- Kalshi prices in more than 22 days of US government shutdown

- Gold surges more than 1.5% to 3950 USD per ounce

- Sanae Takeichi win boosts chances for dovish monetary policy in Japan

- Kalshi prices in more than 22 days of US government shutdown

- Gold surges more than 1.5% to 3950 USD per ounce

- Sanae Takeichi win boosts chances for dovish monetary policy in Japan

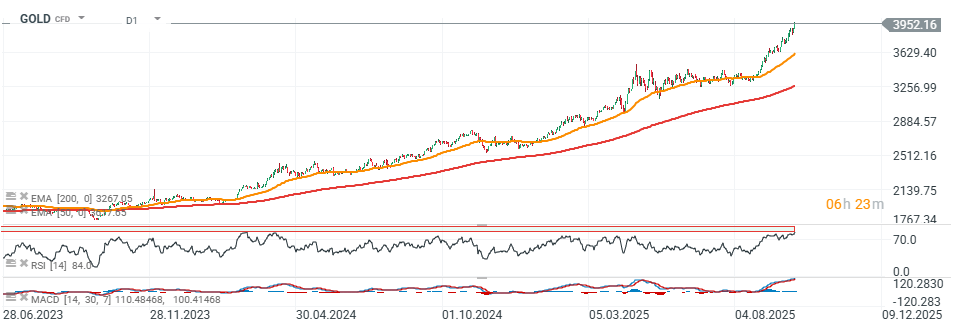

Gold prices continue their nearly uninterrupted upward streak, gradually approaching the $4,000 per ounce mark. The RSI indicator climbed above 84 today, signaling overbought conditions — levels last seen at the turn of 2023 and 2024. Interestingly, gold prices are rising despite a stronger U.S. dollar and climbing bond yields, which have increased by more than 3 basis points to nearly 4.16%.

Still, investors are pricing in a faster rate cut in the United States, with odds for October now increasing. Meanwhile, political tensions are also emerging abroad — in Japan, where the victory of a party favoring loose fiscal policy and exporters could shape future policy, and in France, where the government has been dissolved.

In the U.S., the government shutdown has entered its sixth day, and Kalshi markets now estimate it could last over 22 days.

GOLD (D1 timeframe)

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause