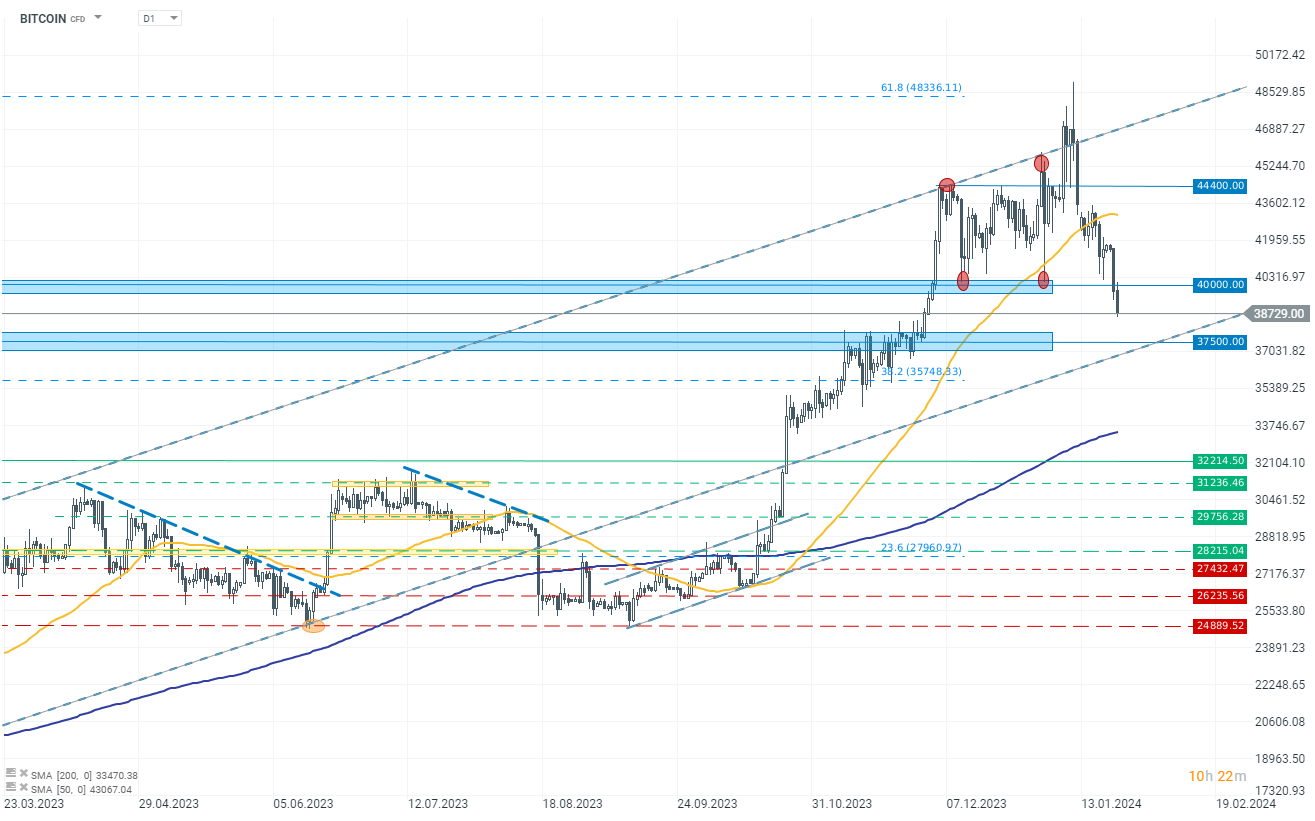

Bitcoin continues to lose value for another consecutive day, with today's decline exceeding 1.60%. Bitcoin's price has broken through two key resistances at 40,000 USD and 39,000 USD, losing over 20% from its peak established shortly after the acceptance of ETFs.

