engines (MTX.DE) jumped after the release of Q3 earnings but most of today's move have been erased by now and stock is trading little changed on the day. Share price failed to break back above the €192.50 price zone that marks the lower limit of previous trading range. A move towards recent low cannot be ruled out. Source: xStation5

MTU Aero Engines (MTX.DE) jumped after the release of Q3 earnings but most of today's move have been erased by now and stock is trading little changed on the day. Share price failed to break back above the €192.50 price zone that marks the lower limit of previous trading range. A move towards recent low cannot be ruled out. Source: xStation5

Chart of the day: JP225 (27.10.2025)

BREAKING: Ifo Index Slightly Above Expectations. DE40 limits jump from the session start

Morning wrap (27.10.2025)

Daily Summary: CPI down, Markets Up