-

Federal Reserve announced reduction in asset purchases

-

Wall Street indices hit record highs

-

DE30 at 16,000 pts

-

Oil drops after inventory build

-

USD weakens, cryptos jump

Indices trade nowhere during the European session as focus was on today's FOMC decision. The Federal Reserve finally announced a decision to begin tapering. Reduction will be made at a pace of $15 billion per month, starting in November. Such pace of tapering was more or less expected therefore no major negative reaction was spotted on the stock market. To the contrary, Wall Street indices moved to fresh all-time highs as Powell assured during press conference that rate hikes are off the table for now. US dollar weakened but it was not enough to allow gold to recover from losses made earlier in the day. Both silver and gold trade lower on the day.

While definitely the most important, Fed meeting was not the only noteworthy macro event in the US. ADP employment data for October beat expectations and showed an over-500k jobs growth, setting expectations for Friday's NFP release (12:30 pm GMT). Services ISM jumped to the highest level since 1997 in October. USD and indices saw a muted reaction to the data however.

Oil moved lower following a build in US oil inventories. WTI and Brent moved to 1-week lows a day ahead of OPEC+ meeting scheduled for Thursday. Oil producers will decide whether to maintain current output policy or bring back production quicker. Many OPEC+ members are reluctant to support output boost.

Cryptocurrencies also gained in the aftermath of FOMC meeting. Bitcoin jumped back above $63,000 while Ethereum reached a new all-time high near $4,660.

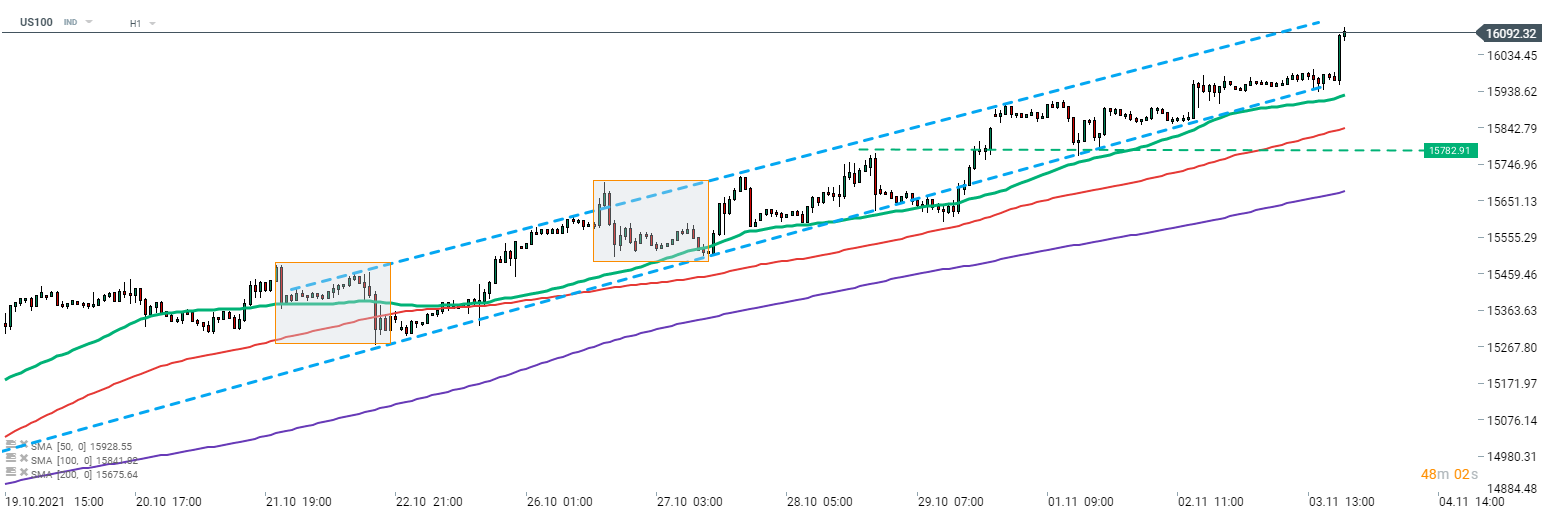

Nasdaq-100 (US100) rallied during Powell's press conference and broke above the 16,000 pts mark for the first time in history. Markets welcomed moderate pace of tapering and a rather dovish guidance on rates. Source: xStation5

Nasdaq-100 (US100) rallied during Powell's press conference and broke above the 16,000 pts mark for the first time in history. Markets welcomed moderate pace of tapering and a rather dovish guidance on rates. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.