- Rising inflation in Europe

- Wall Street retreats for 3rd session

- The Fed may start talking about a tightening of QE in the upcoming meetings

- Cryptocurrency sell-off

European indices joined a global selloff and finished today's session sharply lower amid ongoing inflation concerns, increasing number of coronavirus cases in Asia and lower commodity prices. On the data front, UK inflation rate jumped to 1.5% in April which is a 1-year high and producer prices rose much more than expected with the output index soaring 3.9%, the most since October 2018. Meanwhile consumer price inflation in the Euro Area was confirmed at a 2-year high of 1.6%. DAX fell more than 1.7%, CAC40 lost 1.43% and FTSE100 finished 1.19% lower.

US indices also came under pressure as massive selling returned to the tech sector amid a plunge in cryptocurrencies. Bitcoin price dropped at one point to $30.000 which prompted a fall in cryptocurrency-linked stocks. Crypto-currency sell-off intensified after Chinese regulators signaled a crackdown on the use of such assets. However US stocks managed to partly erase early losses in the afternoon as cryptocurrencies prices came off their lows, but the negative sentiment is still persistent. Minutes from the last FOMC meeting showed that Some Fed officials consider that if the economy continues to pick up strongly, it might be appropriate at some point in upcoming meetings to begin discussing a plan for tapering.

WTI crude fell more than 3.3 % and is trading around $63.30 a barrel, while Brent is trading 3.1% lower around $66.57 a barrel. Elsewhere gold rose 0.65% to $ 1,880.00 / oz, while silver is trading 1.0% lower, below $ 28.00 / oz amid weaker dollar, slightly higher Treasury yields.

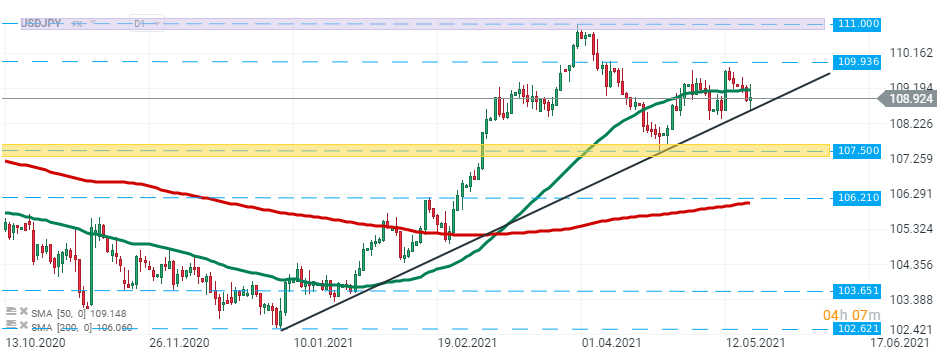

USDJPY - dollar managed to regain some ground after FOMC Minutes. Pair once again failed to break below the long-term trendline, however upward move is halted by the 50 SMA ( green line). Only breaking one of the above-mentioned obstacles should lead to bigger price movements. Source: xStation5

USDJPY - dollar managed to regain some ground after FOMC Minutes. Pair once again failed to break below the long-term trendline, however upward move is halted by the 50 SMA ( green line). Only breaking one of the above-mentioned obstacles should lead to bigger price movements. Source: xStation5

Copper fell sharply today partially due to the supply concerns. Major mining company Glencore will restart operations at the currently idled Mutanda copper mine in the Democratic Republic of Congo in 2022 to offset worries over the threat of a strike at mines in the biggest producer Chile. At the moment buyers managed to defend the major support at $10000 and price is approaching local resistance at $10220. Source: xStation5

Copper fell sharply today partially due to the supply concerns. Major mining company Glencore will restart operations at the currently idled Mutanda copper mine in the Democratic Republic of Congo in 2022 to offset worries over the threat of a strike at mines in the biggest producer Chile. At the moment buyers managed to defend the major support at $10000 and price is approaching local resistance at $10220. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.