- Bitcoin soars past $29,000

- The digital asset seems poised for a run to $30,000

Bitcoin on Thursday jumped to a record $29,180 after the digital currency almost quadrupled in value this year amid heightened interest from institutional investors. In addition to the well-known market giants Grayscale, MicroStrategy or PayPal, more and more companies decide to invest on the Bitcoin market. For example, NexTech AR announced that it will invest $2 million in Bitcoin as a first step to hedge against the FED’s inflationary monetary policy. Bitcoin is emerging as a digital alternative to gold, so more retail and institutional investments may follow next year. Also a second package of stimulus checks worth $600 could affect the price of bitcoin. Few months ago, many Americans decided to use the first stimulus checks worth $1,200 to invest in cryptocurrencies. At that time, the US-based cryptocurrency exchange Coinbase reported a spike of first-time deposits worth $1,200.

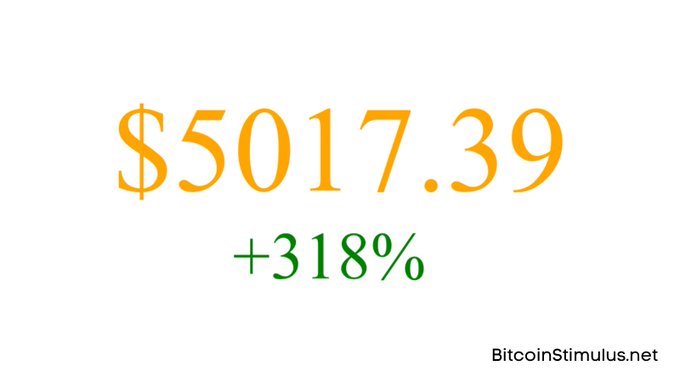

According to a Twitter account tracking the value of the first stimulus check, now it is worth over $5,000, over 300% higher from what it was worth in April. Source: Twitter

The growing functionality and social awareness of the cryptocurrency market also support the upward trend. The mayor of the city of Miami caused a stir when he expressed openness to the idea of putting 1% of the city’s financial reserves into Bitcoin. Meanwhile NFL professional player Russell Okung confirmed that starting from 2021 will receive half of his salary in Bitcoin.

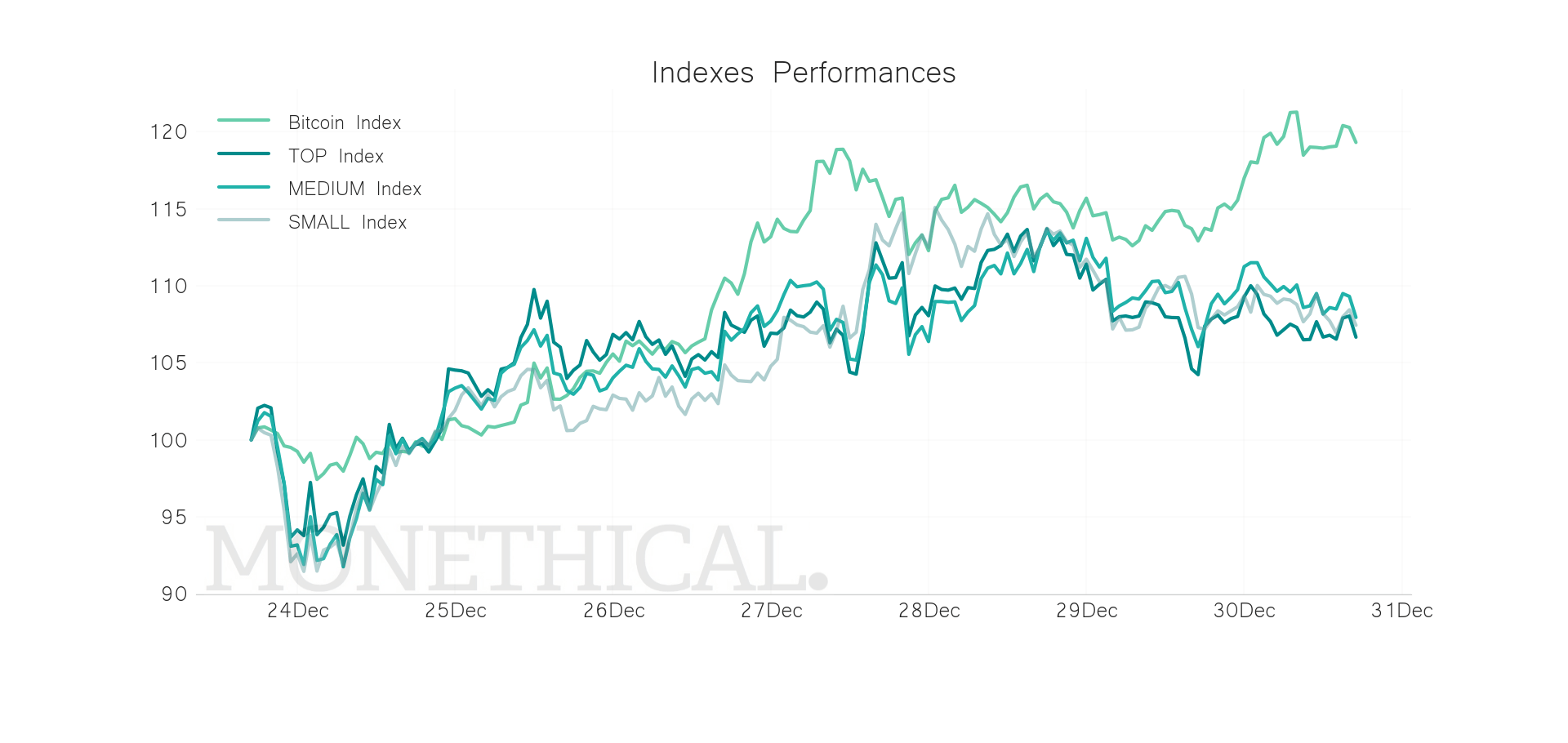

Last few days were very positive for Bitcoin, which is approaching a psychological level of $30,000. Altcoins are also performing well, however are not able to keep the pace of BTC. Bitcoin's market dominance increased to 70.6% market dominance. The total market capitalization of Bitcoin now exceeds $541 billion as the entire cryptocurrency market touches $767 and is slowly approaching the all-time high of $827 billion. Source: Monethical

Bitcoin pulled back slightly after reaching new all-time high. If the current sentiment prevails, then another upward impulse towards psychological level at $30,000 could be launched. On the other hand, a deeper correction could follow in the next few days as the price moves into the overbought zone according to the RSI. Also Bitcoin showed strong price fluctuations of up to $2,500 in recent days, so this scenario does not seem unlikely. The nearest key support to watch lies at $27,000. Source: xStation5

Bitcoin pulled back slightly after reaching new all-time high. If the current sentiment prevails, then another upward impulse towards psychological level at $30,000 could be launched. On the other hand, a deeper correction could follow in the next few days as the price moves into the overbought zone according to the RSI. Also Bitcoin showed strong price fluctuations of up to $2,500 in recent days, so this scenario does not seem unlikely. The nearest key support to watch lies at $27,000. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.