Oil

-

The latest OPEC+ meeting, as rumoured, led to a continuation of production increases. This time, OPEC+ will restore 1.65 million barrels per day from its 2020 Covid-era cuts.

-

Previously, these cuts were scheduled to last until the end of 2026, but the strategy has been changed.

-

The restoration is set at 137,000 barrels per day starting in October. Subsequent months will be subject to monthly decisions. However, this decision was made in just over a dozen minutes during the online meeting.

-

This marks a clear shift in the OPEC+ strategy compared to the last four years, when the priority was price rather than market share.

-

Eight OPEC+ countries are to participate in the production increase: Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman.

-

The reason for these decisions could also be concern about new sanctions on Russia, which would reduce the country's export capacity.

-

Saudi Arabia has cut its export prices for Asia and Europe for October, but at the same time, these prices remain above the Dubai benchmark.

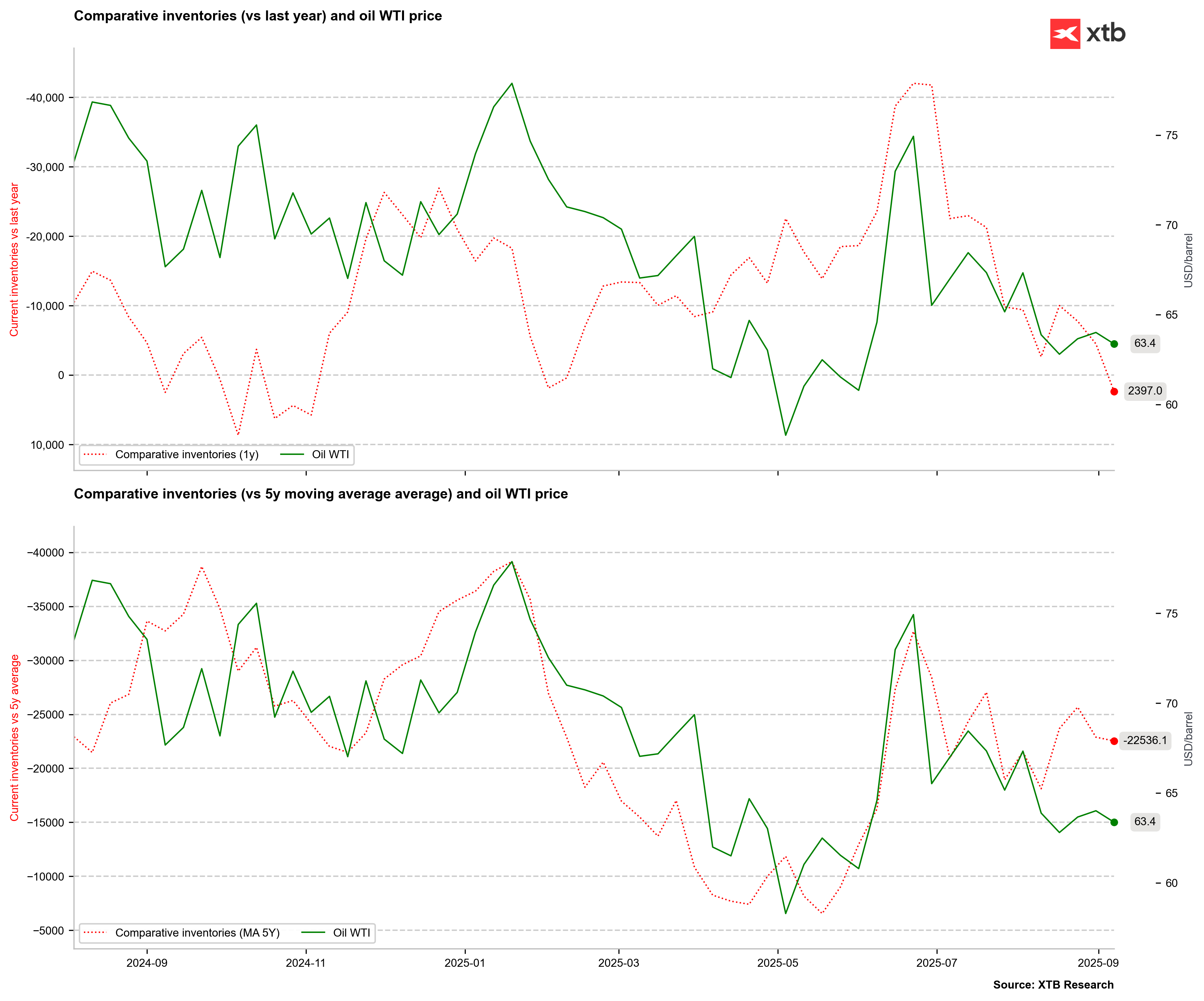

Oil inventories are entering a minimal surplus when compared to last year's stock levels. The fourth quarter will be crucial for the oil market, as the OPEC+ production increase was offset by a seasonal rise in demand. Currently, global production is expected to continue growing, but demand will slow compared to the previous two quarters. Source: Bloomberg Finance LP, XTB

