-

European indices mostly higher

-

DE30 and US500 at new record highs

-

US PPI inflation running hot

Thursday’s session was another successful trading day for European equities. The German DAX (DE30) added 0.70% and climbed to new record highs. The pan-European STOXX 600 notched a fresh all-time high as well, even though the hard data from the Old Continent come in rather mixed. Industrial production from the eurozone for June fell short of expectations.

US indices are trading little changed, but the S&P 500 (US500) still managed to reach new highs. Initial jobless claims from the US fell for third straight week and continuing jobless claims continued to drop as well. Nevertheless, US PPI inflation surprised to the upside as supply chain disruptions in the global economy clearly intensify (we covered the issue in-depth in our today’s MACRO comment). The situation in China seems particularly worrying as Chinese authorities decided to partially shut down 3rd busiest port.

Commodity markets remain relatively stable. Oil, copper and gold prices are little changed. However, silver prices plunged more than 1.50%. Also, cryptocurrencies are under pressure, with Bitcoin tumbling roughly 5% in the evening. As far as FX market is concerned, the US dollar gained significantly against GBP, AUD and NZD (by around 0.40%). The main currency pair remains stable, hovering around 1.1740 in the evening. USDJPY is basically unchanged on the day as well.

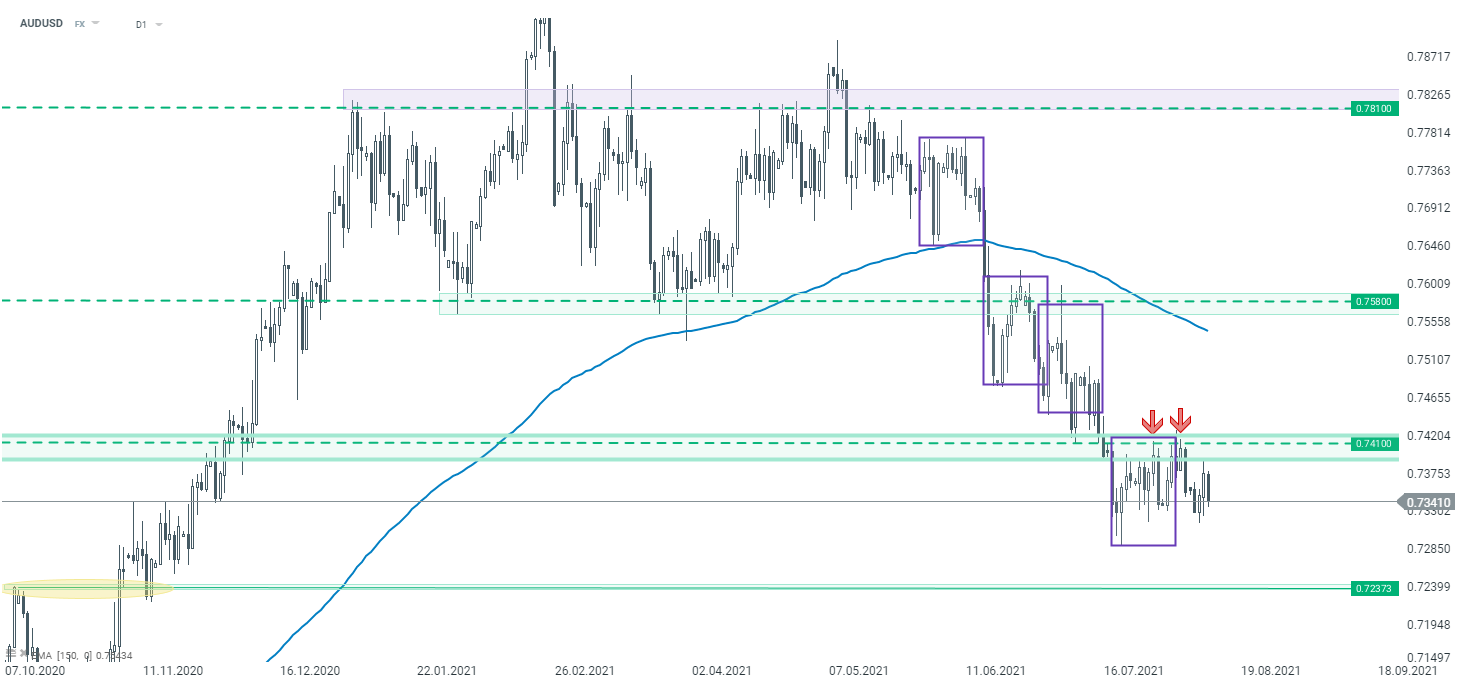

The Australian dollar has weakened significantly against the US dollar today. AUDUSD pair has been trading in a downward trend in recent months. The price bounced off the 0.7410 level during recent upward correction and the currency pair tanked again. As long as the price sits below it, the downward move could potentially deepen. The 0.7237 mark should serve as an important support level in such scenario. Source: xStation5

The Australian dollar has weakened significantly against the US dollar today. AUDUSD pair has been trading in a downward trend in recent months. The price bounced off the 0.7410 level during recent upward correction and the currency pair tanked again. As long as the price sits below it, the downward move could potentially deepen. The 0.7237 mark should serve as an important support level in such scenario. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.