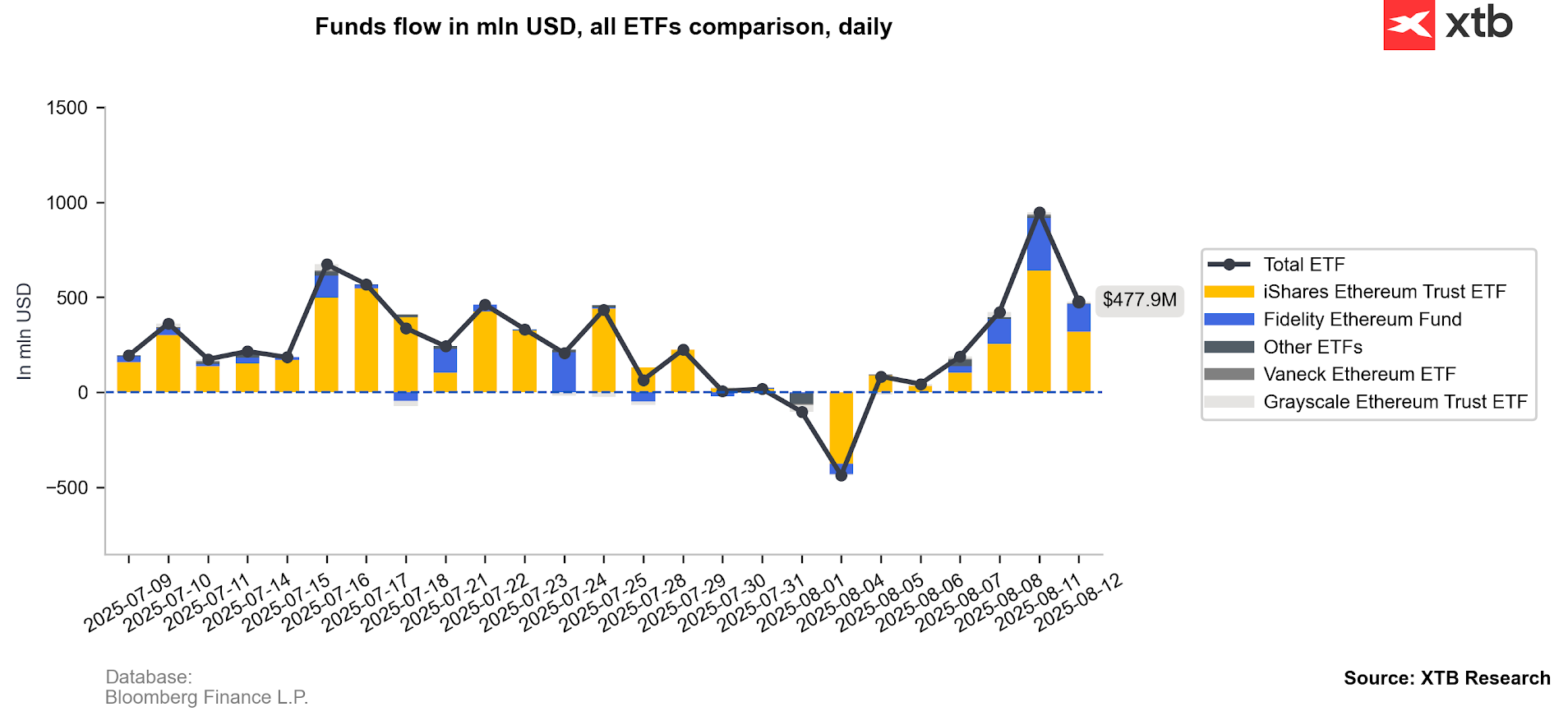

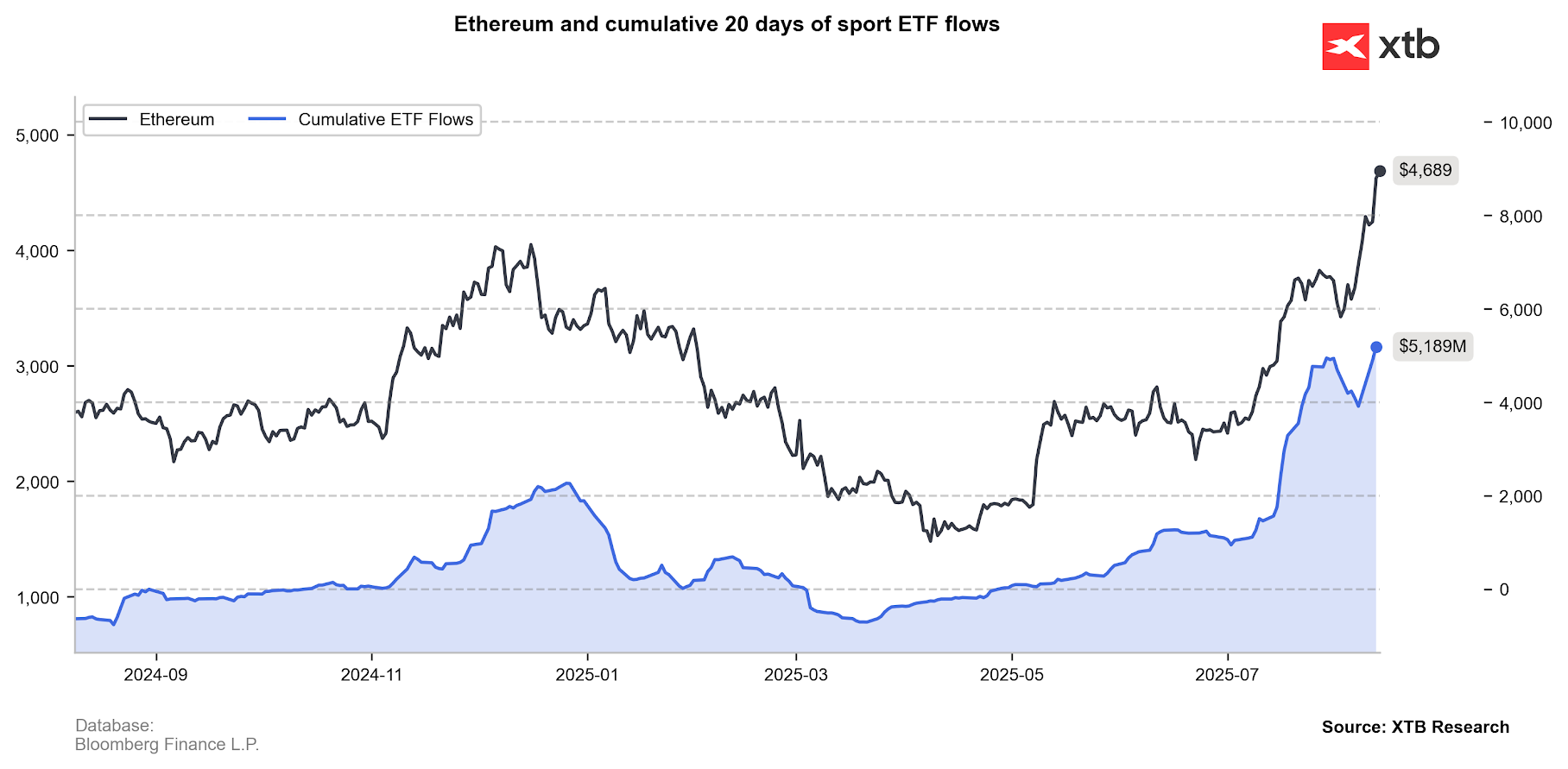

Ethereum is climbing today to nearly USD 4,700, matching the all-time highs from November 2021. Since the beginning of April, the price of ETH has more than tripled, driven by strong inflows into ETF funds and a growing appetite for risk assets. Over the past 30 days, ETH has gained more than 40%, and on Monday, U.S. Ethereum ETFs saw a record net inflow of USD 1.01 billion, compared with just USD 178 million into Bitcoin.

- Demand for Ethereum is supported by the continued weakness of the U.S. dollar and a potential shift in Federal Reserve policy, which could soon begin cutting interest rates (and will almost certainly do so from May 2026). Technological factors are also gaining importance — the ETH blockchain has broad practical applications in tokenization and decentralization trends, boosted by new, industry-friendly regulations in the U.S.

- Bitcoin remains around USD 120,000, while its dominance over smaller cryptocurrencies — so-called altcoins — has been declining for some time. This could signal the start of the so-called altseason, a period when capital flows from Bitcoin into smaller cryptocurrencies in pursuit of higher returns. Historically, this pattern has marked the late, euphoric stage of a bull market, preceding a surge in volatility and panic.

Ethereum (D1 chart)

Looking at the chart, we can see a strong upward trend, with the RSI indicator nearing 80 points, signaling overbought conditions. ETH’s price is in a zone of potentially heavy supply (2021 highs), and if it manages to break above USD 4,800, the path to USD 5,000 and beyond will open.

Source: xStation5

Cumulative inflows into ETH over the past 20 days amount to more than USD 5 billion, and after Monday’s record inflow of over USD 1 billion, yesterday ETF inflow reached also very high number almost USD 480 milllion.

Source: XTB Research, Bloomberg Finance L.P.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report