Micron is up 10% today to $153 per share after Citi raised its price target to $175 (from $150).

The upcycle in the memory market remains intact thanks to high barriers to entry, thus limited supply, and stronger-than-expected demand — especially from data centers and AI. Micron will report its fiscal Q4 results on September 23. Citi expects results roughly in line with consensus (~$2.62 EPS on $11.2bn revenue), but guidance clearly above expectations, driven by higher DRAM and NAND volumes and pricing. Citi’s FY26 EPS estimate is 26% above consensus.

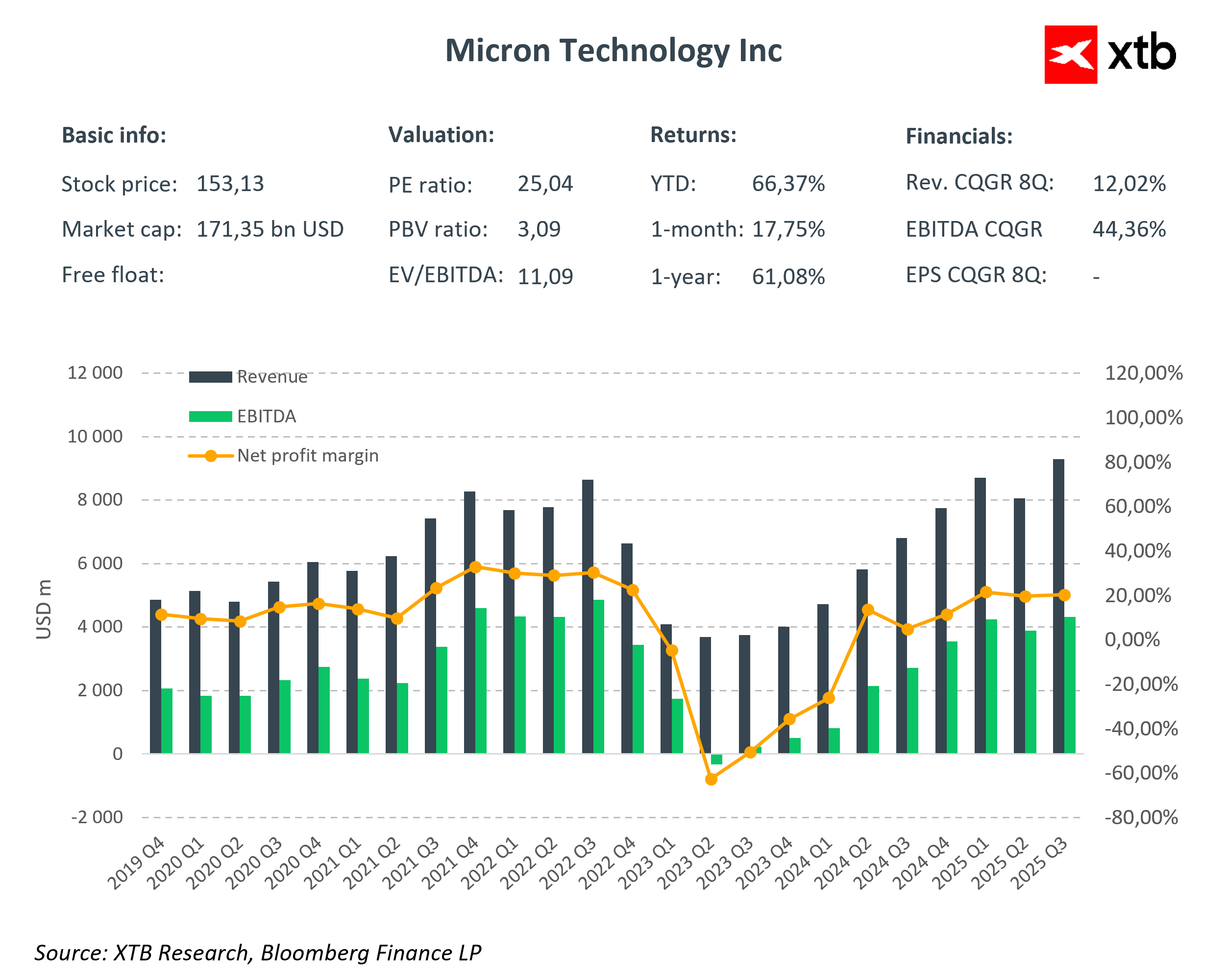

Micron financial dashboard

Morgan Stanley estimates that AI-related NAND demand could reach 34% of the global market by 2029, expanding TAM (total addressable market) by ~$29bn. As a leading NAND supplier, Micron has the opportunity to become a leader in the enterprise SSD segment.

