- Futures contracts indicate a higher opening for today's cash session on European stock exchanges.

- The EURUSD exchange rate is up nearly 0.2% this morning.

The start of the new week on the financial markets begins with slight increases in the prices of most indices/futures contracts based on stock market indices. The calendar for today's session does not contain many publications that could cause a significant jump in market volatility. However, the US CPI report is a key point for the markets this week. After the recent series of weak macro data, investors have begun to factor in a September interest rate cut, as Fed policymakers are also beginning to adopt a more dovish stance.

Concerns about a lower reading are pushing the US dollar down significantly today. The EURUSD pair is gaining nearly 0.20% today. The dollar's weakness is also being driven by comments from Bowman of the Fed, who called for interest rate cuts at all remaining meetings in 2025, citing labor market weakness and inflation risks.

Source: xStation

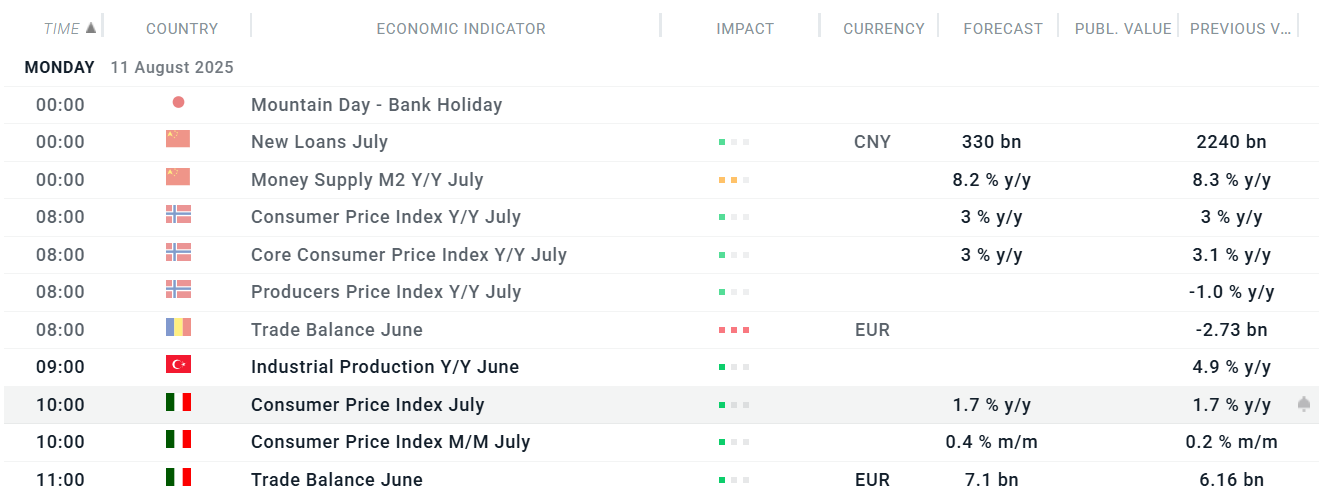

Key data releases scheduled for this week:

Source: Own study, XTB Analysis Departmen

Daily summary: Markets hold breath before Fed, silver rallies above 60 USD (09.12.2025)

Paramount Throws Down the Gauntlet to Netflix in the Battle for Warner Bros Discovery!

Silver nears $60 per ounce 📈

BREAKING: US JOLTS much higher than expected