Cryptocurrencies are trying to maintain gains although Bitcoin and Ethereum are retreating from local peaks. The key event for risky assets will be Thursday's inflation reading from the US. Risk assets would like to finally see that the Fed's restrictive monetary policy is already yielding visible reslutions, and that inflationary pressures in the US economy are waning:

- Bitcoin was unable to stay above $21,000 for much longer, and Ethereum retreated below $1,600. Currently, the cryptocurrencies are trading at $20,700 and $1580, respectively. Litecoin is doing slightly better, with it 'waiting' halving as early as the first half of next year;

- Polygon continues its euphoric rise after Meta Platforms named the network as a 'partner' in processing NFT token trading on one of Meta's main portals, Instagram. The cryptocurrency is approaching the top 10 largest cryptocurrencies in terms of market capitalization, falling just 1 spot short of the ranking. Its nexty 'rivals' in the ladder are projects described as 'ethereum killers' Solana and Cardano. Polygon is closely tied to the Ethereum blockchain;

- Binance announced the sale of $2.1 billion worth of FTX tokens belonging to the exchange run by Sam Bankman-Fried. The decision had to do with the controversy over Bankman-Fried's FTX-related investment firm, Alameda Research. The information provided by Binance negatively affected the FTX token, which scored a dynamic sell-off. According to Chanpeng Zhao, owner of Binance investment vehicle Frieda, Alameda Research is hedged with FTX tokens which may create systemic risk. After Binance, the FTX exchange ranks second in terms of daily user trading volume;

- Alameda Reserach has referred to Binance's information and offered to buy back from Binance all tokens sold at a price of $22. If Alameda actually does so, the value of its token holdings will increase by more than $2.1 billion from $5.8 billion to nearly $8 billion. According to Alameda's recently published report, the company has $14.6 billion in assets and $8 billion in liabilities, of which $7.4 billion are loans.

Polygon's number of daily active users has nearly doubled since the beginning of August. The network's average number of daily users reached 248,000. On October 25, the network peaked in terms of the volume of transaction fees, their value reaching nearly $132,000 at the time. However, looking at the partnership with the partnership, these results could improve significantly thanks to the popularity of NFT. Instagram has nearly 1.45 billion users. Source: Cointelegraph Cryptocurrency market sentiment remains negative. The Fear and Greed Index indicates 'Fear', but in October it was 'Extreme Fear', the improvement in sentiment is noticeable. Source: alternative.me

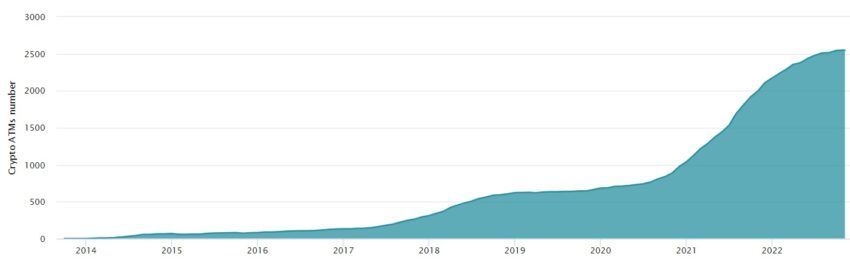

Cryptocurrency market sentiment remains negative. The Fear and Greed Index indicates 'Fear', but in October it was 'Extreme Fear', the improvement in sentiment is noticeable. Source: alternative.me Despite the general slowdown in the cryptocurrency market, bitcoin adoption in some countries around the world is still doing well. The number of ATM bitcoins in Canada has increased by 28% year-over-year, adding some 400 new machines over the past 12 months. Currently, there are already 2,549 of them in Canada. source: CoinATMRadar

Despite the general slowdown in the cryptocurrency market, bitcoin adoption in some countries around the world is still doing well. The number of ATM bitcoins in Canada has increased by 28% year-over-year, adding some 400 new machines over the past 12 months. Currently, there are already 2,549 of them in Canada. source: CoinATMRadar

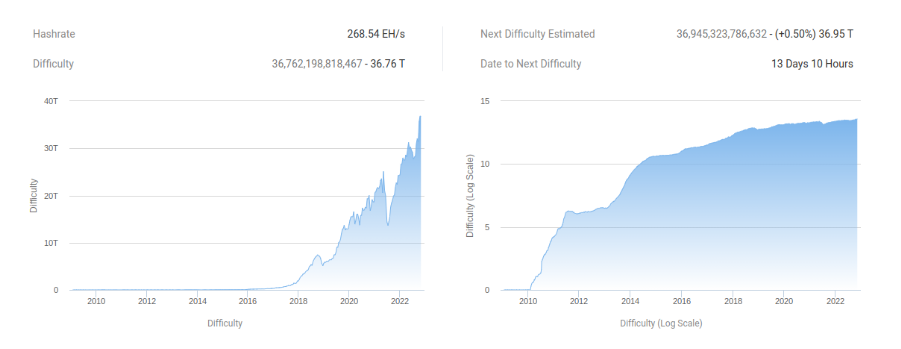

Bitcoin's mining difficulty is at historic highs, with the market expecting it to continue to rise steadily. The so-called 'hash rate difficulty' shows the still high interest in Bitcoin mining and the technological evolution of the chips responsible for validating transactions. Source: Coinglass The 'Bitcoin Yardstick' chart entered the 'cheap' zone marked in green, after Bitcoin's market capitalization in relation to mining difficulty (hash rate) began to show divergence. Previous levels marked in green heralded an impending unwinding. An increase in the difficulty of mining is usually associated with increasing competition in the miner market, and the sheer activity of miners and the available computing power of the entire Bitcoin network are one of the fundamental indicators of Bitcoin market analysis. Its organic growth has usually heralded a reversal of the downward trend. Source: Glassnode

The 'Bitcoin Yardstick' chart entered the 'cheap' zone marked in green, after Bitcoin's market capitalization in relation to mining difficulty (hash rate) began to show divergence. Previous levels marked in green heralded an impending unwinding. An increase in the difficulty of mining is usually associated with increasing competition in the miner market, and the sheer activity of miners and the available computing power of the entire Bitcoin network are one of the fundamental indicators of Bitcoin market analysis. Its organic growth has usually heralded a reversal of the downward trend. Source: Glassnode

Polygon chart, H4 interval. The cryptocurrency is in a dynamic uptrend. The RSI has cooled down, however, it still holds near 70 points signaling overbought conditions. Source: xStation5 Bitcoin chart, H4 interval. The price of the major cryptocurrency remains above major support at the SMA 200. A drop below it could break the uptrend line and trigger a retest of $20,000. Source: xStation5

Bitcoin chart, H4 interval. The price of the major cryptocurrency remains above major support at the SMA 200. A drop below it could break the uptrend line and trigger a retest of $20,000. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.