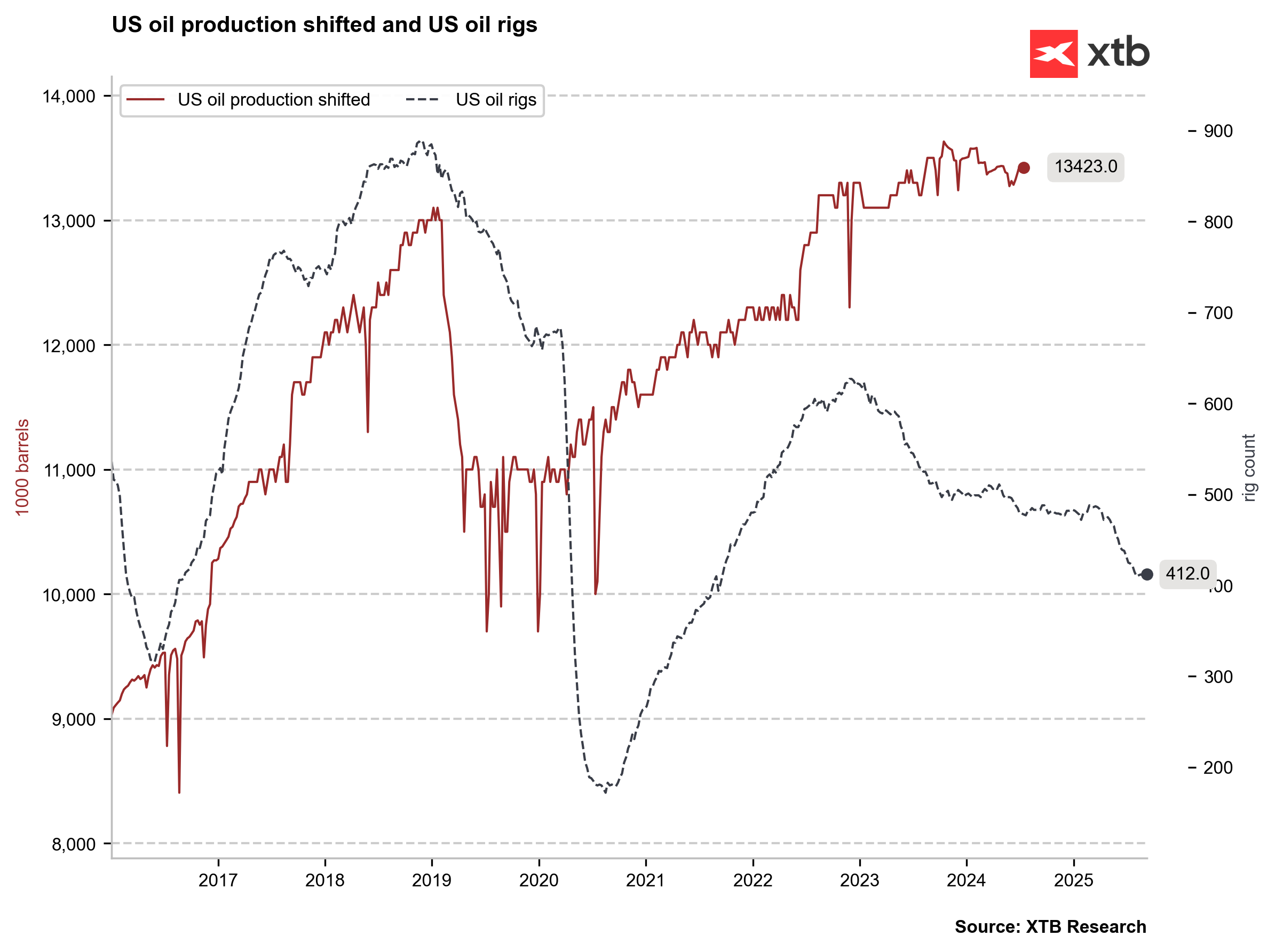

Crude oil production likely peaked at the end of the Biden presidency. Looking at the leading indicator—active drilling rigs—one might theoretically expect a consolidation or even a decline in production in the coming months. However, production drops should not be significant enough to cause a global decline in inventories. Source: Bloomberg Finance LP, XTB

Crude oil production likely peaked at the end of the Biden presidency. Looking at the leading indicator—active drilling rigs—one might theoretically expect a consolidation or even a decline in production in the coming months. However, production drops should not be significant enough to cause a global decline in inventories. Source: Bloomberg Finance LP, XTB Oil is rebounding for the second consecutive session, despite the recent OPEC+ decision to continue increasing production next month. Theoretically, we could be looking at a double-bottom formation, but its confirmation would only come with a break above the $65 per barrel range. Source: xStation5

