-

Wall Street indices are trading higher after recovering from early losses as continued streak of worse-than-expected jobs data from the United States makes Fed rate hike pause in May more likely

-

Tech Nasdaq is the best performing major Wall Street index while Dow Jones lags the most

-

Stock markets in Europe traded higher today with UK FTSE100, Italian FTSE MIB and Swiss SMI outperforming with over-1% gains. Some weakness could be spotted in the east with Polish WIG20 dropping 0.15%

-

Upbeat European session came in spite of a rather downbeat trading in Asia-Pacific where Japanese, Australian and South Korean indices traded lower. Indian Nifty 50 gained while indices from China traded mixed

-

Fed's Bullard said that the US central bank should continue on its rate path. Bullard also said that he expects financial stress caused by recent banking turmoil to continue to abate

-

ECB's Lane said that another rate hike would be appropriate at next meeting if macroeconomic situation develops in-line with projections

-

US Challenger report showed job cuts at 89.7k in March (exp. 65.0k) - an increase of almost 320% YoY

-

US initial jobless claims climbed to 228k (exp. 200k) in a week ended April 1, 2023. Previous reading was revised higher from 198k to 246k

-

US continuing claims climbed from 1817k, revised higher from 1689k, to 1823k (exp. 1700k)

-

Canadian jobs data for March showed a 34.7k increase in employment (exp. +12.9k), with 18.8k increase in full-time jobs and 15.9k increase in part-time jobs. Unemployment rate stayed unchanged at 5.0% (exp. 5.1%)

-

German industrial production increased 2.0% MoM in February (exp. +0.1% MoM)

-

US natural gas trades almost 5% lower after EIA report showed a 23 billion cubic feet drop in US natural gas inventories (exp. -21 bcf) and new forecasts for the United States continue to show a period of above-average temperatures ahead

-

Oil is trading a touch higher with Brent testing $85 area and WTI trading near $80.50 mark

-

Cryptocurrencies are trading mixed with major coins dropping slightly. Bitcoin drops 0.4% to $28,000 area

-

EUR and CHF are the best performing major currencies while NZD and AUD lag the most

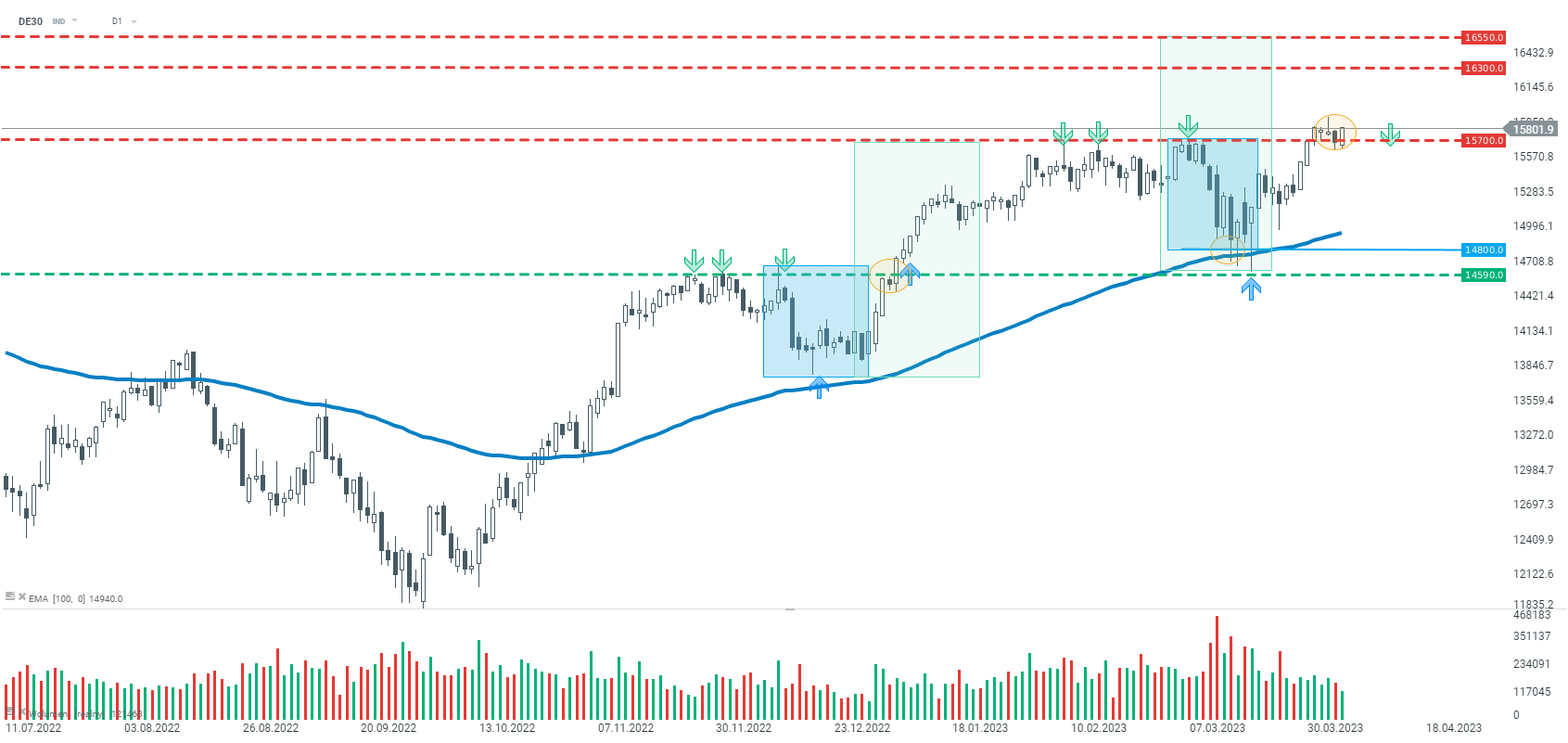

DE30 managed to defend 15,700 pts area, marked with previous local highs. According to classic technical analysis, such a situation suggests a high chance of continuation of the upward move. Source: xStation5

DE30 managed to defend 15,700 pts area, marked with previous local highs. According to classic technical analysis, such a situation suggests a high chance of continuation of the upward move. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.