Financial markets are not going through an easy week. The improvement in economic data in the U.S. and the exhaustion of AI companies are weighing on Wall Street’s main indices, while pushing the dollar to its best week in the past two months. This afternoon, a key figure will also be released: the PCE. Although it has lost some prominence in favor of labor market data, it could add new doubts about the Fed’s next steps.

Although the Federal Reserve cut interest rates by 25 basis points last week due to weakening employment, it is necessary to monitor the evolution of inflation before committing to a more aggressive easing cycle. The release of this afternoon’s PCE data, the Fed’s preferred measure for tracking price trends, will be crucial.

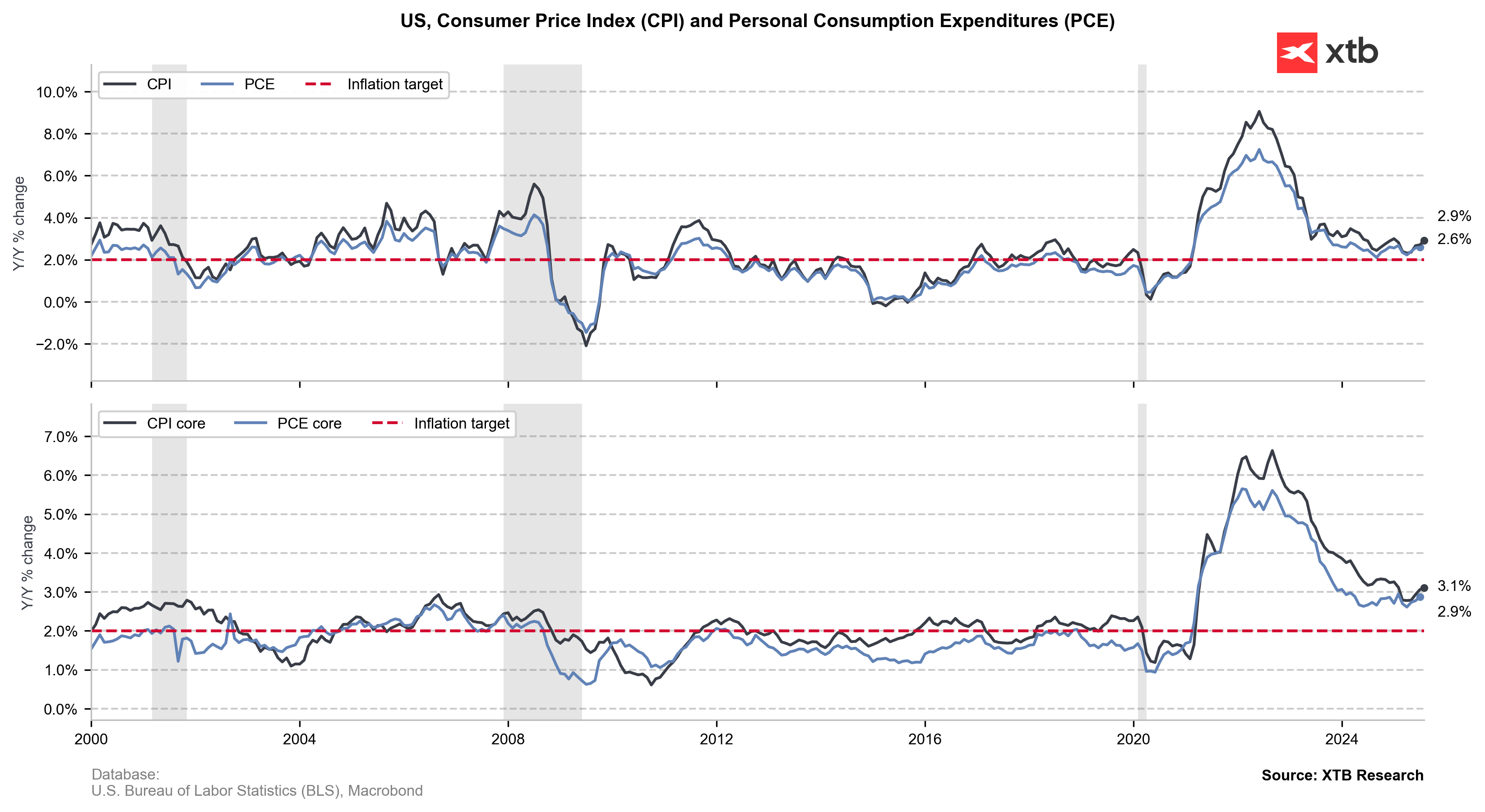

The data is expected to show a slight rebound in price growth in August, even as annual inflation remains stable. The PCE tends to fluctuate more slowly than the Consumer Price Index (CPI), as it reflects consumers switching to cheaper goods when prices rise. It also covers a broader spectrum of spending.

How does the PCE differ from inflation?

When analysing the importance of the PCE, it’s key to understand its differences with inflation as measured by the CPI (Consumer Price Index). The CPI captures only what consumers pay out of pocket. By contrast, the PCE includes all goods and services consumed in the country, whether purchased by consumers themselves, businesses, or the government.

They also use different calculations and weightings. The CPI uses fixed weights generated from a basket that is updated every two years, which does not allow for the introduction of new products or price changes.

The PCE, on the other hand, allows consumers to substitute items each month based on relative prices—for example, switching from beef to chicken if beef prices rise. That is why the PCE tends to grow more slowly, although the effect is relatively small

As a result, the PCE gives less weight to prices that have risen more quickly. Housing is another example of this difference: it currently represents 33% of the CPI basket but only 15% of the PCE. Consequently, the CPI is usually higher than the PCE, as is the case now.

Lastly, there are also methodological differences in the calculation of some products, such as airline tickets. The CPI is calculated using a fixed number of air routes, while the PCE uses data on passenger spending and miles travelled.

What can we expect today?

