- The political crisis in the US and rising geopolitical tensions are supporting gold prices.

- Prediction market Kalshi suggests the government shutdown will last around 15 days.

- BofA Global Research has shifted its forecast for a Fed rate cut from December this year to October.

- The political crisis in the US and rising geopolitical tensions are supporting gold prices.

- Prediction market Kalshi suggests the government shutdown will last around 15 days.

- BofA Global Research has shifted its forecast for a Fed rate cut from December this year to October.

Gold is gaining over 0.5% while the US dollar weakens. Expectations for Federal Reserve rate cuts are rising amid a weakening labour market and the absence of NFP data, caused by furloughed government staff at the BLS.

- Anticipation that the Fed may ‘not want to risk’ delaying a lifeline for the labour market after weak ADP figures is boosting demand for safe havens, weighing on the dollar.

- BofA Global Research has shifted its forecast for a Fed rate cut from December this year to October.

- Prediction market Kalshi suggests the government shutdown will last around 15 days.

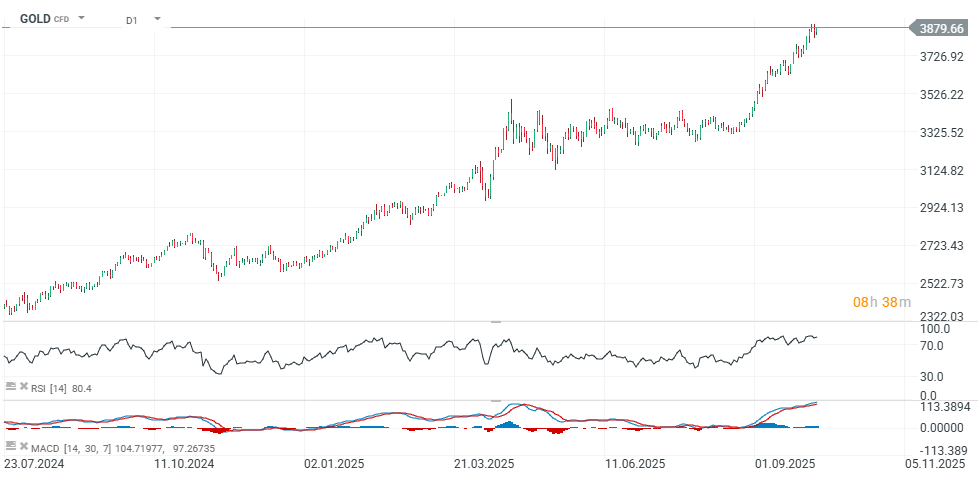

As a result, gold continues its strong rally, approaching $3,900 per ounce. The RSI on the daily chart has surpassed 80, aligning with several previous local peaks in the metal’s price.

Source: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)