• European stocks close mostly in the red

• Pelosi sets 48-hour deadline for White House on stimulus talks

US indices are trading lower on Monday despite a positive start, as investors are waiting for more details regarding new stimulus deal. House Speaker Nancy Pelosi set a Tuesday deadline for the Trump administration to reach an aid deal before the Nov. 3 election. Meanwhile, coronavirus continues to worry investors as Covid-19 cases are growing by 5% or more in 38 states as of Friday. Nationwide, the daily case average has risen by more than 16% on a week-over-week basis to nearly 55,000 according to CNBC analysis of Johns Hopkins University data.

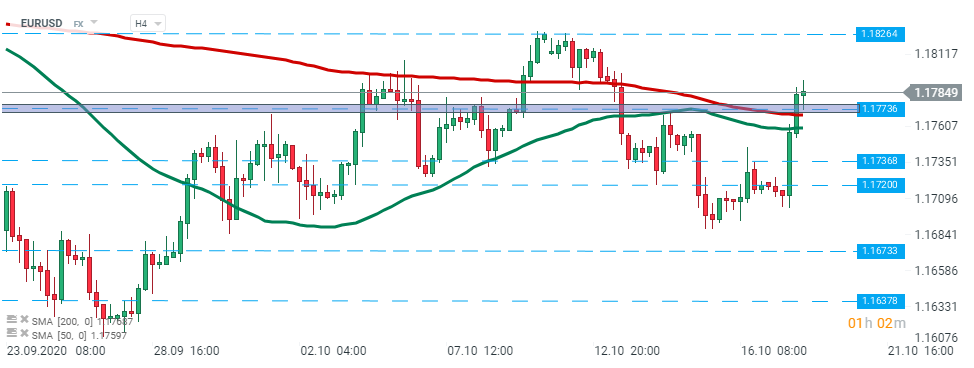

EURUSD – pair broke above and re-tested major resistance at 1.1773 which is additionally strengthened by 200 SMA (red line). Should buyers manage to uphold momentum then next resistance at 1.1826 may be at risk. Source: xStation5

EURUSD – pair broke above and re-tested major resistance at 1.1773 which is additionally strengthened by 200 SMA (red line). Should buyers manage to uphold momentum then next resistance at 1.1826 may be at risk. Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Chart of the Day: USD/JPY highly volatile ahead of US CPI

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.