- US stocks opened higher

- US500 hovers near all-time high

- Moderna (MRNA.US) faces shareholders pressure

- Airlines stocks took a hit due to flight cancellations

US indices launched today's session higher, following the Christmas holiday. S&P500, which historically moves higher during the Santa Claus rally period — the final five trading days of the current year and the first two of the new year, rose 0.5% and reached new all-time high, Dow Jones jumped 0.4% and Nasdaq ticked up 0.6%. Investors still assess the impact of omicron on the economy after the spread of the virus forced several US airlines to cancel thousands of flights.

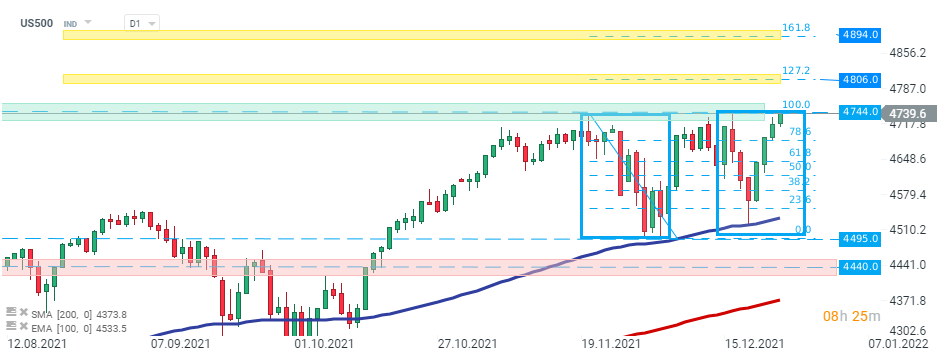

US500 bounced off the EMA 100 (purple line) last week and managed to erase all of the recent losses. Currently the index is approaching its all-time high at 4744 pts which coincides with the upper limit of the 1:1 structure. Should break higher occur, the next target for buyers is located around 4806 pts which coincides with 127.2% external Fibonacci retracement of the recent correction. On the other hand, if sellers manage to regain control, then nearest support lies at 4495 pts. Source: xStation5

US500 bounced off the EMA 100 (purple line) last week and managed to erase all of the recent losses. Currently the index is approaching its all-time high at 4744 pts which coincides with the upper limit of the 1:1 structure. Should break higher occur, the next target for buyers is located around 4806 pts which coincides with 127.2% external Fibonacci retracement of the recent correction. On the other hand, if sellers manage to regain control, then nearest support lies at 4495 pts. Source: xStation5

Company news:

Moderna (MRNA.US) stock over 3% before the opening bell on news of shareholder pressure over the high costs of its vaccine and low availability in poorer countries.

Moderna (MRNA.US) stock launched today's session lower and is testing the lower limit of the triangle formation. If current sentiment prevails, downward move may accelerate towards support at $210.80. Source: xStation5

Moderna (MRNA.US) stock launched today's session lower and is testing the lower limit of the triangle formation. If current sentiment prevails, downward move may accelerate towards support at $210.80. Source: xStation5

GoDaddy (GDDY.US) stock rose nearly 4.0% in premarket action after the Wall Street Journal reported that activist fund Starboard Value has taken a 6.5% stake in the web domain retailer.

Cigna (CI.US) announced it will reaffirm its 2021 and 2022 earnings guidance at its upcoming investor meetings, according to an SEC filing. The insurer expected 2021 adjusted earnings of at least $20.35 per share and sees projected growth of at least 10% for 2022.

Airline stocks took a hit in the premarket after thousands of US flights were canceled due to the pandemic and amid reports of COVID-19 outbreaks on ships. American Airlines (AAL.US) dropped 1.4%, Delta Air Lines (DAL.US) fell 1% and Southwest (LUV.US) lost1.5%.

Daily Summary: CPI down, Markets Up

Procter & Gamble: After Earnings

"Mad Max" mode - Is Tesla in trouble?

Intel’s turnaround is showing results