WTI crude prices rose over 2% during today's session despite lingering concerns regarding lower demand, caused by the omicron variant. In the US, almost 2,400 flights were cancelled over Christmas, with major airlines citing the spread of omicron among crews as a reason for the disruption. In Asia, China reported its highest daily rise in local cases in 21 months over the weekend as infections more than doubled in the city of Xian and many investors fear that this may lead to introduction of further restrictions. At the same time, talks on reviving Tehran's 2015 nuclear deal resumed today, while traders also await the OPEC+ meeting on January 4th, as the group is set to decide whether to go ahead with a planned 400,000 barrels per day production increase in February.

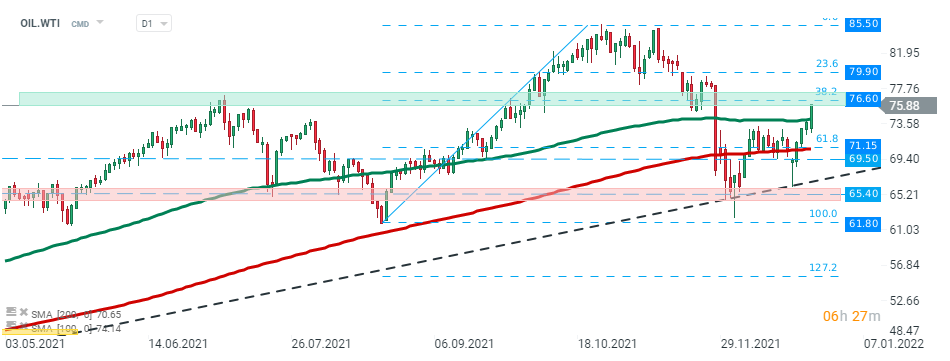

WTI crude oil price (OIL.WTI) fell sharply at the beginning of the previous week, however sellers failed to break below the long-term downward trendline and price rebounded sharply. During today’s session price broke above the 50 SMA ( green line) and psychological $75.00 level and is currently approaching resistance at $76.60 which coincides with 38.2% Fibonacci retracement of the last upward wave. Source: xStation5

Daily summary: Dollar dominates FX trading as odds of US intervention in Iran rise (13.01.2026)

Daily Summary: Conflict with the Fed Does Not Stop Wall Street📈

⏫Silver surges nearly 7%

Daily summary: Markets recover optimism at the end of the week

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.