- Global stocks under pressure after US defense reports

- US announced further sanctions on Russia

- Commodities prices soar, wheat price highest since 2011

- Cryptocurrencies move higher despite risk off sentiment

- Tesla (TSLA.US) fell below crucial support

European indexes erased early gains and finished today's session mostly lower, with DAX losing 0.4% and reaching an 11-month low. Market sentiment turned sour after the US warned Ukraine about the possibility of a full-fledged invasion, which could begin within the next 48 hours. US defense revealed that Russian forces around Ukraine are as ready as they can be. The gloomy sentiments were additionally affected by cyber-attacks targeting Ukraine's IT infrastructure and banks. Ukraine has decided to introduce a state of emergency in the main districts for the next 30 days. Meanwhile, Moscow has begun to evacuate the staff from its Kyiv embassy. On the data front, Germany’s GfK consumer confidence gauge took an unexpected downturn heading into March.

Major Wall Street indices also took a hit on Wednesday as market volatility returned, amid fresh concerns over the crisis in Ukraine. Washington decided to take further action against Nord Stream 2 AG and its corporate officers. Several other countries are expected to announce additional sanctions on Russia as well. The Dow Jones fell over 0.70% after adding more than 200 points at the open and the S&P 500 fell 1.0%, moving deeper into correction territory. The Nasdaq dropped 1.4% hitting a 37-week low. Tesla (TSLA.US) stock fell nearly 5.0% below major support at $788.00 and reached its lowest since October 2021.

Commodity prices benefit from the uncertainty related to the escalation of tensions in the East. Gold rose 0.5% and tested $ 1,910 level amid a weaker US dollar. However, silver, wheat and soybeans are among the top performers, gaining 1.7%, 4.1% and 2.5% respectively. Wheat and soybean prices reached their highest levels in almost a decade during today's session. Geopolitical uncertainty, increasing demand and shortages in major transshipment ports are driving the prices of these two agricultural commodities.

Although the cryptocurrency market is considered the most risky, today the main projects do not correlate with the stock market. Bitcoin trades flat, while Ethereum rose nearly 2%. Cardano is doing particularly well and is now up 5.5%.

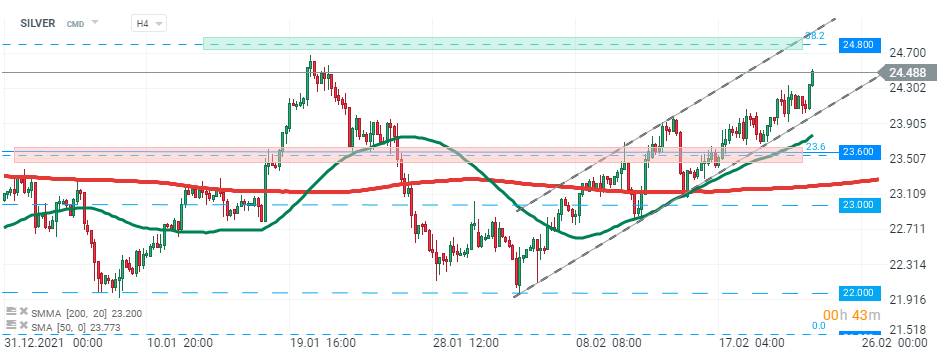

Silver price rose over 11% since the beginning of February as precious metals in general tend to perform well during times of geopolitical turmoil. Today silver also recorded strong gains and if current sentiment prevails upward move may accelerate towards major resistance at $24.80, which coincides with 38.2% Fibonacci retracement and upper limit of the ascending channel. Source: xStation5

Silver price rose over 11% since the beginning of February as precious metals in general tend to perform well during times of geopolitical turmoil. Today silver also recorded strong gains and if current sentiment prevails upward move may accelerate towards major resistance at $24.80, which coincides with 38.2% Fibonacci retracement and upper limit of the ascending channel. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.