A lot of attention at the start of a new week is paid to oil, which launched today's trading with a big bearish price gap amid signs of potential de-escalation in the Middle East. However, there is also another group of commodities that is standing out today - precious metals. Gold continues to rally even in spite market expectations for Fed policy moves becoming less dovish after Friday's strong jobs data.

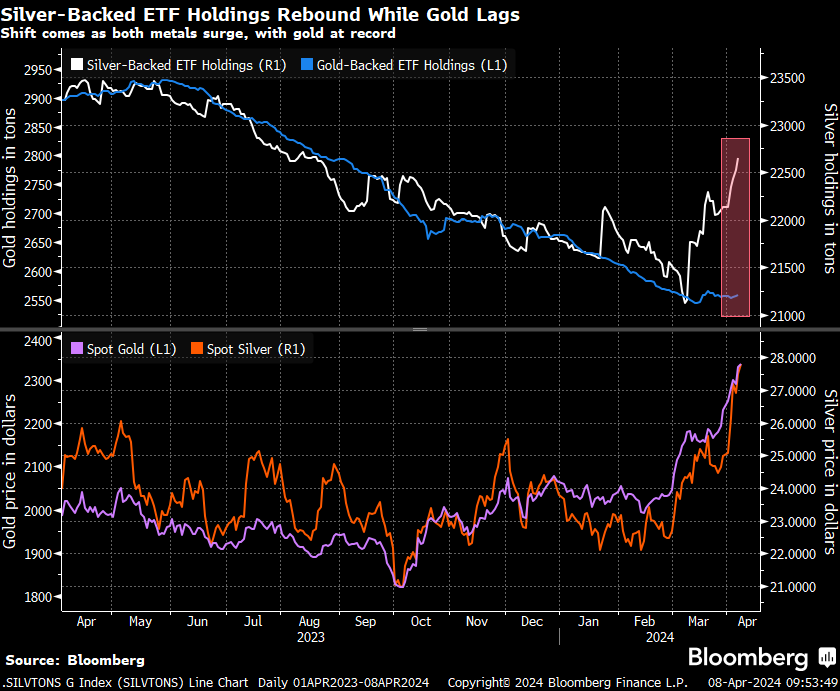

While gold is drawing the most attention among precious metals as it is trading at record highs, silver also deserves a note. SILVER is the best performing precious metal today, gaining around 1.7% at press time. Gold seems to be driven mostly by expectations of easier monetary policy from major central banks, especially Fed, as data on ETF holdings does not show any increase in demand for gold from such institutions. The situation looks different when it comes to silver, with ETFs noticeably increasing their physical silver holdings since the beginning of March.

Source: Bloomberg Finance LP

Source: Bloomberg Finance LP

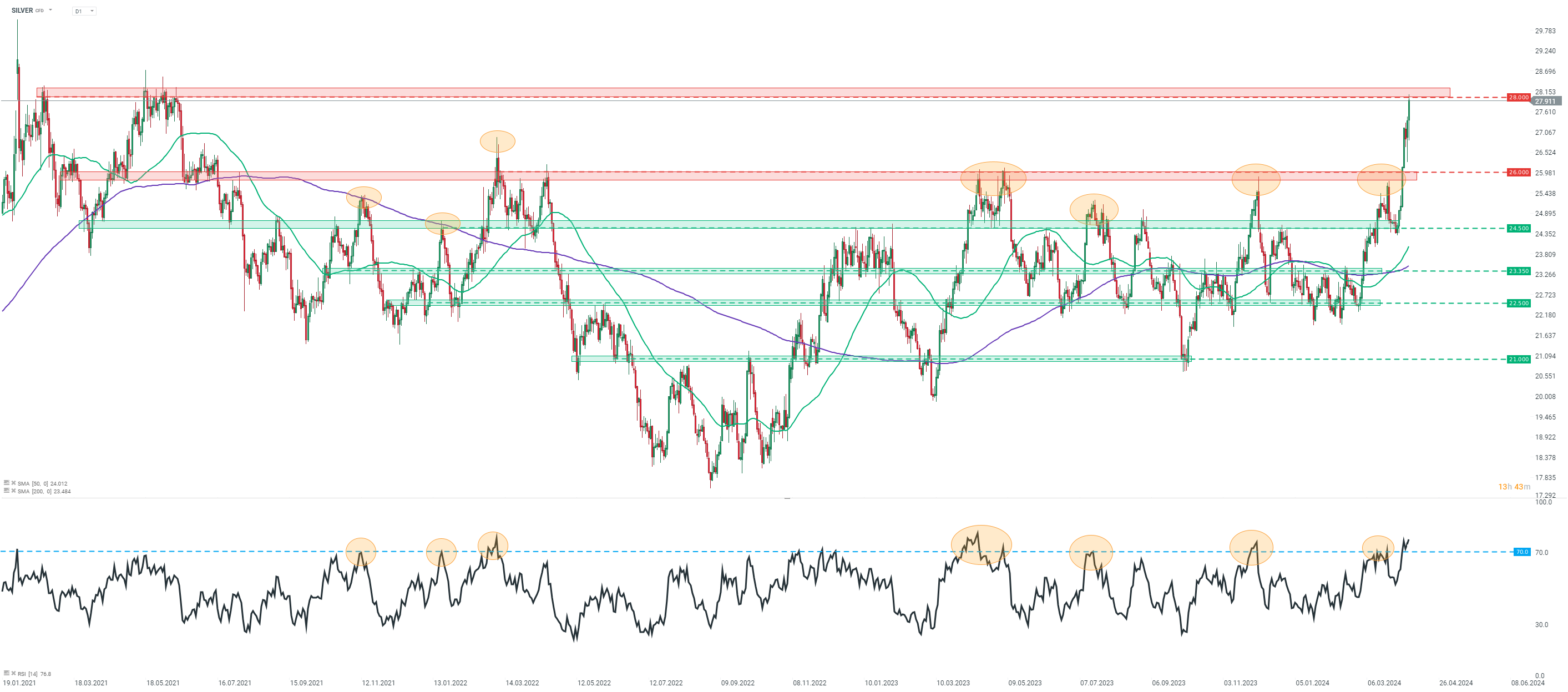

Taking a look at SILVER chart at D1 interval, we can see that the commodity broke above the $26 resistance zone last week and continued to rally afterward. Precious metal tested resistance zone ranging above $28 mark today and reached the highest level since June 2021. However, bulls were unable to break above the area and a small pullback occurred. Nevertheless, price remains nearby and another attempt to break above the $28 area cannot be ruled out. However, it should be noted that 14-day RSI indicator sits above 70.0 level, which was associated with local highs in the past, so bulls should stay on guard.

Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.