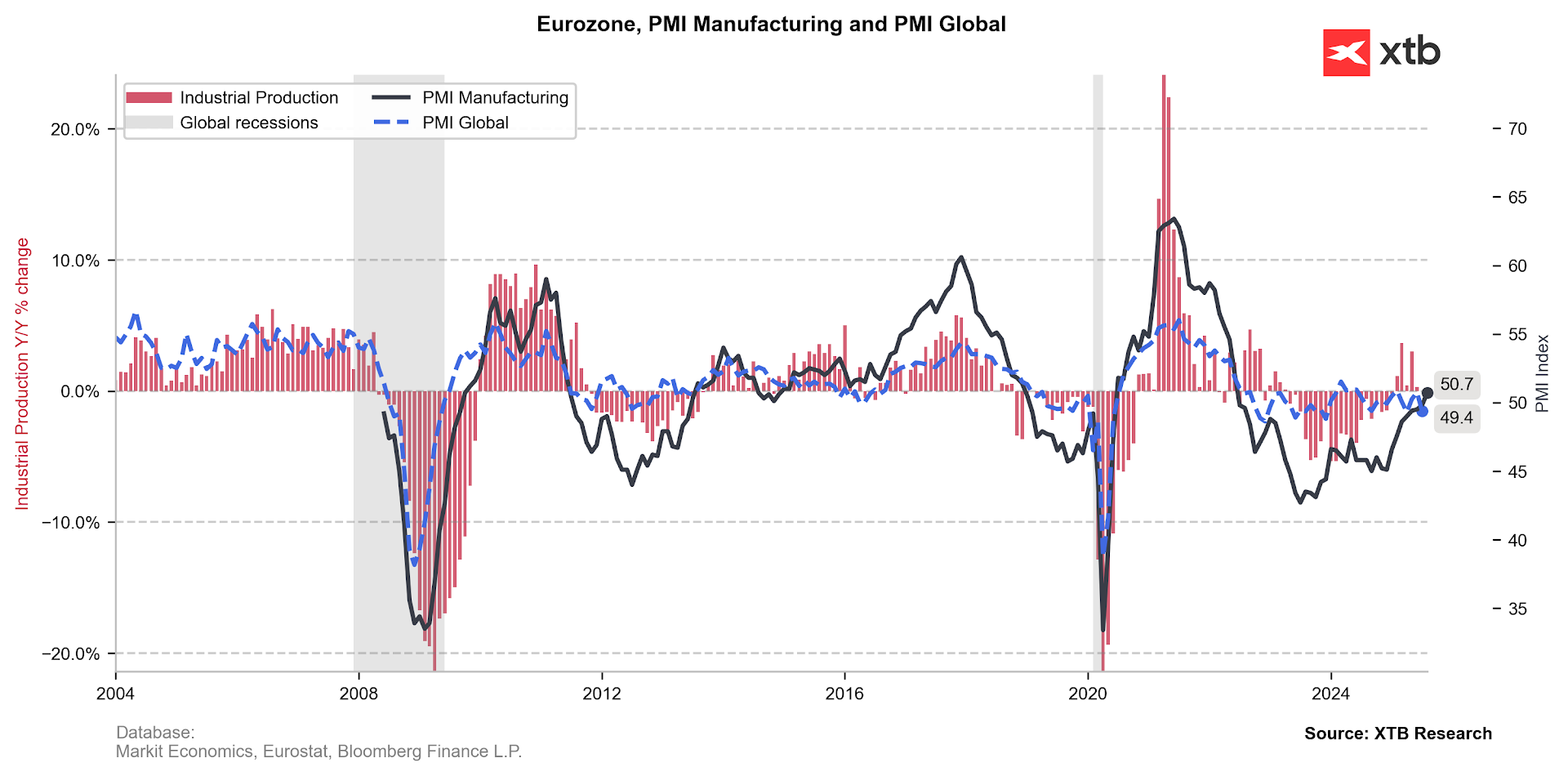

Today's release of manufacturing PMI data for the eurozone revealed stronger-than-expected results. While the figures for the largest economies were final readings, several key points are noteworthy:

-

Spain showed a significant improvement, with the index rising to 54.3, well above the expected 52.0 and the previous month's 51.9.

-

Italy returned to expansion territory, with the index at 50.4, surpassing both the forecast of 49.8 and the previous reading of 49.8.

-

France's final reading was stronger than the preliminary one, climbing above 50 to 50.4. This is a marked improvement from the preliminary 49.9 and July's 48.2.

-

Germany's data was slightly below the preliminary reading and remained below the expansion threshold. The final figure was 49.8, compared to the preliminary 49.9, though it still represents a gain from July's 49.1.

-

Overall, the final eurozone manufacturing PMI stood at 50.7, beating both the forecast and preliminary reading of 50.5. This is a notable rise from July's 49.8 and marks the highest reading since June 2022, reversing a downward trend. A key driver of this rebound is the recovery in new orders, which came in at 50.8 compared to 49.3 in July.

Beyond the eurozone, PMI readings were largely better than anticipated across the globe. Switzerland's data improved to 49.0, defying expectations of a significant decline, likely fueled by concerns over tariffs. During the Asian session, readings from Australia and smaller Chinese firms also exceeded forecasts. The only outlier was a slightly weaker-than-expected PMI from Japan.

Today's European data is providing momentum for the EUR/USD pair, which is being driven not only by dollar weakness but also by signs of a European recovery. The pair has already climbed past the 1.1720 level. Despite a sharp sell-off on Wall Street at the end of last week, European markets are showing signs of life this morning.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.