- European shares end higher on Monday

- DAX above 16,100 pts

- Continuation of the downward trend on the EURUSD

- US stocks cut some gains

The vast majority of European indices ended the day in positive territory. The German DAX even managed to break above the level of 16,100 points and hit an all-time high. However, volatility leaves much to be desired, and today's upward impulse did not lead to a significant acceleration of the uptrend, on the contrary, the index remains in consolidation. On corporate news, Philips erased 10.6% this session following news that US regulators probed the Dutch firm’s laboratories amid suspicions that the company’s ventilators could contain hazardous materials. On the pandemic front, traders monitored the reintroduction of public health restrictions in Austria and the Netherlands. Meanwhile, ECB Persistent Lagarde noted supply chain pressure and rising energy costs are hurting Eurozone growth but highlighted that cutting back stimulus should not be rushed.

The US indices started the day above Friday's close, but the selling side quickly took the initiative and wiped out early gains. Nevertheless, declines also seem to be slowing down and major indices are trying to resume upward move. Currently, the Nasdaq is losing just 0.2%, the S&P500 is flat and the Dow Jones is gaining 0.1%. On the corporate front, Boeing shares were up more than 5% after the company received an order from Emirates for two 777 Freighters, valued at more than $704 million. On the other hand, Tesla stocks fell 4% after Elon Musk and Bernie Sanders shared some tweets and the US senator demanded the wealthy pay their "fair share" of taxes.In the following days, investors will focus on retail sales and industrial production data and earnings from retail giants including Walmart and Home Depot.

Today we have not seen any major moves in the oil and precious metals markets. WTI crude oil is trading above $ 80 a barrel while gold is hovering just above the $ 1,860 level. Industrial metals took a hit early in the session. Sentiment towards base metals deteriorated following a release of monthly activity data from China for October. Industrial production and retail sales turned out to be better-than-expected while urban investments disappointed.

During Monday's session we could observe mixed sentiment in the Forex market. In the evening hours the dollar appreciates 0.5% against the euro. In turn, the franc fell 0.27%, and the yen is weakening 0.18% against the US currency. On the upside, the AUD rose 0.3% and CAD added 0.2% In contrast, GBP and NZD appear to be muted.

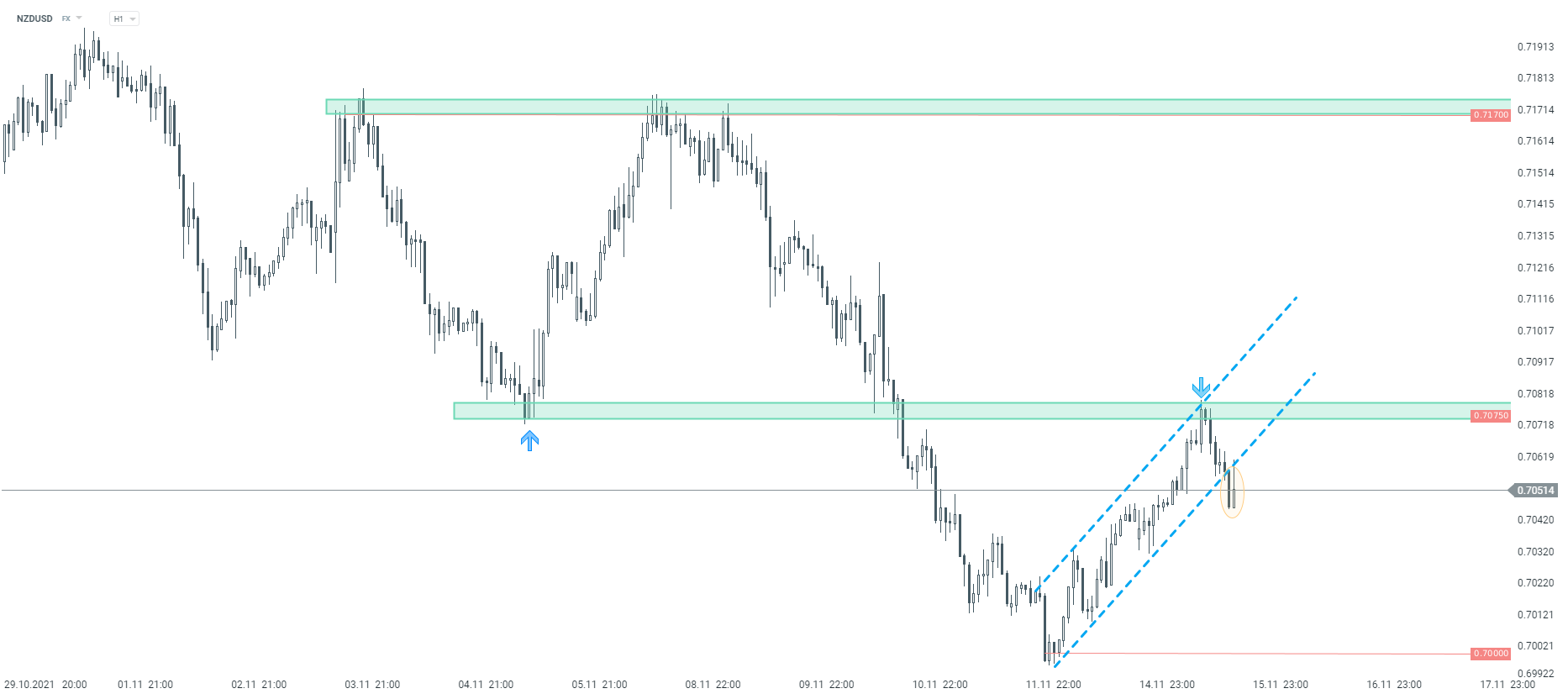

NZDUSD pair bounced off the key short-term resistance zone at 0.7075. Moreover, looking at the chart in a closer perspective, pair broke below the lower limit of the local ascending channel, which may indicate continuation of the downward movement. Source: xStation5

NZDUSD pair bounced off the key short-term resistance zone at 0.7075. Moreover, looking at the chart in a closer perspective, pair broke below the lower limit of the local ascending channel, which may indicate continuation of the downward movement. Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.