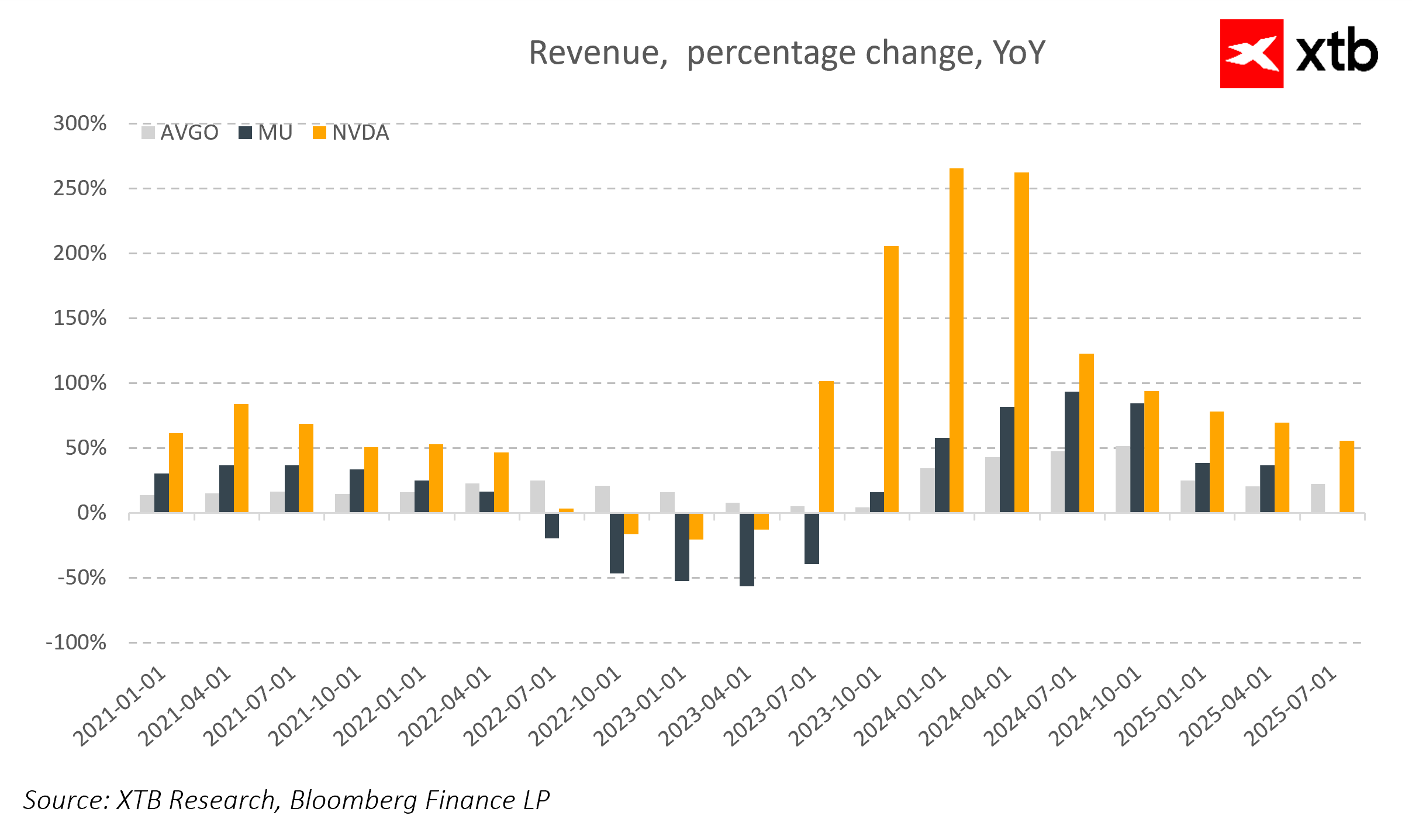

Micron’s revenue momentum has been significantly stronger in recent quarters, though still far below Nvidia in absolute terms. However, forecasts for 2026 appear optimistic for the company.