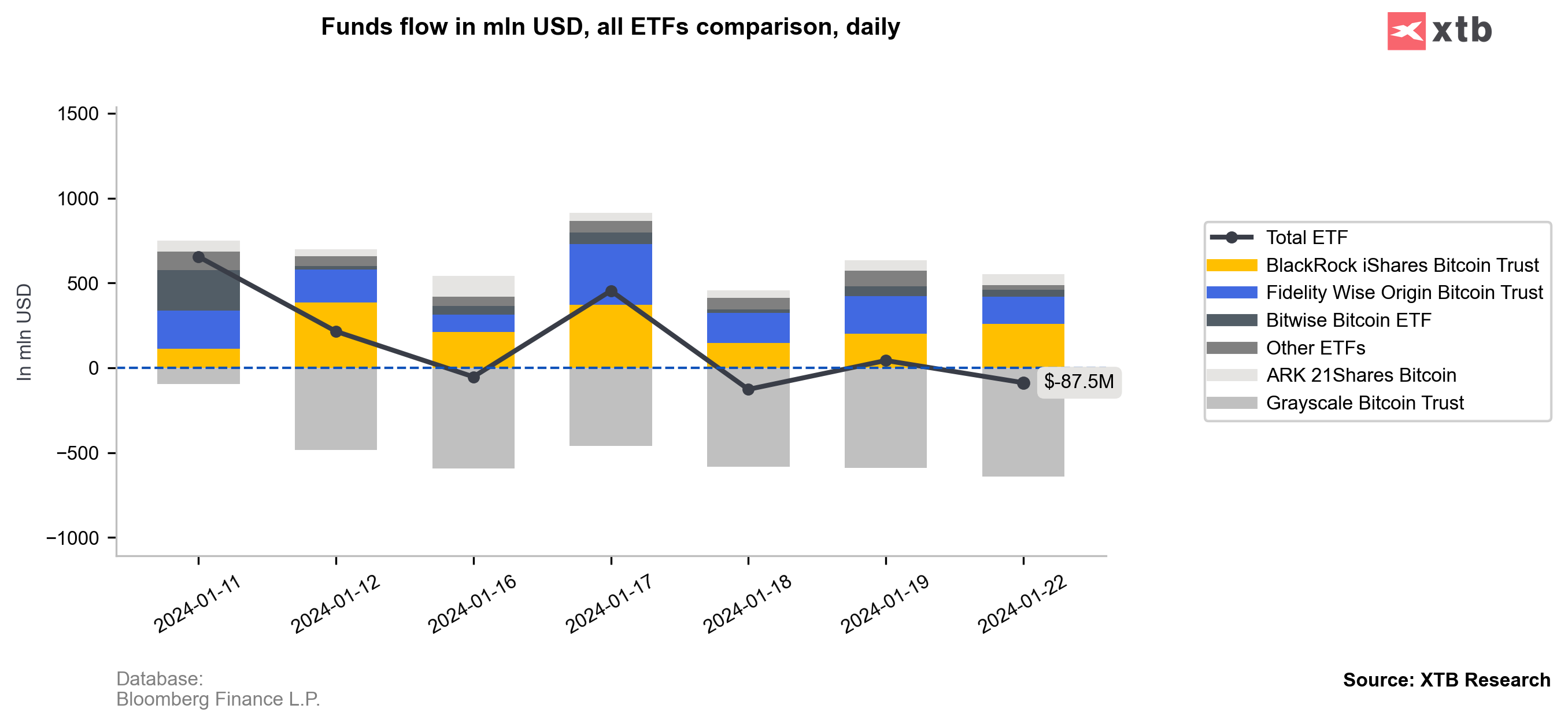

The main factor exerting such significant selling pressure is the sell-off of Grayscale Trust assets, including funds from the collapsed FTX exchange. The scale of outflows is influenced by several factors. Firstly, investors had their capital frozen for several years; secondly, they could buy shares at a significant 40-50% discount; and most importantly, Grayscale introduced management fees in its ETF that are nearly five times higher than its competitors. In such a scenario, it's hard to imagine a rational investor who would choose to keep their funds in the trust. Grayscale has also not yet commented on the issue of fund outflows.

