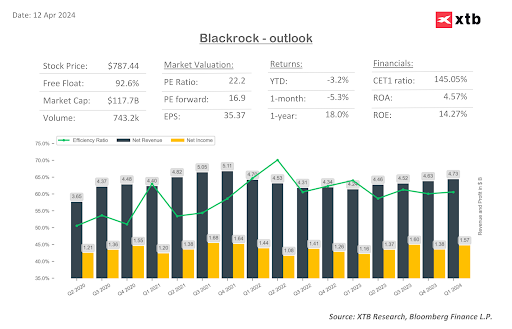

BlackRock reported higher 1Q24 results than market consensus. The company recorded a record AUM (assets under management), which at the end of the quarter amounted to $10.47 trillion (+15% year-over-year). The average AUM for the quarter was $10.18 trillion, up 14% year-over-year. Revenues exceeded market expectations by 1.06%, diluted earnings per share were 5.04% higher than consensus, and the AUM value surpassed expectations by +0.37%.

Revenues amounted to $4.73 billion, up +11% year-over-year and +2% quarter-over-quarter. The solid growth foundation includes a positive market impact on AUM value, organic growth of base fees, which increased by 8.8% year-over-year—marking the third consecutive quarter of increasing dynamics—and a strong rebound in the performance fees segment, which saw a +270% growth year-over-year, although these fees were -34% lower than in the previous quarter.

The quarterly capital inflow to the long-term segment amounted to $76 billion, nearly 40% of the inflows recorded in the entire year of 2023. The largest inflow was recorded from the Americas, accounting for $58 billion.

The fund shows strong results against the financial sector backdrop, presenting solid growth in every key financial performance segment. Following these results, it is likely that market expectations for future quarters may increase, which ultimately, in the long-term perspective, could be an impetus for growth. After a strong opening, the share price initially stabilized (at the peak moment, the company recorded a +3.7% increase in share price), and now the supply side prevails, pushing down the share price.

FINANCIAL RESULTS FOR 1Q24:

- AUM: $10.47 trillion (+15% year-over-year)

- Average AUM: $10.18 trillion (+14% year-over-year)

- Revenue: $4.73 billion (+11% year-over-year)

- Operating profit: $1.69 billion (+18% year-over-year)

- Operating profit margin: 35.8% (+1.9 percentage points)

- Net profit: $1.57 billion (+36.8% year-over-year)

- Diluted earnings per share: $10.48 (+37% year-over-year)

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.