- European indices extended losses into a second day, with DAX down 0.95% led by losses in auto stocks after carmaker BMW warned that higher interest rates and ongoing price pressure will have negative impact on sales

-

ECB's Kazaks believes that 50-75 bp hikes are possible in December

-

BoE delivered an interest rate hike of 75 bps to tame stubbornly high inflation, the largest rate increase since 1989, but suggested Bank Rate would peak at a lower-than-expected level by financial markets.

-

Later BOE's Bailey told Bloomberg that nobody should read a 75 basis points as a new normal

-

Dow Jones is trading 0.30% lower, while S&P500 and Nasdaq fell 0.80% and 1.20% respectively as fresh economic data did not help to ease concerns about the pace of the Federal Reserve's interest rate rises.

-

US service providers expanded in October at the slowest pace since May 2020 as orders growth and production slowed.

-

US jobless fell to 217k, below analysts’ estimates of 220k, which points out that the labor market remains tight, backing the hawkish policy signaled by the Federal Reserve at its November meeting. Tomorrow traders attention will focus on October's NFP report .

-

Amazon are to pause on its new incremental hires in the corporate workforce, however it still intends to hire a meaningful number of people in 2023.

-

Donald Trump is considering launching a new presidential campaign after the midterm elections in the US, which will be held next week.

-

NATGAS price dropped below $6.0/MMBtu on Thursday, after the EIA report showed a bigger-than-expected storage build. US utilities added 107 bcf of gas to storage during the week ended October 28th, more than market expectations of a 97 bcf build.

-

Oil price retreated from three-week high as disappointing data from China raised demand concerns. Caixin services purchasing managers' index falling to the lowest level since May. Meanwhile Chinese health regulators dismissed speculations regarding easing the country’s Zero-Covid policy.

-

Mixed moods prevail on the precious metals market amid a stronger dollar. Gold tested major support at $1615.00, while silver erased early losses and approaches $19.50 level.

-

The dollar index hovers near 113.00 as investors turned to the US dollar following a more hawkish than expected message from the Federal Reserve.

-

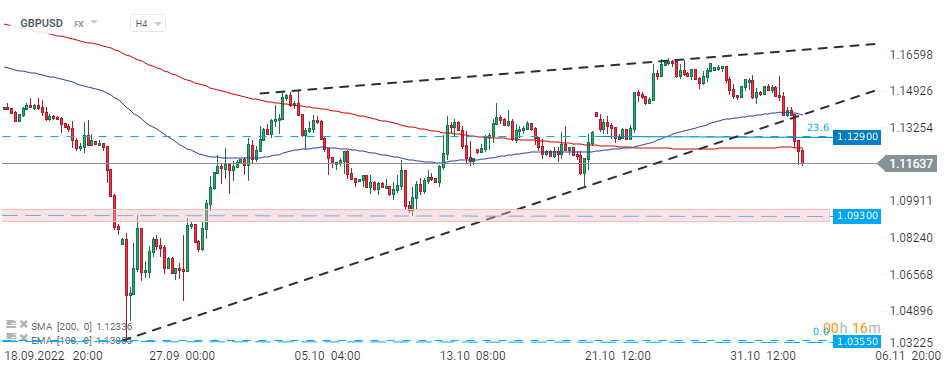

GBPUSD pair fell nearly 2.0% as markets now expect that the UK’s benchmark interest rate will peak just above 4.6% in September 2023, compared with 4.75% before today's BoE announcement.

-

Currently USD and CAD are the best performing major currencies while GBP and CHF lag the most.

GBPUSD pair broke below the major support zone around 1.1290 in the morning and the downward move gained steam following the BoE meeting. If current sentiment prevails, support at 1.0930 may be at risk. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.