Wednesday is unquestionably the most interesting day this week from market's perspective. Investors will be offered FOMC minutes at 7:00 pm GMT. The document will relate to the January 30-31, 2024 meeting, during which Fed Chair Powell said that the central bank may not have enough confidence in inflation by the March meeting to cut rates. Traders will look for more hints on what can be seen as 'enough confidence'. However, there will be another event this week, which will be watched even more closely than FOMC minutes release - fiscal-Q4 earnings from Nvidia (NVDA.US). Report will be released after close of the Wall Street session at 9:20 pm GMT and will show whether Nvidia's business performance lived up to the hype that has pushed the company's shares to all-time highs. Expectations going into the report are very high, and failure to deliver on them and provide an optimistic outlook for the coming quarters may be a huge disappointment. Earnings disappointment may put Wall Street rally at risk given that Nvidia was its backbone.

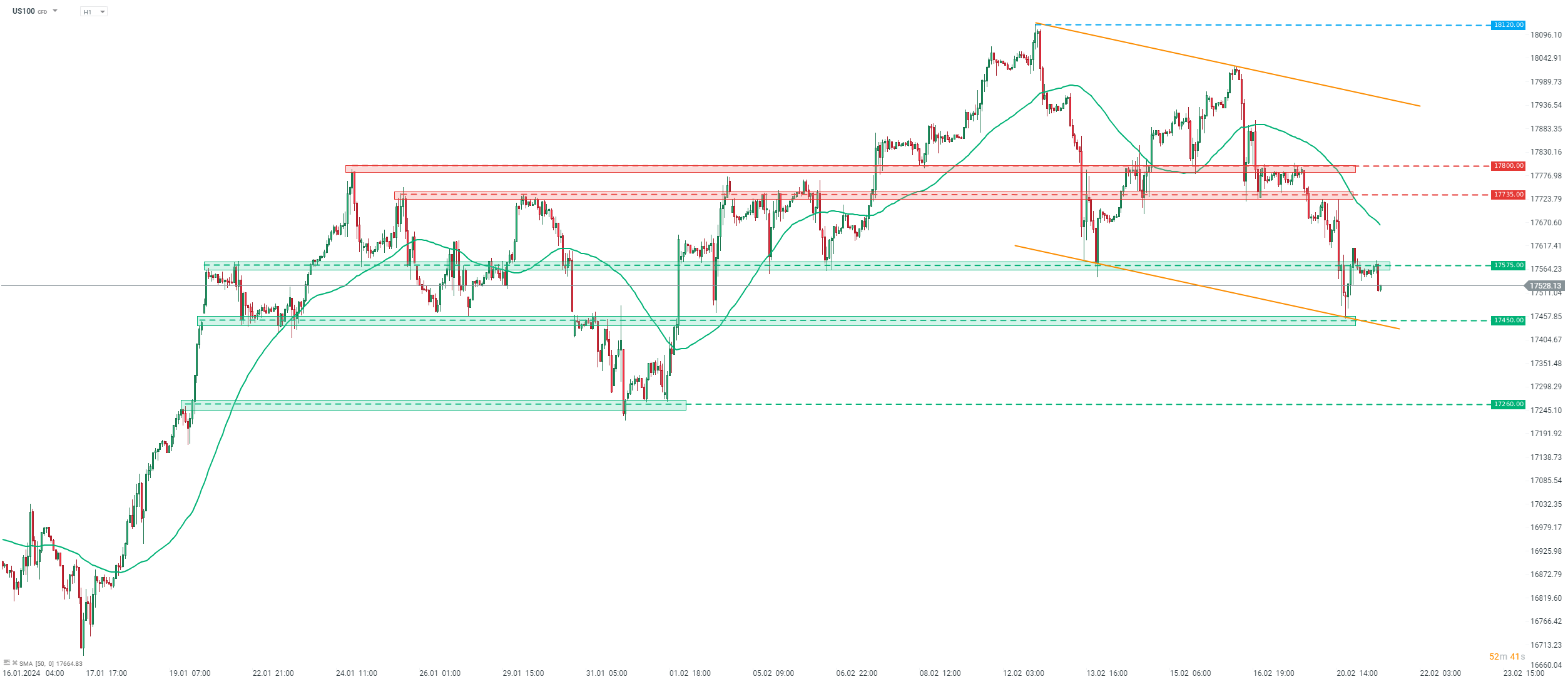

Taking a look at Nasdaq-100 futures chart (US100) at H1 interval, we can see that the index reached fresh record highs in the 18,120 pts area at the beginning of the previous week, but has been struggling since. Index is trading over 3% below recent all-time highs and has broken below the 17,575 pts support zone. A test of the 17,450 pts support area was made yesterday but bears failed to break below it. The aforementioned 17,450 pts area is a key near-term support to watch, given that US100 was unable to break back above 17,575 pts area overnight. A solid report from Nvidia is likely to push the stock, as well as the whole tech sector, higher while a disappointing report may exert strong downward pressure on US100 and push it towards 17,260 pts support.

Source: xStation5

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.