Oil is rebounding for the second consecutive session, despite the recent OPEC+ decision to continue increasing production next month. Theoretically, we could be looking at a double-bottom formation, but its confirmation would only come with a break above the $65 per barrel range. Source: xStation5

Gold

-

Rising expectations for US interest rate cuts are driving gold prices to new all-time highs.

-

The price of gold has already reached $3,660 per ounce, breaking through the $3,600 level earlier this week.

-

Gold prices are now approaching the most optimistic forecasts from banks for this year. JP Morgan projected $3,675 in Q4 2025, while Goldman Sachs pointed to $3,700 by year-end.

-

Both banks also see the $4,000 level by the middle of next year.

-

The US dollar is at its weakest level in 1.5 months, fuelling the gold market's rally, although at the same time, purchases in the jewellery sector are expected to decline due to such extremely high prices.

-

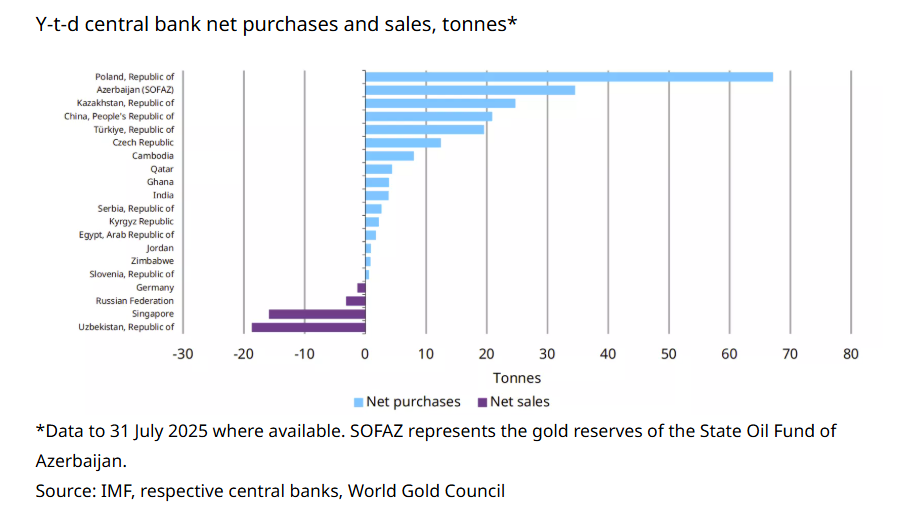

Gold prices, however, should be supported by purchases from ETFs and central banks. The National Bank of Poland recently announced the possibility of increasing its gold purchase target to 30% of reserves. The NBP was the main buyer among central banks in 2024 and remains the strongest buyer in 2025.

