-

Mixed session in Europe

-

Last trading day of 2020 in some countries

-

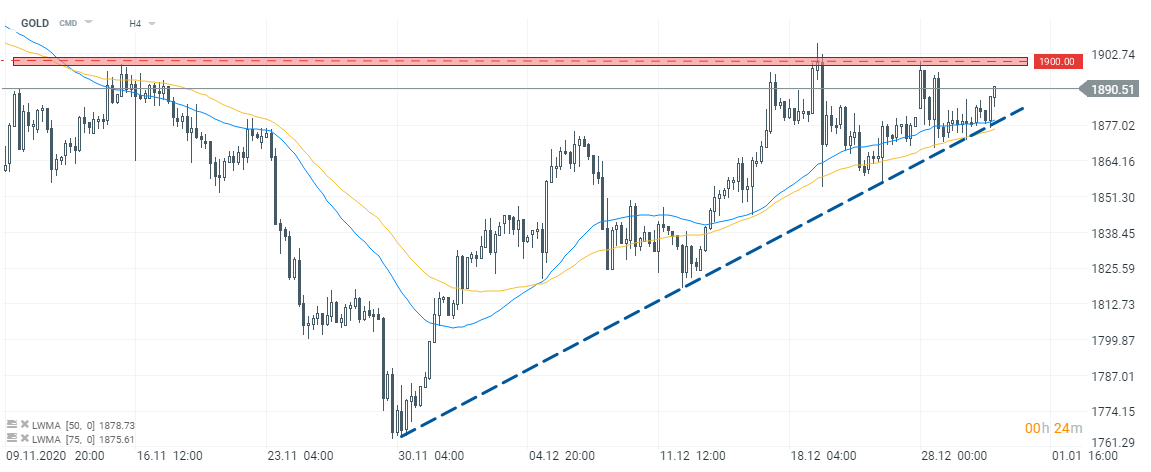

Gold approaching $1,900

Today’s session was the last trading day of the year for some stock exchanges. European indices finished the day mixed. The DAX lost 0.04%, CAC 40 dropped 0.20% while Euro Stoxx 50 gained 0.08%. Stocks in the United States push higher and Russell 2000 outperforms.

FTSE 100 may be found among today’s laggards as UK is set to impose tougher restrictions for millions of people. More regions will be placed into the toughest Tier 4 category as Covid-19 cases soar in the country. Meanwhile, UK lawmakers approved Brexit trade deal today and the agreement will be implemented on New Year’s Day.

Investors might spot some gains on precious metals markets today as gold prices has been approaching the $1,900 mark. Silver prices climbed above $26.60. Oil prices reached session highs following DOE’s oil inventories report, which showed that oil inventories declined more than anticipated. Chicago PMI for December came in above estimates (59.5 vs exp. 57.0).

Stock markets in some countries will be closed tomorrow (including Germany, Japan or Switzerland). Other exchanges will close earlier due to New Year’s Eve. As far as economic calendar is concerned, China will release its PMIs for December. Investors will also eye initial jobless claims from the US.

Gold climbed towards $1,890 and market bulls might eye critical $1,900 area again. Buyers were not able to smash through that barrier several times despite an upward impulse initiated a month ago. An upward trendline might serve as the nearest support. Source: xStation5

Gold climbed towards $1,890 and market bulls might eye critical $1,900 area again. Buyers were not able to smash through that barrier several times despite an upward impulse initiated a month ago. An upward trendline might serve as the nearest support. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.