Sentiment across the U.S. equity market is notably weak today, with Nasdaq 100 (US100) futures down over 1% as semiconductor and software stocks weigh on the broader U.S. indices. Meta Platforms, Broadcom, Nvidia, Amazon and Alphabet stocks are down, signalling negative momentum across the BigTech stocks today.

- Yesterday’s comments from Nvidia CEO Jensen Huang, who suggested that China is getting very close to surpassing the United States in artificial intelligence, appear to be deepening market concerns about valuations, despite a very successful earnings season.

- Austan Goolsbee of the Chicago Fed stated today that U.S. interest rates are likely to decline in the medium term, but he does not feel comfortable supporting another rate cut while the Fed lacks access to inflation data amid the ongoing government shutdown.

- Importantly, today’s Challenger report, released at an unusual hour, indicated the largest increase in U.S. layoffs since 2003, suggesting that the labor market may be losing momentum. The report pointed to a reduction of over 153,000 jobs.

- Goldman Sachs indicated that the U.S. Supreme Court is expected to issue a ruling on American import tariffs by January 2026, while the Wall Street Journal noted that the justices may take a critical stance toward the tariffs announced by Donald Trump.

- According to Wells Fargo, companies that were initially hit hardest by the tariffs — including Caterpillar, Nike, Five Below, Best Buy, and Gap Inc. — could benefit the most in such a scenario. Some of the stocks that reacted sharply in April have since managed to recover and resume their upward trend, despite the lingering risk of higher import duties.

US100 (D1)

Today, US100 is one step closer to testing EMA50 moving average (the orange line) near 25,000 pts.

Source: xStation5

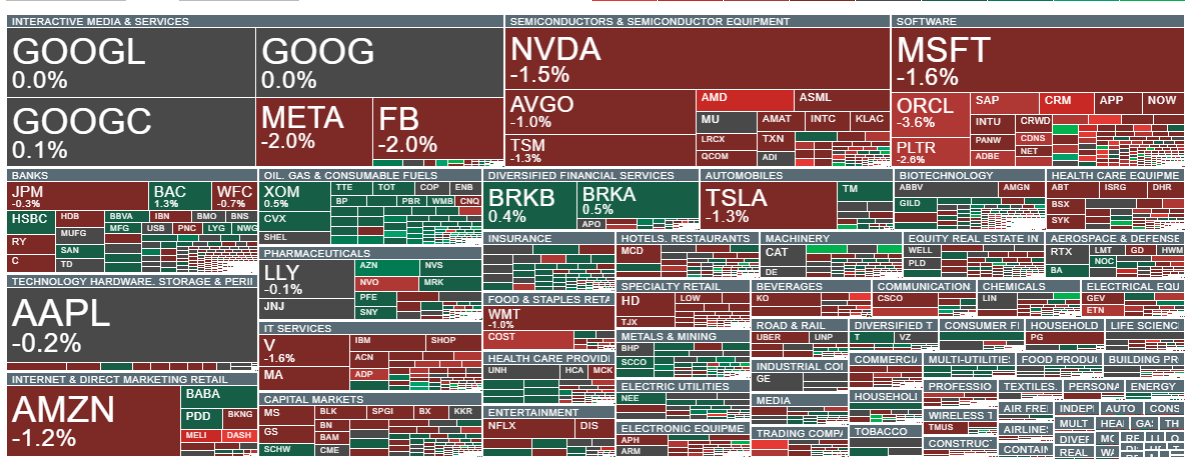

Sector Overview

Technology stocks — from software firms like Oracle and Salesforce to semiconductor giants such as Nvidia and AMD — are sharply lower today. Meanwhile, the energy sector is performing slightly better, supported by a gradual recovery in oil prices.

Source: xStation5

Company News

- Acadia Healthcare (ACHC.US) shares sank 10% after the operator of behavioral health facilities reported weaker-than-expected third-quarter results. Adjusted EBITDA missed analyst forecasts, while full-year earnings guidance also came in below Wall Street expectations.

- Albemarle (ALB.US) gained 3% in early trade after the lithium and specialty chemicals producer posted better-than-expected sales and adjusted EBITDA for the third quarter, beating consensus estimates.

- Becton Dickinson (BDX.US) slid 8% after the medical equipment maker issued its fiscal 2026 outlook, which analysts at Bloomberg Intelligence described as “likely to underwhelm,” signaling potential investor disappointment.

