- European finished today's session slightly higher, with DAX 40 adding 0.46% and FTSE 100 gaining 0.13%. German industrial production growth beat expectations in January, while retail sales surprised on the downside.

-

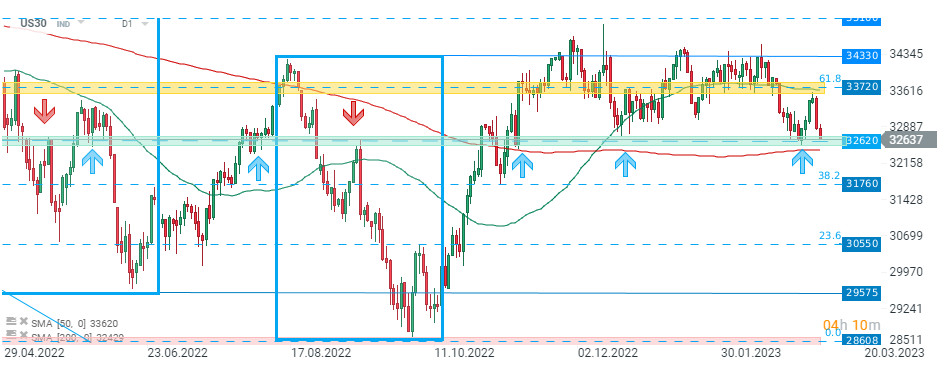

Major Wall Street indices resumed downward move in the evening, with Dow Jones trading 0.70% lower, while S&P500 and Nasdaq fell 0.25% and 0.15% respectively as traders digested latest data from the labour market and hawkish remarks from FED Chair Powell.

-

JOLTS fell by 410K to 10.824 million in January from an upwardly revised 11.234 million in December, compared to analysts’ estimates of 10.5 million.

-

ADP report showed that the private sector in the US unexpectedly created 242K jobs in February, well above an upwardly revised 119K in January and market forecasts of 200K. Both reports point to a still-tight US labor market and raised expectations that FED will remain hawkish.

-

Fed Chair Jerome Powell during the second day of testimony in front of Congress said that the central bank would likely need to raise rates more than expected in response to solid employment and inflation data. Powel said that the size of the next interest rate increase is dependent on upcoming jobs and inflation data.

-

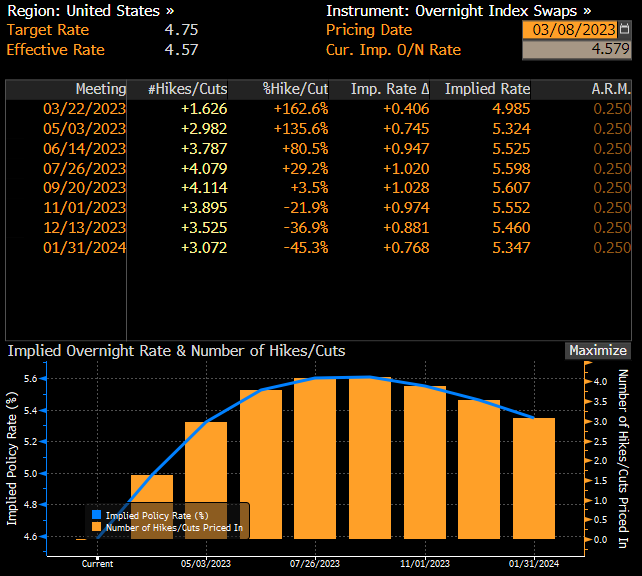

Markets are now priced for a 70% chance of a 50 basis point rate hike in March, according to CME’s FedWatch tool, up from a 30% chance a day ago.

-

OIL. WTI bounced off major support at $76.10, however is still trading 1.3% lower despite US crude oil inventories unexpectedly dropping by 1.694 million barrels in the week ended March 3rd, compared with market expectations of a 0.395 million barrel increase, the latest EIA report showed.

-

Precious metals are trading slightly higher around recent lows. Gold pulled back to $1815 after an unsuccessful attack on the $1825 mark, while silver hovers near crucial $20.00 support as tight supplies limited the decline. Silver inventories at the LBMA and COMEX remaining at low levels. Additionally, new data revealed reserves by major producer, Peru, dropped by 22,000 tonnes to 98,000 in 2022.

-

USDCAD pair surged above resistance at 1.3800 as BoC kept the rate unchanged at 4.5% in March, as widely expected, and stated that it should keep them at the current level should economic conditions develop broadly in line with expectations.

-

EURUSD pulled back to major support at 1.0535 as fresh ADP data strengthened the greenback, however buyers managed to regain control later in the session.

-

Wheat futures dropped to the lowest in 18 months, as the USDA’s WASDE report confirmed the supply from the world’s top producers - Russia and Ukraine is set to increase.

-

Major cryptocurrencies moved lower. Bitcoin fell below support at $22,000 while Ethereum is testing a crucial support zone around $15550.

Markets price in further hikes from the FED in the upcoming months. Source: Bloomberg

US30 again pulled back towards crucial support at 32620 pts, which is marked with previous price reactions and 200 SMA (red line). Should break lower occur, next support to watch can be found at 31750 pts. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.