US labor market data came in poorly. Despite expectations for a reading of around 75,000, the change in employment was ultimately 22,000. The July data was slightly revised upwards, but the net two-month change was already negative. This indicates that the labor market is in increasingly poor condition. The unemployment rate rose as expected to 4.3% year-on-year, while wage dynamics slowed to 3.7% year-on-year.

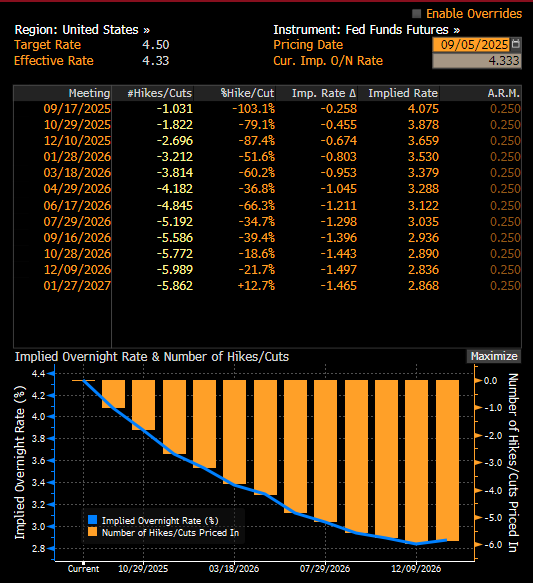

This data clearly suggests that the Fed must cut interest rates at its September meeting. Even if August inflation surprises with a higher reading, it is important to remember that the Fed has a dual mandate: price stability and maximum employment. In his last speech, Jerome Powell indicated that the labor market has clearly weakened, which determines a possible adjustment to monetary policy. Nevertheless, the current data may suggest that the Fed is already late with cuts and that a significant economic slowdown could occur, necessitating a deeper cut. A September rate cut is currently priced in at 100%.

September cut is almost certain and the market is pricing nearly 3 cuts this year. Source: Bloomberg Finance LP

Lower interest rates and increased risk of a slowdown or recession are good news for gold, which is a safe-haven asset. Gold is up around 1% today, testing the area of $3,580 per ounce. The $3,600 level is reinforced by the 127.2 Fibonacci retracement of the last major downward wave. Support for gold in the event of a correction is at $3,500 and $3,430 per ounce.

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report