Oil futures (OIL) are declining today, reflecting a combination of key market developments; year-to-date oil brent prices are down more than 15%. Firstly, sources indicate limited risk of a direct U.S. attack on Venezuela, though they do not rule out such action in the future. Secondly, Saudi Arabia lowered its oil export prices to Asia, while OPEC slightly increased production, raising concerns about a potential record oversupply in 2026. Earlier, President Donald Trump said his goal is to bring U.S. gasoline prices down to $2 per gallon.

U.S. Rules Out Ground Attacks in Venezuela — For Now

Officials from the Trump administration informed Congress on Wednesday that the United States is not currently planning ground attacks in Venezuela and lacks legal justification for such operations, according to sources familiar with the briefing.

The meeting included Secretary of State Marco Rubio, Defense Secretary Pete Hegseth, and a representative from the White House Office of Legal Counsel (OLC).

- The Justice Department’s legal opinion allowing strikes on suspected drug-smuggling vessels at sea does not cover attacks on land targets in Venezuela or other countries in the region.

- However, the administration plans to request a new legal opinion that could permit limited military action without Congressional approval, though no final decision has been made.

- Since September, the U.S. military has conducted 16 strikes on suspected drug boats in the Caribbean and eastern Pacific, resulting in at least 67 deaths.

- These operations are based on intelligence linking the vessels to 24 Latin American cartels and criminal organizations.

- Senator Mark Warner acknowledged the strength of U.S. intelligence capabilities but questioned the use of lethal force instead of interdiction procedures typically employed by the Coast Guard.

- Other lawmakers, including Gregory Meeks, raised concerns about the legality of the operations and the lack of presented evidence directly linking the targets to drug trafficking.

- Administration officials insist that every strike follows a thorough, multi-stage intelligence process and emphasize that the current U.S. military presence in the Caribbean, including the USS Ford carrier strike group, supports counter-narcotics and reconnaissance operations, not preparations for direct strikes on Venezuelan territory.

The U.S. Senate is scheduled to vote today on a War Powers Resolution aimed at blocking unauthorized military action in Venezuela. The proposal, introduced by Senator Tim Kaine (D-Virginia) and co-sponsored by 15 lawmakers from both parties, calls for ending the use of U.S. armed forces against Venezuela unless Congress formally authorizes military action or declares war.

Saudi Arabia Cuts Oil Prices to Asia to 11-Month Low

- Saudi Aramco has lowered the December price of its flagship Arab Light crude for Asian buyers by $1.20 per barrel, setting it at a $1 premium to the regional benchmark — the lowest level in 11 months.

- The cut follows the OPEC+ decision to pause planned production increases in the first quarter of 2026, reflecting caution amid signs of oversupply.

- Saudi Arabia and other key producers have temporarily halted additional output hikes after a modest increase in December, citing weaker seasonal demand and the impact of U.S. sanctions on Russian oil exports.

Aramco also reduced prices for Medium and Heavy grades by $1.40 per barrel, and for Super Light and Extra Light by $1.20 for Asian customers. Prices for North American buyers were cut by $0.50 per barrel, while European and Mediterranean prices remained unchanged.

OPEC Output Rises Slightly in October

According to a Bloomberg survey, OPEC increased crude production by 50,000 barrels per day in October, reaching 29.07 million barrels per day. Rising output from Saudi Arabia, Iraq, the UAE, and Kuwait was partially offset by declines in Libya and Venezuela, which together reduced production by about 120,000 barrels per day.

- The month marked the first stage of a gradual supply restoration under the OPEC+ agreement, as Saudi Arabia and key allies continue to revive 1.65 million barrels per day of output previously halted since 2023.

- Earlier this year, Riyadh surprised markets by bringing back 2.2 million barrels per day of production in a bid to regain market share, contributing to a 14% drop in Brent prices so far this year.

- The International Energy Agency (IEA) now warns of a potential record surplus in 2026. OPEC+ members agreed last week that after the December increase, they will pause further hikes in Q1 2026 in response to weakening market conditions. Saudi Arabia alone boosted output by 40,000 barrels per day in October, reaching an average of 10.02 million barrels per day.