- Biogen (BIIB.US) advanced 1.6% after Stifel analyst Paul Matteis upgraded the stock from Hold to Buy, citing an improving risk-reward profile and the potential impact of upcoming clinical catalysts.

- Celsius Holdings (CELH.US) tumbled 15% despite reporting third-quarter revenue above consensus. Analysts noted, however, that results failed to meet more optimistic buy-side expectations for the fast-growing energy drink maker.

- Coherent Corp (COHR.US) climbed 13% after the semiconductor manufacturer’s latest earnings and outlook underscored strong demand linked to artificial intelligence (AI), reinforcing the firm’s position in advanced chip technologies.

- Datadog (DDOG.US) surged 21% after the cloud monitoring and analytics company posted stronger-than-expected third-quarter earnings and raised its full-year revenue forecast, signaling continued business momentum.

- Fastly (FSLY.US) jumped 22% following quarterly results that topped estimates. The edge computing provider also lifted its full-year outlook, reflecting a notable rebound in revenue growth.

- Figma (FIG.US) rose 5% after the design software company increased its full-year revenue guidance, coming in above the average analyst projection.

- IonQ (IONQ.US) added 4% after the quantum computing company’s third-quarter performance came in ahead of expectations, reflecting ongoing progress in commercialization efforts.

- Planet Fitness (PLNT.US) jumped 14% after the gym operator raised its full-year adjusted earnings per share forecast, reflecting stronger performance and resilient demand in the fitness sector.

- Porch Group (PRCH.US) plunged 20% after the home services software company missed Q3 revenue expectations and narrowed its full-year guidance, signaling a more cautious business outlook.

- Sprout Social (SPT.US) gained 5% after the social media management platform beat Q3 estimates and lifted its full-year adjusted earnings forecast, underscoring steady growth across enterprise clients.

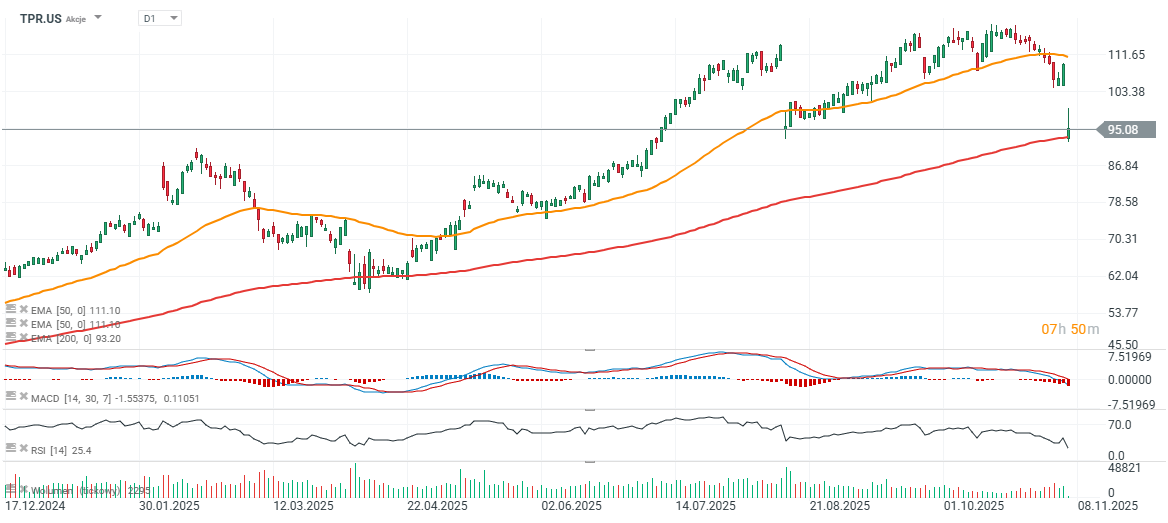

Tapestry (TPR.US) – Technical Outlook (D1 Interval)

Tapestry shares (TPR.US) fall nearly 8% after the handbag maker’s raised full-year EPS guidance failed to meet market expectations. The decline halted at a key support area near $94 per share, where the EMA200 (red line) currently lies.

If the stock holds this level, a gradual recovery toward $110 per share remains possible.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war