-

Wall Street opens higher, Nasdaq leads gains

-

Nvidia earnings support tech shares

-

Dollar Tree and American Eagle Outfitters slump over 20%

Wall Street indices launched today's trading higher, led by tech-heavy Nasdaq index which traded almost 1.8% higher at the market open. Outperformance of tech shares is driven by a rally on Nvidia shares and other chip stocks, triggered by upbeat guidance offered by Nvidia in its earnings release.

US House Speaker McCarthy said that progress on the debt ceiling was made yesterday but it is too early to say whether the deal will be reached today or not. This is a kind of comment we are being offered daily and as we already know, they do not change much. Nevertheless, US default remains highly unlikely and the deal will most likely be reached, even if it is a last-minute deal.

Source: xStation5

Source: xStation5

US100 rallied yesterday in the evening following release of Nvidia earnings (orange circle on the chart above). Index has fully recovered from losses suffered on Tuesday and Wednesday, and has once again tested the resistance zone marked with recent local highs in the 13,950 pts area. However, bulls have once again failed to break above and the index started to erase gains after launch of Wall Street cash session today. Should a pullback continue, 13,830 pts support zone will be on watch. A failure to break below could hint at a period of range trading in the 13,830-13,950 pts area until another catalyst for major move surfaces.

Company News

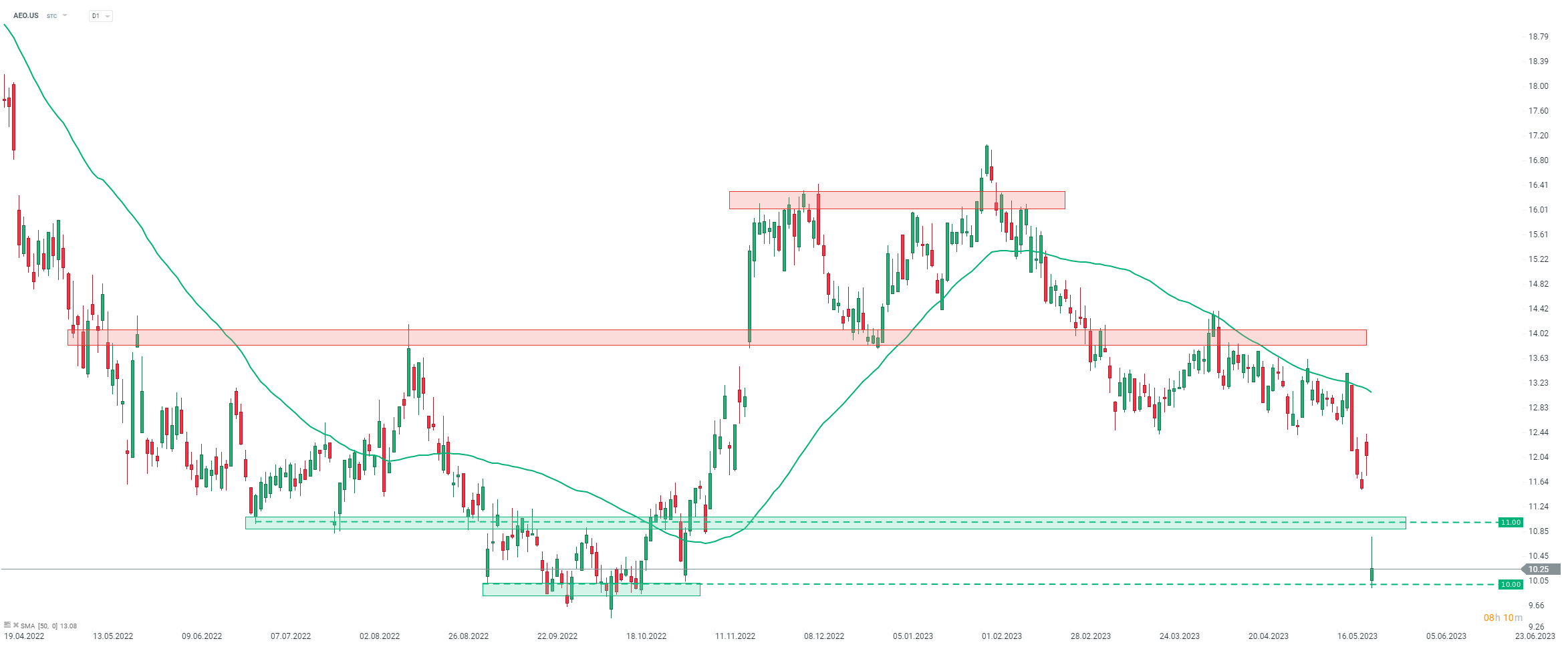

American Eagle Outfitters (AEO.US) slumped today after the US retailer reported fiscal-Q1 2024 earnings (February - April 2023) and delivered disappointing guidance for the full fiscal year yesterday after the close of the Wall Street session. Company reported adjusted EPS at $0.17 (exp. $0.17) and net revenue at $1.08 billion (exp. $1.07 billion). While fiscal-Q1 earnings turned out to be in-line with estimates, guidance for a low-single digit revenue drop in fiscal-Q2 as well as flat to low single digit drop in full-year revenue weighs on share price today.

Desktop Metal (DM.US) trades higher today after Stratasys agreed to buy the company. An all-stock transaction is valued at around $1.8 billion. Desktop Metal shareholders will receive 0.123 shares of Stratasys for each DM share they hold, valuing DM at around $1.88 per share (7.4% premium over Wednesday's closing price).

