OPEC+ is set to announce output levels for November today. Cartel's meeting will begin at 1:00 pm BST. Expectations are for a major production cut with markets positioning for a 1-1.5 million barrel reduction in recent days. However, media reports surfaced over the past couple of hours suggesting that a cut as big as 2 million barrels may be made. On top of that, UAE officials said that today's meeting will be groundbreaking and will see a change in OPEC+ policy. However, it should be noted that OPEC+ is already producing below an agreed-on quota and JPMorgan says that even if no agreement is reached, cartel members would still lower their production on their own. As such. JPMorgan expects oil prices to retest $100 per barrel area in the final quarter of 2022. Meanwhile, UBS said that with such high output cut expectations, a reduction smaller than 0.5 million barrels could be seen as negative for prices.

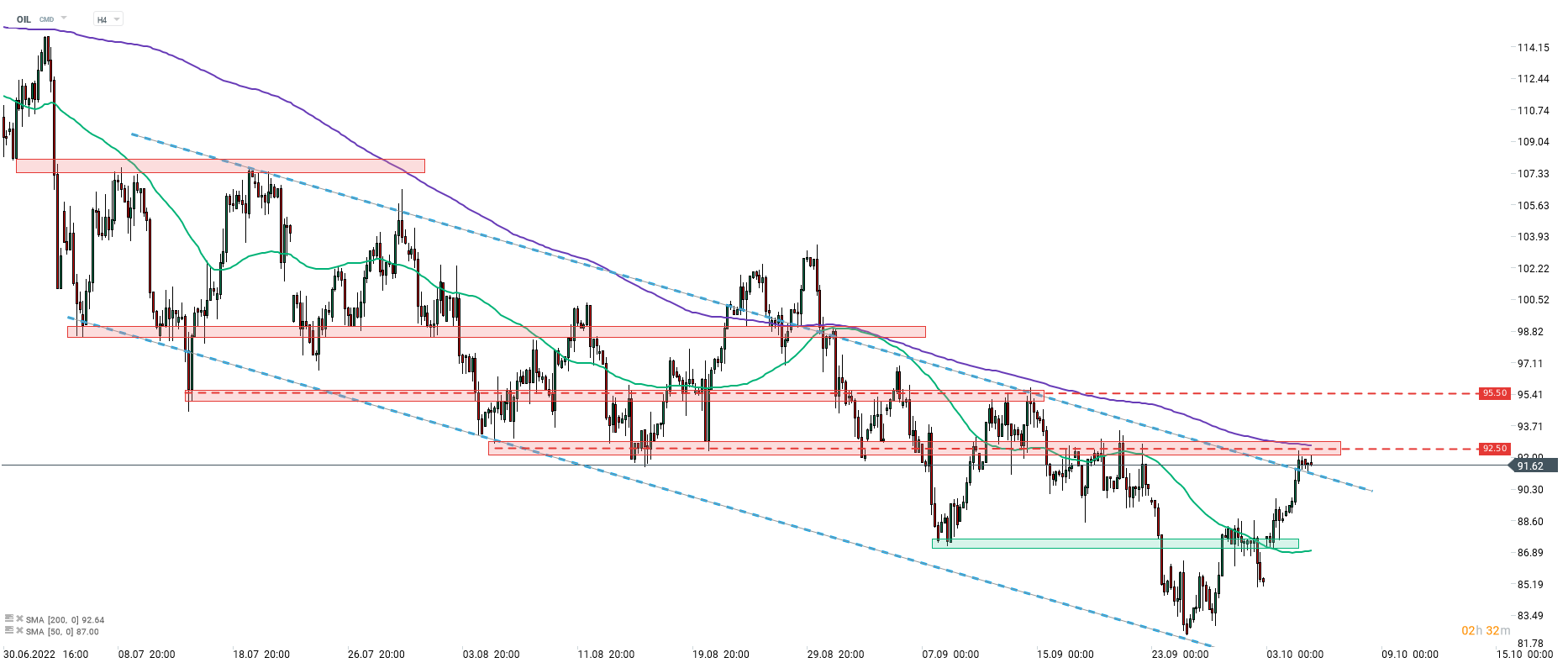

Taking a look at Brent chart (OIL) at H4 interval, we can see that oil price has been trading in a downward channel for some time. A break above the upper limit of the channel occurred this week. However, advanced was halted later on as price started to struggle near $92.50 support zone. Some sideways trading can be spotted since suggesting that market is in wait-and-see mode ahead of OPEC+ decision.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Silver surges 5% 📈

Morning wrap: Tech sector sell-off (06.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.