Despite rising Wall Street indices and significant drop in both treasury bond yields and US dollar, we can see Bitcoin weakening by almost 3% today. Weaker than expected ISM data from the US economy didn't support the largest cryptocurrency. Also, so-called altcoins are losing today, with Ethereum and Solana dropping almost 4% and 8% respectively.

- We can assume that investors on the crypto market remain cautious amid unfavourable summer seasonality for Bitcoin (which is surprisingly losing correlation with the stock market, for which first 2 weeks of July are historically very strong) and risk of selling reserves from Mt.Gox crypto stock exchange, which can start repayments of investors since the 1 July, with more than 140k BTC held.

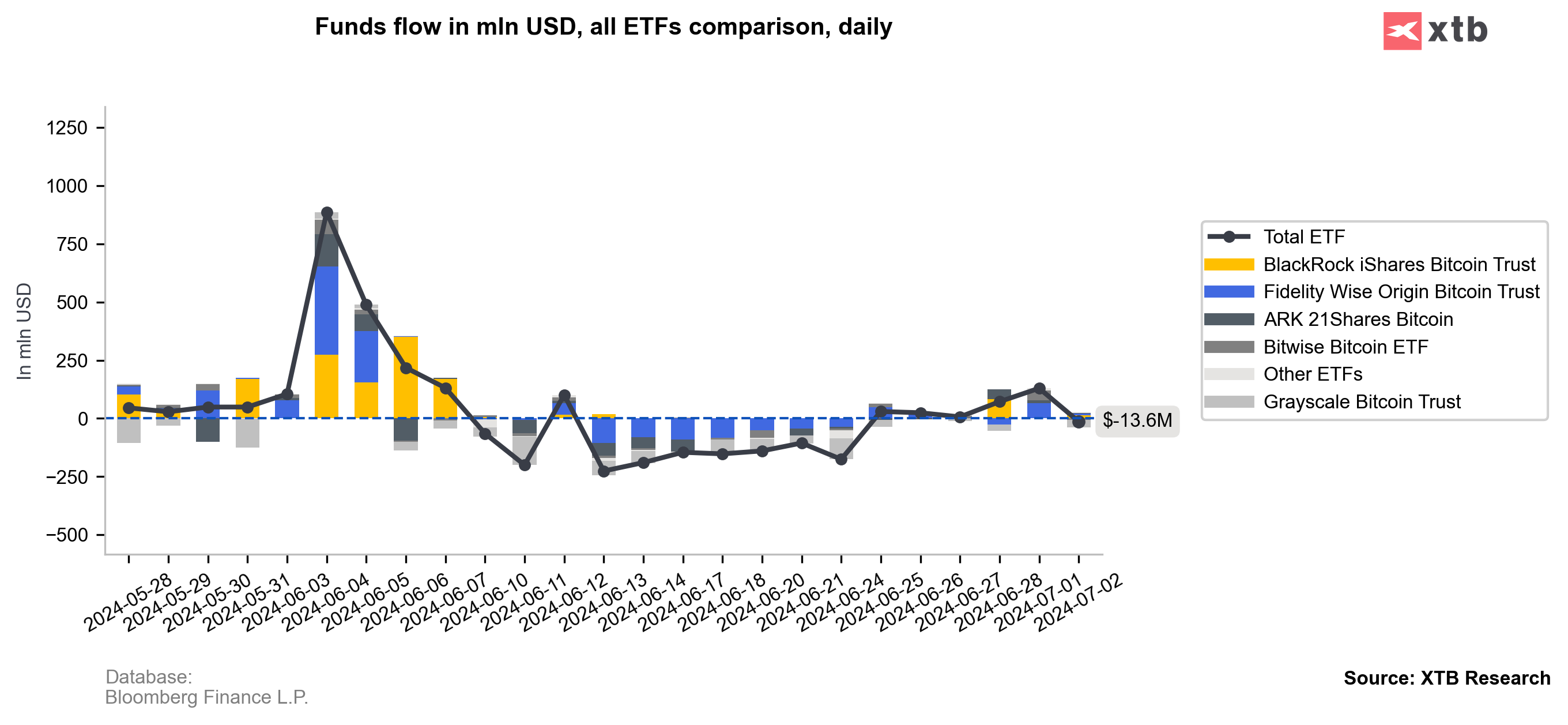

- A very important factor for Bitcoin is weakening activity and demand for Bitcoin ETFs. Investors demand for Bitcoin was very high during the H1 2024 - and it's still unknown will the 2024 H2 will be at least as good as H1 (or even better). Investors may see that lack of Bitcoin reaction to significantly dropping yields is a signal, that any positive BTC reaction to 'dovish Fed' or even rate cuts in the fall of 2024 are not guaranteed.

Inflows to US Bitcoin ETFs cooled off yesterday again, with $13.6 net outflows. Source: XTB Research, Bloomberg L.P.

Inflows to US Bitcoin ETFs cooled off yesterday again, with $13.6 net outflows. Source: XTB Research, Bloomberg L.P.

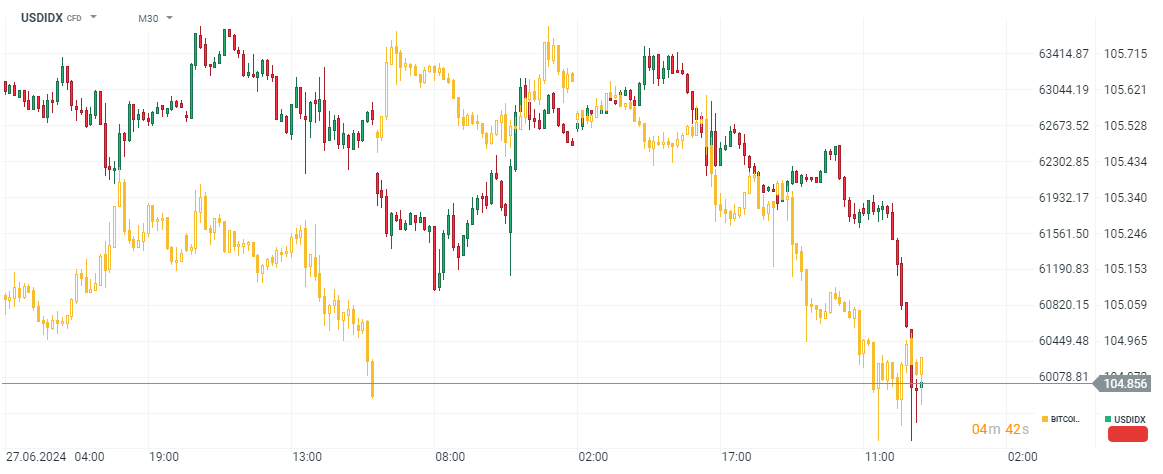

Bitcoin charts (M30, USDIDX VS BITCOIN)

Source: xStation5

Source: xStation5

What's interesting, while historically Bitcoin (orange chart) was mostly negatively correlated with US dollar, but now it drops in line with USDIDX.

Source: xStation5

Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.