American Eagle Outfitters (AEO.US) launched today's trading with a big bearish price gap. However, buyers found support in the $10.00 per share area and stock started to recover. An important price zone to watch can be found in the $11.00 area. Source: xStation5

American Eagle Outfitters (AEO.US) launched today's trading with a big bearish price gap. However, buyers found support in the $10.00 per share area and stock started to recover. An important price zone to watch can be found in the $11.00 area. Source: xStation5

Dollar Tree (DLTR.US) trades lower today after the company reported worse-than-expected fiscal-Q1 2024 earnings (February - April 2023) and a disappointing forecast. Company reported adjusted EPS at $1.47 (exp. $1.54) and net sales at $7.32 billion (exp $7.29 billion). Gross profit margin dropped from 33.9% in fiscal-Q1 2022 to 30.5% in fiscal-Q1 2023 (exp. 31.6%). EPS in fiscal-Q2 is seen between $0.79 and $0.89 (exp. $1.27) while sales are expected to reach $7.0-7.2 (exp. $7.16 billion). EPS guidance for full fiscal-2024 was trimmed from $6.30-6.80 to $5.73-6.13 range.

Semiconductor stocks are rallying following earnings release from Nvidia (NVDA.US). Nvidia is trading almost 25% higher, AMD (AMD.US) jumps almost 9%, Micron Technology (MU.US) trades 5% higher while Marvell Technology (MRVL.US) adds 6%.

Dollar Tree (DLTR.US) slumped after earnings releases and launched today's trading in the $135 area. However, sell-off continued after the opening of the cash session and now stock is trading below $130 mark - at the lowest level since late-May 2022. Source: xStation5

Dollar Tree (DLTR.US) slumped after earnings releases and launched today's trading in the $135 area. However, sell-off continued after the opening of the cash session and now stock is trading below $130 mark - at the lowest level since late-May 2022. Source: xStation5

Daily wrap – US Export Restrictions on China and Weaker Earnings Trigger Wall Street Correction

Google Quantum Echoes – A Quantum Computing Breakthrough

Those Stocks Scared Investors Ahead Of This Halloween🎃 — Market Losers of 2025

IBM Earnings Preview: Will grandfather of IT industry deliver expectations?