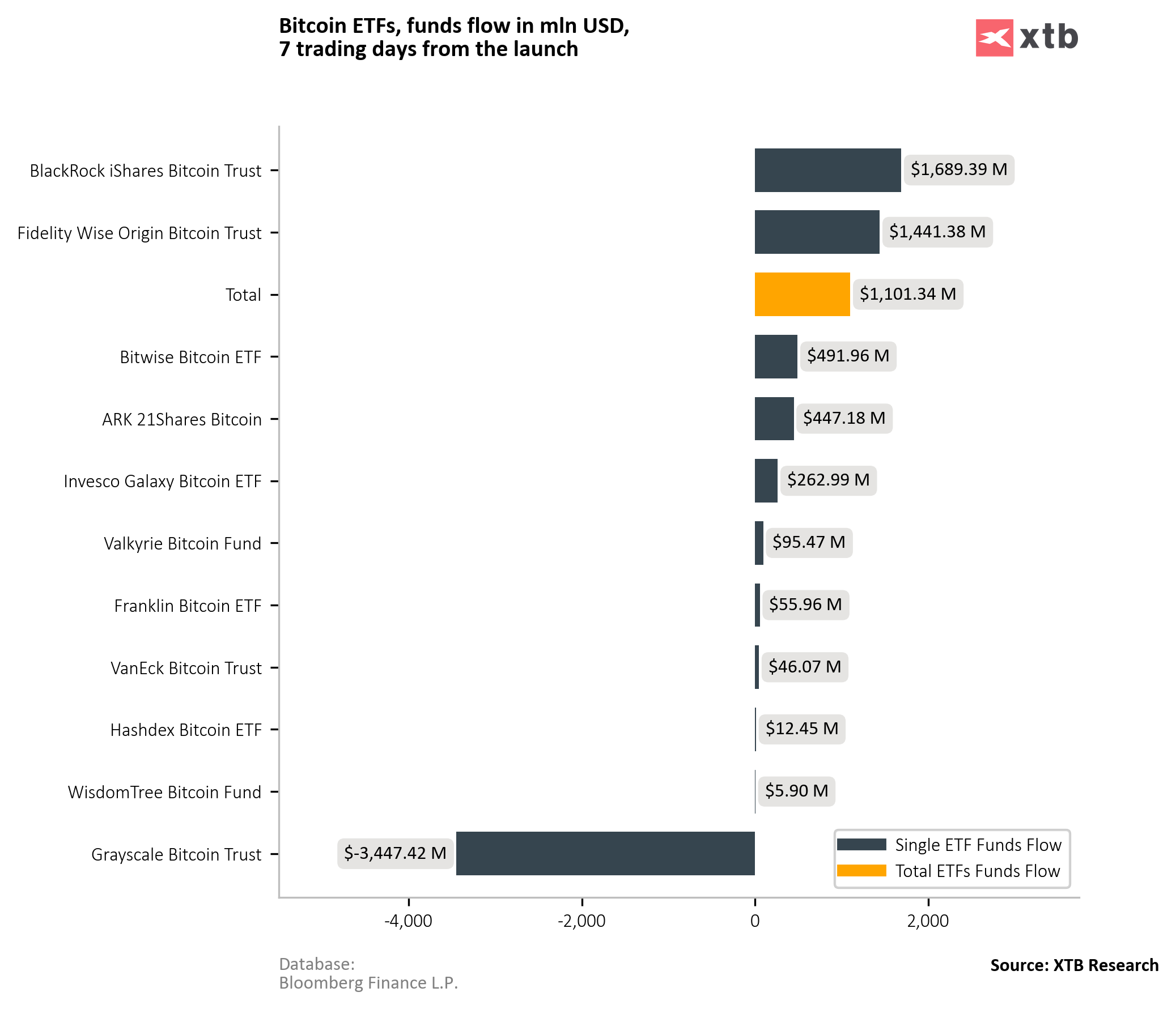

However, it should be noted that there are still net positive capital inflows into all ETFs totaling 1.10 billion USD, despite outflows from Grayscale amounting to nearly 3.45 billion USD. Although the launch of ETFs can be considered disappointing, they still rank high in terms of inflows and turnovers in the first days since their introduction compared to other popular ETFs, and interest remains high.

The sell-off of Grayscale assets may continue for several more weeks. The total assets of the fund have decreased from 28.5 billion USD to 25.9 billion USD currently, which theoretically means the potential for outflows nearly eight times greater than so far. Much also depends on the actions Grayscale takes, as under current conditions, the Grayscale Bitcoin Trust is on a direct path to liquidating all assets.

During today's session, Bitcoin broke below the 39,000 USD barrier and is currently trading above the next support zone around 37,000-38,000 USD.

Source: xStation

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

🚨Bitcoin crashes 4% to $69k📉Sell-off on Ethereum and Ripple

Chart of the day: BITCOIN 40% below recent peak 🚨 Eroding fundamentals risk selling spiral 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.