Summary:

-

MPC members Carney, Haldane and Tenreyro conduct inflation report hearings

-

Governor Carney: “MPC doesn’t have a forecast for no-deal”

-

GBP a little higher despite earlier construction data miss

It’s been a busy start to the week for sterling traders with the GBP coming under pressure following a series of negative news stories. GBPUSD gapped lower after comments from Barnier that he "strongly opposed" UK PM May's proposals on future trade while advising European carmakers that they will have to use fewer British-made parts after Brexit before both the manufacturing (yesterday) and construction PMI (this morning) saw further selling. One potential source of hope for pound bulls was this afternoon’s inflation report hearings, with MPC members Carney, Haldane and Tenreyro all testifying following the bank’s decision to raise rates last month.

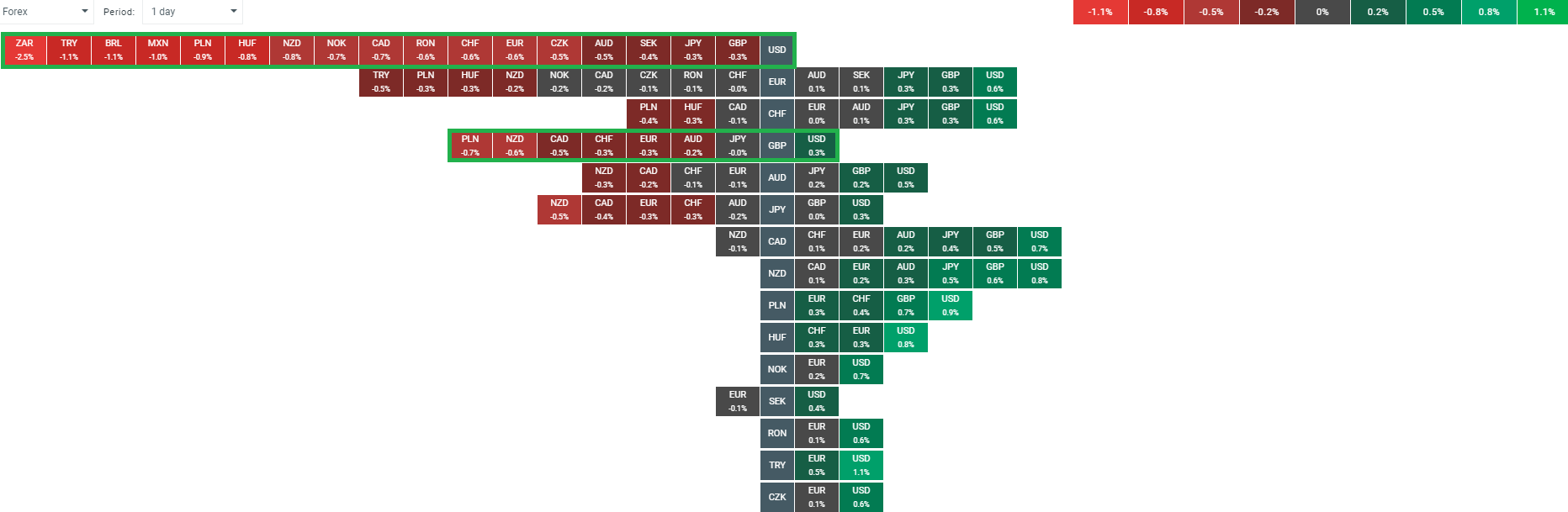

There haven’t been any major revelations from the questions and answers but it has seemingly helped stabilise the pound a little. While the GBPUSD rate dropped to its lowest level in over a week this morning the heatmap on xStation reveals that this was actually almost entirely due to a strengthening of the buck rather than pound weakness. The buck is appreciating against all of its peers on the day with the GBP actually the second strongest.

The heatmap reveals that the GBPUSD decline today is entirely due to USD strength, with the GBP actually the second strongest currency on the day, despite the earlier soft construction PMI data. Source: xStation

Some of the most noteworthy comments from the MPC members are shown below, with the emphasis ours:

Carney

-

MPC doesn’t have a forecast for a no-deal Brexit

-

The economy is still operating as if there will be a deal

-

Less than 20% of firms are putting in contingencies

-

A no-deal, no-transition deal is an extreme scenario

-

Willing to extend my tenure at BoE beyone June 2019

Haldane

-

Odds of a no-deal Brexit at about 25% compared to 20% a few months ago but this is still broadly inline with where they were 1 year ago

Tenreyro

-

Private sector wage growth has been relatively high

We earlier commented on the GBPUSD following the UK construction PMI data, so let’s now look at two other pairs involving the pound; EURGBP and GBPNZD

EURGBP

Last week saw a bearish engulfing candle on W1 which could be seen to represent a key reversal. The recent high just below 0.91 now becomes potentially key resistance and unless this is broken above then a pullback towards the 0.87 level may lie ahead. Source: xStation

GBPNZD

This pair has reached its highest level in 3 ½ months today as the market moves back above the 1.96 level. There has been several large up days in recent trade and this shows some strong buying pressure. Price is now not too far from longer term resistance going back to the tail-end of last year at 1.9835 and this could be worth keeping an eye on going forward if there is any further upside in the coming sessions. Source: xStation