The next meeting of OPEC+ members involved in production adjustments is set for November 30, alongside a full 22-nation OPEC+ session to outline strategy for 2026. Today, crude futures are down nearly 1%, trading around $63 per barrel.

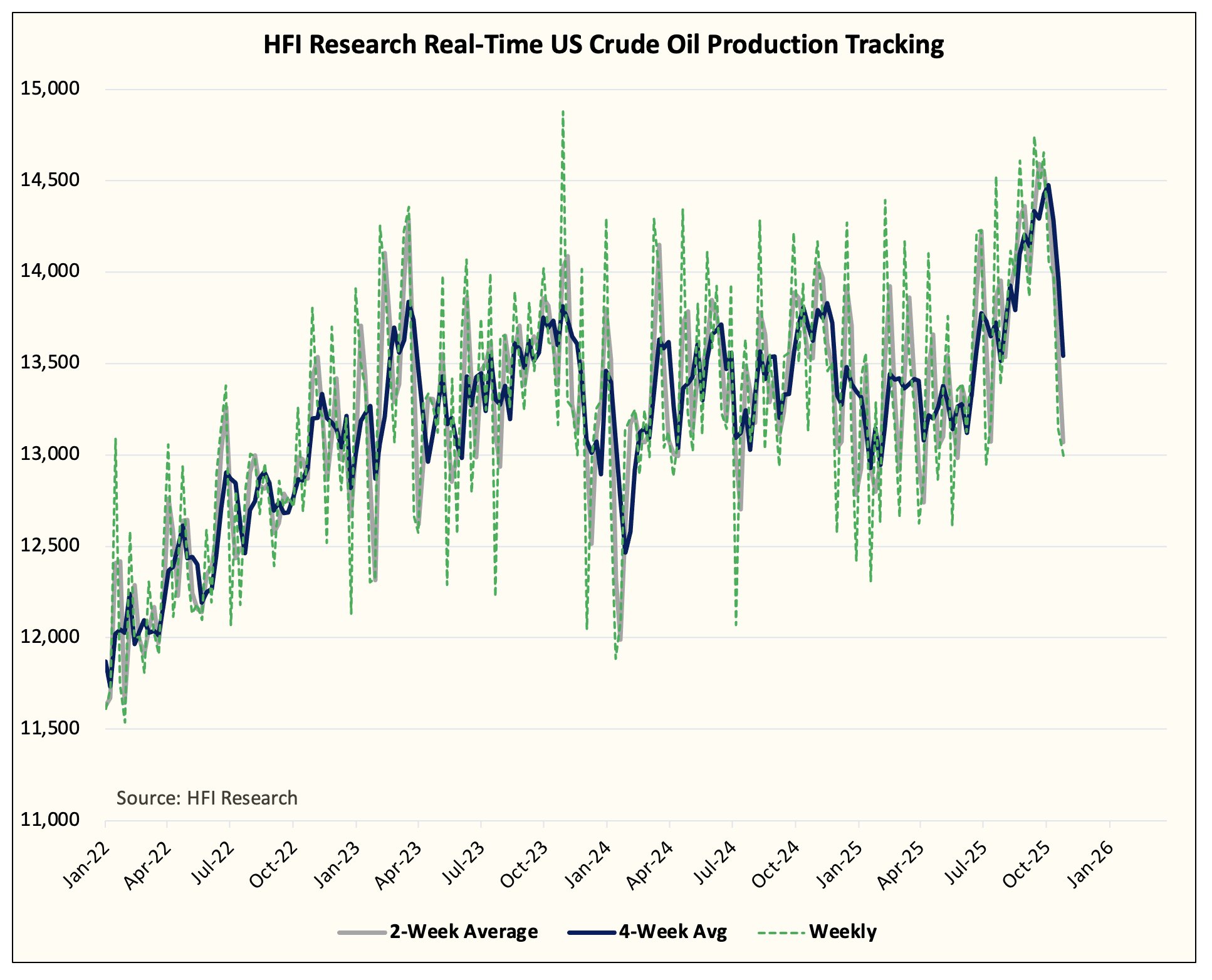

U.S. crude production has begun to decline slightly, though this is offset by rising OPEC output and adequate global inventories. Source: xStation5,

Source: HFI Research

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)