-

In July, however, purchases slowed down significantly compared to the previous six months, with central banks buying a net of just 10 tonnes of gold.

-

There is also a lot of talk about significant fiscal uncertainty, not only in the US but also in Europe (UK, France, Poland), which is leading to increased demand for gold among individual investors seeking protection against potential risks from excessive deficits.

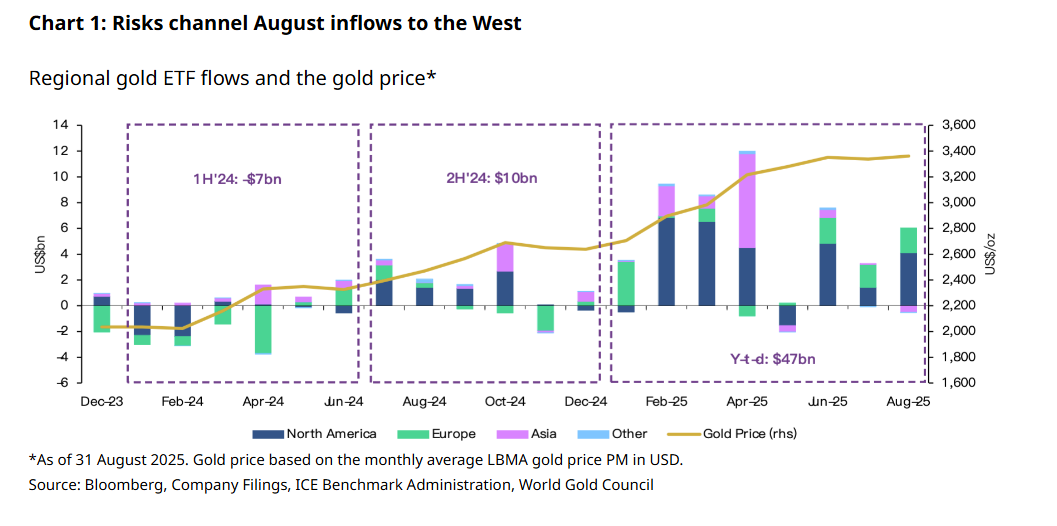

ETF purchases are taking place primarily in the US and Europe. Although the current increases are quite strong, they are far from the robust purchases seen in 2020 or 2016. Source: WGC

ETF purchases are taking place primarily in the US and Europe. Although the current increases are quite strong, they are far from the robust purchases seen in 2020 or 2016. Source: WGC Poland is one of the largest buyers of gold in recent years. It is officially buying significantly more than, for example, China or Turkey. It is worth noting that this year we also have other buyers from Europe such as the Czech Republic and Serbia. Source: WGC

Poland is one of the largest buyers of gold in recent years. It is officially buying significantly more than, for example, China or Turkey. It is worth noting that this year we also have other buyers from Europe such as the Czech Republic and Serbia. Source: WGC The price of gold tested the $3,660 per ounce area, breaking through successive important resistance levels. The 161.8% Fibonacci retracement of the decline from April and May points to the $3,730 per ounce level. The key support levels are currently $3,600 and $3,550 per ounce. Source: xStation5

The price of gold tested the $3,660 per ounce area, breaking through successive important resistance levels. The 161.8% Fibonacci retracement of the decline from April and May points to the $3,730 per ounce level. The key support levels are currently $3,600 and $3,550 per ounce. Source: xStation5

Natural Gas

-

Gas prices remain elevated above $3.0-$3.1/MMBTU.

-

Technically, the price has crossed the 50-period moving average and is testing the range of the previous major upward correction in the downtrend.

-

Prices have risen due to a recent downtrend in gas production (although production remains at a 5-year high for the period) and rising temperatures, which could increase demand from gas-fired power plants.

-

Gas production on Monday was 108.1 bcfd, which was about 6% higher year-on-year, and demand was just under 70 bcfd, which was 2.5% higher year-on-year. LNG exports were 15.2 bcfd, slightly lower than a week ago.

-

Electricity production in the last week of August was almost 8% lower year-on-year, but since the beginning of this year, production is up by almost 3% year-on-year.