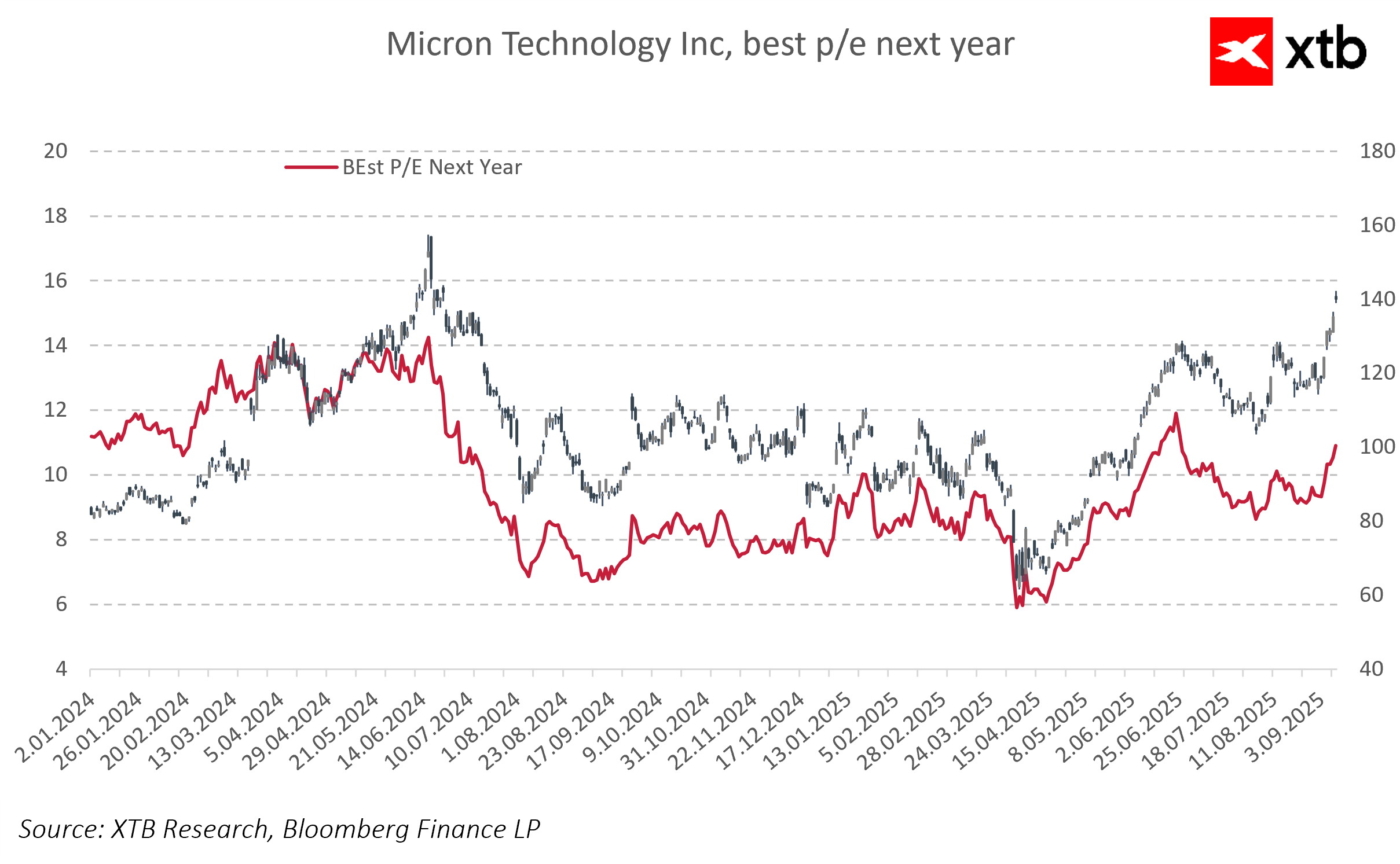

Valuation also does not appear overly stretched. Forward PE for next year stands at just around 11 compared with the current PE above 25.

