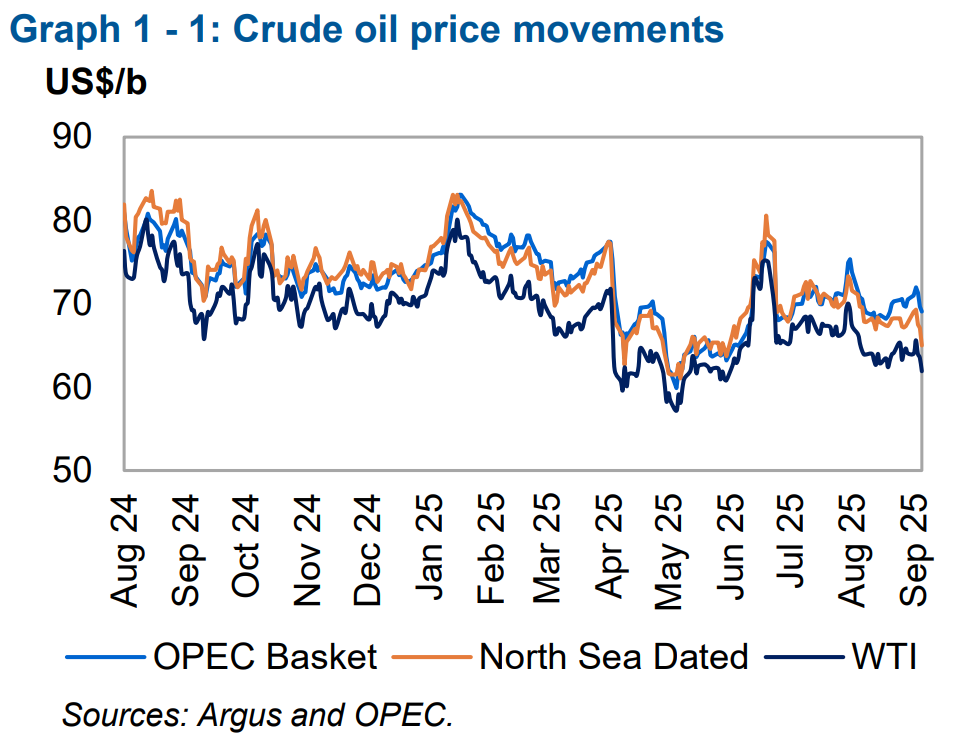

On the global fuel markets, we are observing a clear decline in crude oil prices. The latest OPEC report indicates that pressure on prices persists despite solid demand and supply fundamentals. WTI crude contracts are falling by over 2%.

The decline in crude oil prices is the result of several overlapping factors—both market and financial. From the perspective of physical fundamentals, the market situation seems stable: global demand continues to grow, and the contract structure remains in backwardation, which usually signals a strong market. However, financial factors and short-term economic signals have proven stronger and currently dominate the quotations.

These include:

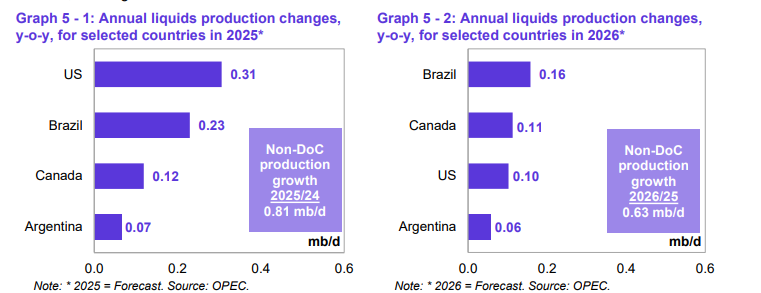

- Supply pressure from non-OPEC+ producers: including the USA, Brazil, Canada, and Argentina.

- Aggressive sell-off of futures contracts by hedge funds and money managers.

- Seasonal decline in demand in the USA after the end of the summer period.

- Concerns about the pace of economic growth in the USA and the consequences of trade tariffs.

- Signals of weaker refinery processing in China in July, suggesting a slight weakening of demand from the largest importer.

- The current declines in oil prices do not result from a fundamental collapse in demand but from the dominance of financial and short-term factors. This means that markets may still see a price rebound in the event of a supply shock or geopolitical escalation.

The stable economic growth—both in developed countries and emerging economies—primarily supports demand. Global GDP is expected to grow at a rate of 3.0% in 2025 and 3.1% in 2026.

Asia contributes particularly strongly:

- China - 4.8% in 2025

- India - 6.5% in 2025

These markets are the engines of energy consumption—the growing middle class, dynamic industrial and transport development ensure that fuel demand remains high.

The second factor supporting demand is transport fuels and petrochemicals. The increase in air travel, stable gasoline demand in OECD countries, and developing logistics in Asia sustain oil demand. Meanwhile, LPG and kerosene, used in the petrochemical industry, drive consumption in the plastics and chemicals production sector. This means that despite financial pressure and short-term price declines, demand fundamentals remain strong, and the market still has grounds for growth in the medium term.

Oil price declines have broad consequences beyond the commodity market. Lower energy prices translate into inflation, trade balances, company results, and investor sentiment.

The biggest losers of lower oil prices will be:

Oil-producing countries—Russia, Brazil, the USA, or Saudi Arabia. Lower oil prices mean lower budget revenues and weaker currency. Indirectly, this will also exert pressure on local stock indices, proportionally depending on the financial market's dependence on extraction sector revenues.

Energy companies and extractors—Lower oil and finished product prices mean lower margins, revenues, and profits, which will certainly affect the valuation of companies in the sector.

Beneficiaries of lower prices will include:

Energy importers—Countries dependent on the import of oil products will improve their trade balances. These include India, China, Turkey, and Japan.

Transport and logistics—Transport companies will reduce fuel expenses, translating into higher profits, price competitiveness, or investments, positively affecting their valuations.

Consumers—Due to lower transport costs, consumers can expect a slower pace of price increases.

OIL.WTI (D1)

Source: Xstation

The chart shows a clear downward trend confirmed by a series of lower peaks. The price remains below key resistances at 65.20 USD, where the FIBO 61 level is located. The most important support is in the region of 61.70 USD, and its breakout would open the way towards 56.50 USD, towards the lower boundary of the channel. As long as the market remains below 65.20 USD, the sellers' advantage dominates, while only a breakout above 67.70 USD could signal a trend change to upward.

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