Summary:

-

3% rise seen in Oil after two tankers attacked

-

Raises the prospect of further disruption in the region

-

Potential double bottom seen in Oil at 59.50

There’s been a sharp move higher in the price of oil after reports that two tankers in the Gulf of Oman have been attacked in a development that could have further reaching geopolitical implications. Equities are moving higher, albeit in a more measured fashion with the FTSE 100 trading back near the 7400 mark. The pound is drifting lower after MPs yesterday rejected an attempt to legislate against a no-deal Brexit, which keeps the possibility of this outcome on the table.

Growing tensions threaten supply shock

There’s been some large moves in the crude oil markets in the past 8-9 months with a large drop in the final quarter of 2018, an impressive recovery at the start of this year and recently another drop lower, with brent crude down by around $13 (almost 20%) in the past month. The last two swing highs back in October 2018 and April of this year came about after fears of a supply shock from US sanctions on Iran proved to be over exaggerated, but the latest developments have raised the spectre of a significant drop in production once more.

The Oil market has dropped over 20% in the past month after the impressive rally seen at the start of the year has fizzled out. Source: xStation

The Oil market has dropped over 20% in the past month after the impressive rally seen at the start of the year has fizzled out. Source: xStation

Strait of Hormuz a bottleneck for waterborne crude

The incident this morning comes at a time of heightened geopolitical tensions in the region with US-Iranian relations deteriorating further after attacks on 4 tankers off the coast of the UAE last month. This region is particularly important to the crude oil markets with the Strait of Hormuz one of the most important “choke points” for waterborne oil and any further escalation could well cause a significant move higher in the market. There is a school of thought that Trump may look to target a war with Iran to boost his re-election prospects in 2020 and while there is still some way to go for this eventuality to play out, given his erratic nature and populist policies it could well become a reality.

US inventories showing unseasonal gains

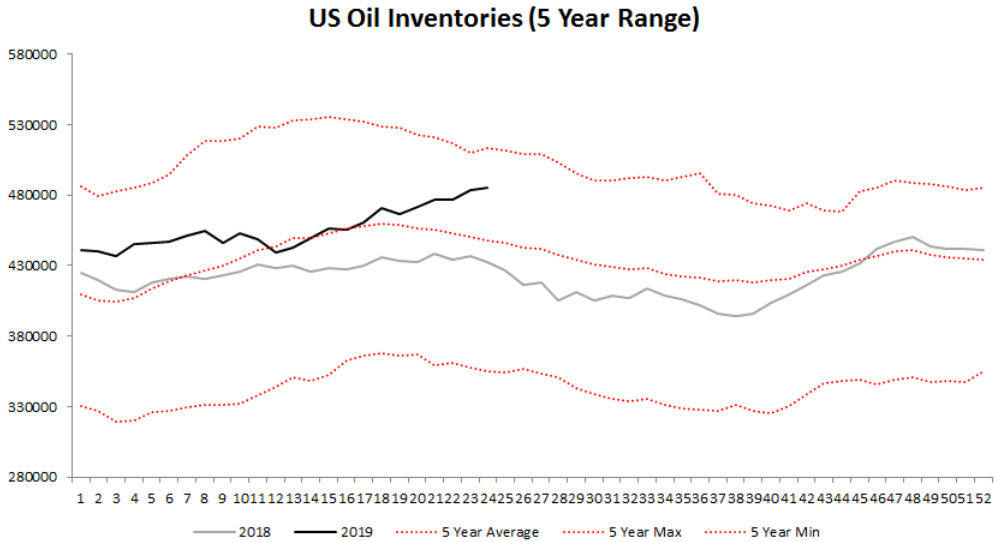

Even though it doesn’t pose as dramatic impact on the supply side of the equation as the potential situation developing in the middle east, it is worthwhile looking at US inventories which have shown an unseasonal gain of late. Wednesday showed 4th increase in the past 5 weeks for the EIA number with a print of +2.2M but the report overall was more mixed to be honest with a dip in production and distillates providing some fundamental support to the market.

US Oil inventories are currently above their 5-year average and showing an unusual increase of late at a time when they have typically fallen in prior years. Source: XTB Macrobond

Double Bottom at 59.50?

The inventory data yesterday caused a further slide in the oil price, with the market dropping over 3% to trade back down near last week’s low at 59.50. However, this level held as support and the news this morning caused a strong bounce from the region and raises the possibility of a double bottom forming. As long as this level holds then there’s a chance of a recovery with price now testing the Ichimoku cloud on H1. A break above there could be seen as signalling a change in the near-term trend, with the next swing level of resistance seen around 63.85.

A potential double bottom could be forming in Oil at 59.50. Price is now attempting to move above the H1 cloud and a break above there could be seen as indicating a change in the near-term trend. Source: xStation