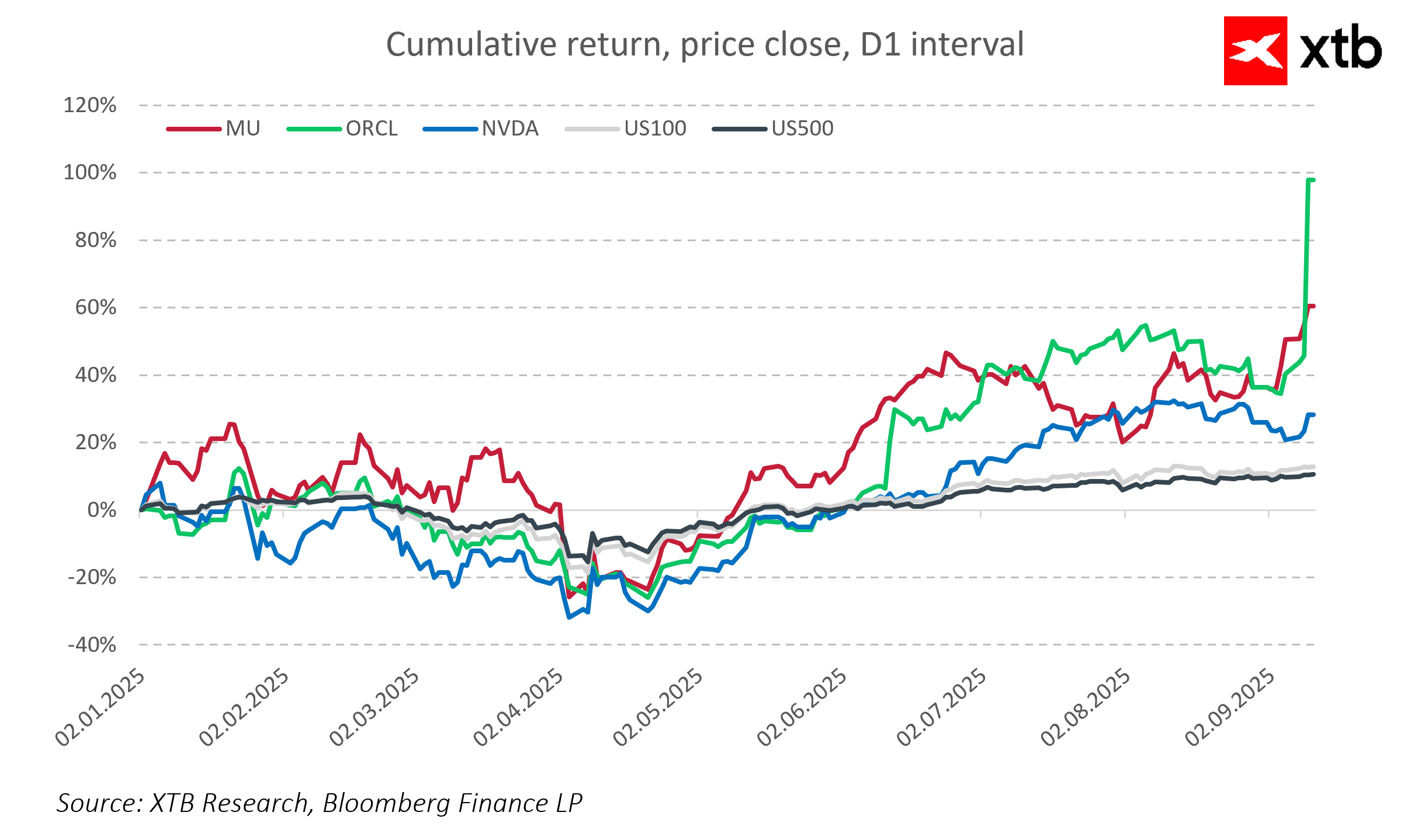

Micron is up 10% today and already more than 60% year-to-date — comparable to other semiconductor peers and clearly outperforming the US500 and US100 indices.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street