- Mixed moods in Europe

- S&P and Dow reached new ATH after Powell nomination

- Cryptocurrencies swing between gains and losses

- Precious metals under selling pressure

Although Mondays are usually quiet, today we could observe quite significant moves. The cryptocurrency market attracted the greatest attention, after the Phunware company confirmed the purchase of a large amount of Bitcoin, which in turn led to a dynamic strengthening of the prices of the main digital assets. However, in the evening hours, one can see that almost all of the early gains have been erased. It is therefore possible that the correction in the crypto market may even deepen.

As for the traditional market, the major European stock indices had a problem with defining a clear direction after last week's sell-off. Resurgence of COVID-19 and possible lockdown in other countries took the center stage and weighed on market sentiment. European indices finished today's session in mixed moods, with Germany's DAX fell 0.3% and London's FTSE 100 gained over 0.4%.

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appUS stocks waver on Monday, the S&P rose around 0.3% to a fresh record high and the Dow Jones added as much as 250 points, boosted by gains in banks shares after President Biden nominated Federal Reserve Chair Jerome Powell for a second four-year term, fueled bets in a sooner rate hike in the US during 2022. Lael Brainard, who was the other top candidate, will be vice-chair. Meanwhile, the Nasdaq erased early gains to trade below the redline.

Powell's nomination also affected the Forex market. The US dollar appreciated immediately after the news hit the market, and upward move continued later in the session. The American currency gained 0.7% against JPY, while CAD and NZD lost around 0.5%. Elsewhere EUR, CHF and GBP dropped over 0.3% against the USD.

When it comes to the commodity market, gold is doing very poorly today, mainly due to the stronger dollar. Other precious metals are also under pressure, while crude oil rose by about 1%.

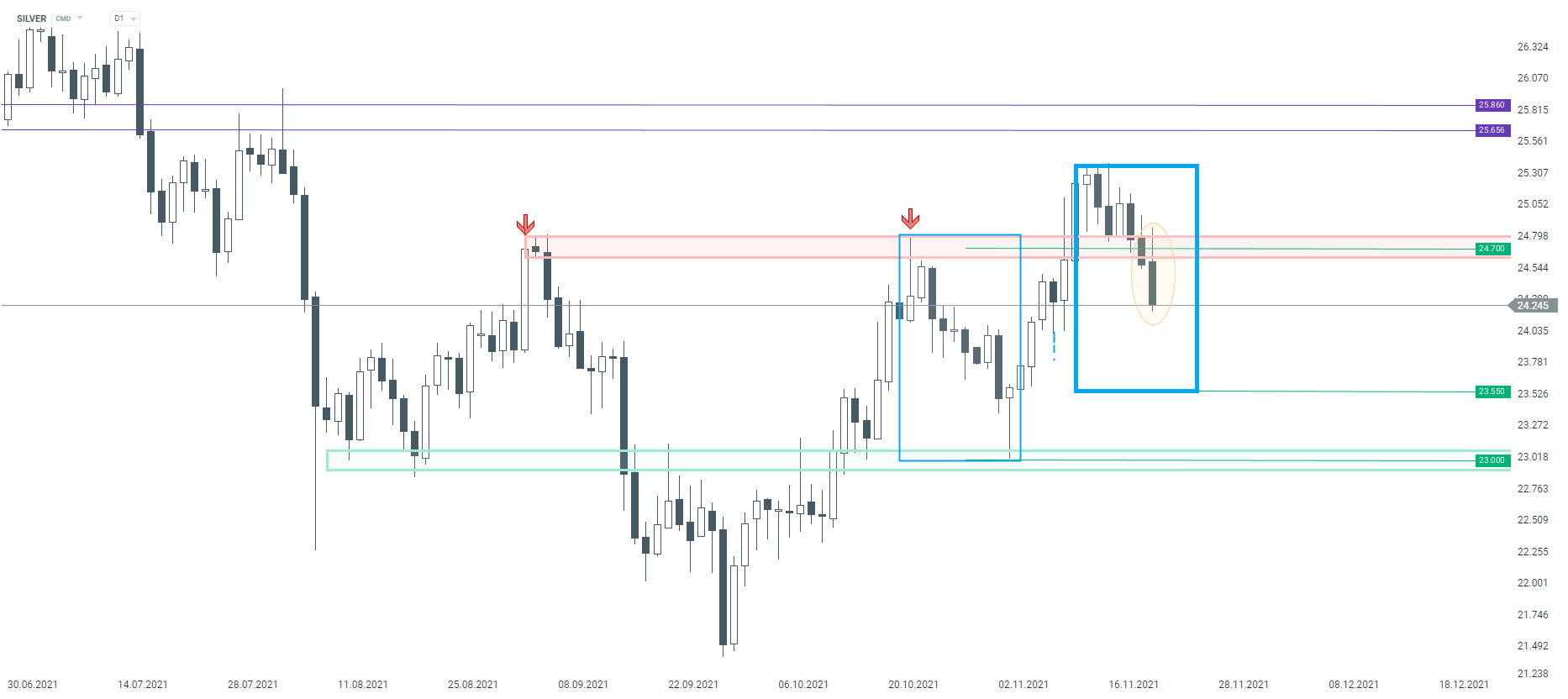

The technical situation on the silver market does not look very favourable for buyers. Last week one could observe a wide formation of inverted head and shoulders on the D1 interval, however today the price has receded below the key neckline at $ 24.70, thus there is a risk that decline could deepen. In this case, investors should focus on support at $ 23.55, which is marked by the lower limit of the 1:1 structure.

Silver interval D1. Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.