-

The latest inventory increase for the week ending August 29 was 55 bcf, in line with expectations, but significantly higher than the average. Due to the increase in demand in recent days, subsequent reports may show a smaller inventory build.

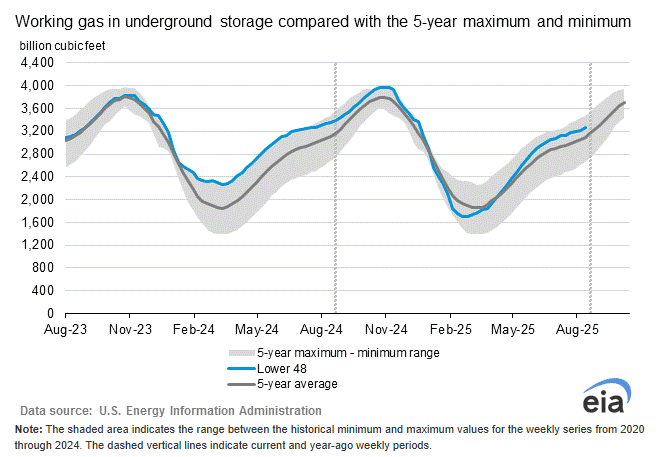

Inventories remain above the 5-year average. In line with seasonality, we have seen a reduced inventory build in recent weeks, and the current trend points to an acceleration of inventory growth. Last year's replenishment ended at 4,000 bcf, but the winter led to a clear drop in inventories. Source: EIA

Inventories remain above the 5-year average. In line with seasonality, we have seen a reduced inventory build in recent weeks, and the current trend points to an acceleration of inventory growth. Last year's replenishment ended at 4,000 bcf, but the winter led to a clear drop in inventories. Source: EIA The price reached its highest level since late July on Monday. Although there was a significant reduction later, the gains continued on Tuesday. The price is also once again above the 50-period moving average, which was a key resistance during a similar upward correction in July. If the price closes above the average and breaks out of the previous correction range, the target could be around $3.3 at the 100-period average. If the price returns to a downtrend, the key level will be the 14-period average approaching the $3 level. A break of this average could signal a return to the downtrend. Source: xStation5

The price reached its highest level since late July on Monday. Although there was a significant reduction later, the gains continued on Tuesday. The price is also once again above the 50-period moving average, which was a key resistance during a similar upward correction in July. If the price closes above the average and breaks out of the previous correction range, the target could be around $3.3 at the 100-period average. If the price returns to a downtrend, the key level will be the 14-period average approaching the $3 level. A break of this average could signal a return to the downtrend. Source: xStation5

Cocoa

-

Cocoa prices are under pressure due to an expected improvement in the supply situation in the coming quarters.

-

These arguments were recently presented by one of the world's largest chocolate producers, Mondelez. According to the company, cocoa production will rebound in the upcoming season despite previous mixed expectations regarding supply.

-

However, the weather in West Africa remains less than ideal for crops. It is said that the past summer was the driest since the late 1970s.

-

Asset management firm Bernstein presents interesting prospects for Mondelez. According to Bernstein, Mondelez has strong growth prospects, especially in view of a further decline in cocoa prices. In its report, it points to a scenario of a possible return of cocoa prices to the $2,500-$4,200 per tonne range from 2023.

-

A Reuters poll indicates a possible further decline in cocoa prices this year, given the expectation of a growing surplus, mainly due to a drop in demand.

Cocoa prices continue to fall, testing the $7,200 per tonne level today, their lowest since November 2024. The next harvest week begins in October, so initial price pressure can be expected if the first deliveries turn out to be higher than last year. We are also seeing a continued decrease in net positions on cocoa. Source: xStation5

Cocoa prices continue to fall, testing the $7,200 per tonne level today, their lowest since November 2024. The next harvest week begins in October, so initial price pressure can be expected if the first deliveries turn out to be higher than last year. We are also seeing a continued decrease in net positions on cocoa. Source: xStation5Daily summary: Risk assets keep sliding on US rate cut jitters (17.11.2025)

Soybean at 15-month high on USDA report and US-China trade optimism 📈 🫛

Quantum Computing after Earnings: Quantum Breakthough?

Chart of the day: USDJPY (17.11.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.