If the PCE continues to rise, it could give Fed officials pause. A stable or softer reading could help justify two rate cuts before the end of the year. For now, according to Fed Watch, there is an 87% probability of a rate cut in October and a 58% chance of another cut in December. But if the PCE rises above the following levels, everything could change dramatically:

- Core PCE year-over-year: +2.9%, the same pace as July

- Core PCE monthly: +0.2%, below July’s +0.3% increase

- PCE year-over-year: +2.7%, higher than July’s +2.6%

- PCE monthly: +0.3%, higher than July’s +0.2%

These figures come after surprisingly strong revised GDP numbers published on Thursday. The U.S. economy grew at an annualized pace of 3.8% in the second quarter, compared to the previous estimate of 3.3%, recovering from a -0.5% contraction in the first quarter. That earlier decline was due to a surge in imports ahead of tariff changes announced by President Donald Trump—a drag that dissipated in recent months as trade flows normalized.

Given strong economic growth, the Fed’s focus remains on inflation and labor market weakness. Tariffs remain a risk, but so far they have not triggered the feared inflationary shock, although Trump continues announcing new measures, as he did today with medicines, furniture, and trucks. In addition, rate cuts, dollar weakness, and immigration policies are factors to consider in price developments.

On the other hand, yesterday Donald Trump commented that Fed rate cuts should be the base scenario ‘even along with great economic data’, which may signal that even if the Federal Reserve this year will be more cautious on inflation, the next year may be fundamentally different, with the new, nominee by Trump Fed chair and dovish policy, oriented on lower debt financing costs. In the long term, strong US economic data usually point to a stronger stock market.

Market expectations

Any deviation from expectations will have consequences in financial markets. We believe the key will mainly lie in the monthly core PCE growth figure. An increase in the monthly core PCE from 0.3% to 0.4% should negatively impact Wall Street indices, especially technology and small-cap stocks, with corrections potentially exceeding 1% in a single day. Meanwhile, gold and silver could continue their long-term upward trend, and the dollar could keep strengthening as it has in recent days. Today we can see that EURUSD tries to rebound after the yesterday sell-off.

Attention will also need to be paid to bond yields. Higher inflation expectations that limit the Fed’s ability to cut interest rates could generate significant growth in debt yields. On the other hand, if PCE data will be weaker than expected, we expect a stock market rebound with US500 potentially rising above 6700 pts level.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS