*Natural gas (NATGAS) prices are undergoing a dynamic correction, moving away from last week's highs of $5.5/MMBTU and testing key support around $4.3. Importantly, bearish sentiment persisted even despite the publication of a bullish EIA report.

Key conclusions:

-

The market ignores historical data: The EIA report showed a massive decline in inventories of -177 bcf (compared to forecasts of -166 bcf and the previous reading of -12 bcf). Although this reflects the cold start to December (the coldest since 2017), the market is already discounting the future, not the past. The downward reaction to such a strong reading is a sign of weak speculative demand.

-

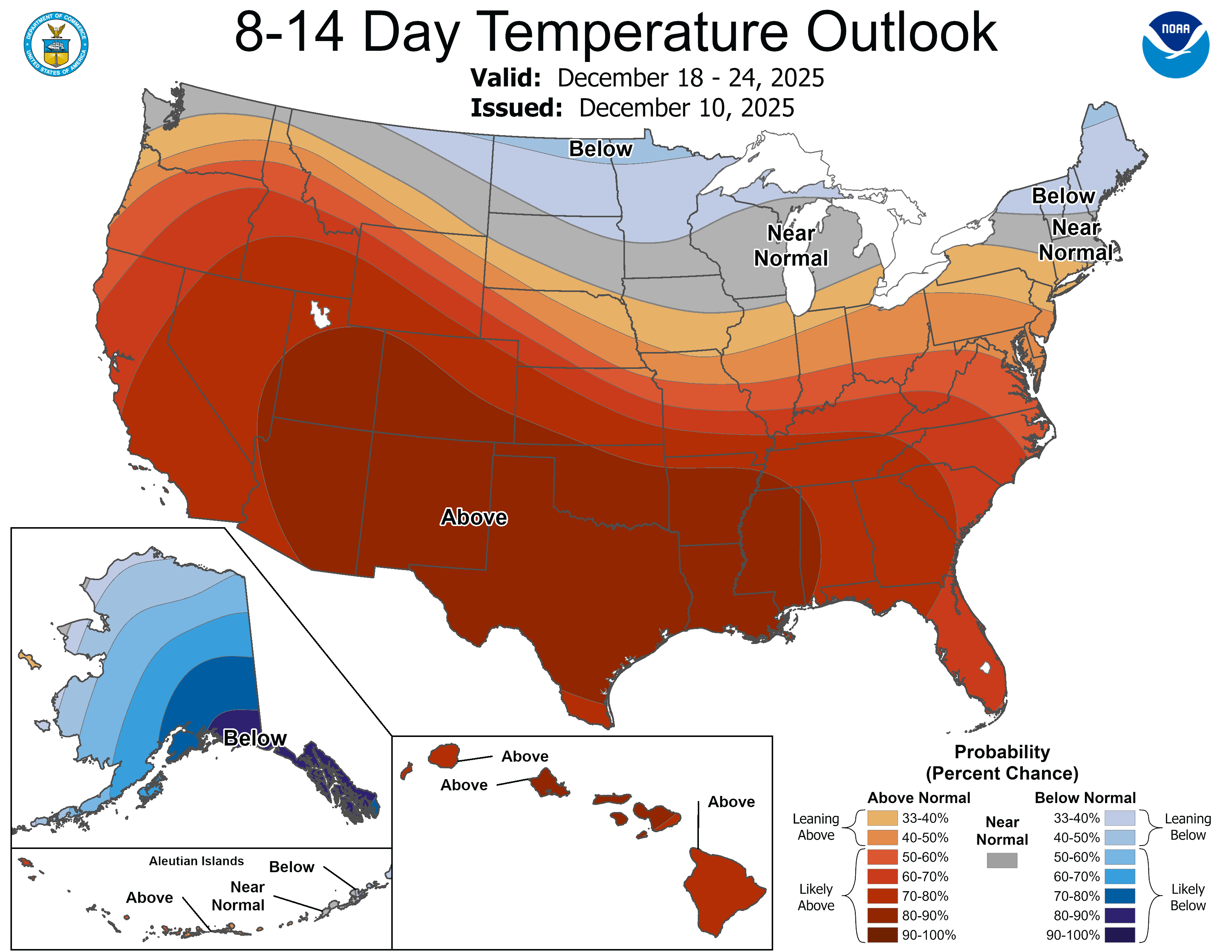

Weather front change: The main catalyst for the sell-off is the update of weather models (NOAA). Forecasts for the second half of December indicate the arrival of a heat wave moving from west to east across the US, which will drastically reduce the number of heating degree days (HDD) during the key period.

Sources: NOAA

-

Supply remains a burden: Record gas production in the US represents a ceiling for growth once weather pressures ease.

-

Technical situation: The price is testing support at $4.3/MMBTU, coinciding with the 50-day exponential moving average, which the market has not tested since 20 October. Interestingly, however, the RSI indicator for the last 14 days does not indicate that the instrument is oversold.

Source: xStation

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets