- European indices finished today's session lower, with Dax down 0.52% as private sector activity unexpectedly grew much faster than anticipated in the Euro Area, France and Germany, led by a rebound in the services sector while manufacturing activity shrank more, according to preliminary S&P Global PMIs, which reinforces bets that thar rates will remain higher for longer. At the same time, the ZEW Economic Sentiment for Germany improved for a fifth consecutive month.

-

Lagarde repeated that the ECB intends to hike 50 bps in March

-

Dow Jones is trading 1.65% lower, and the S&P 500 and Nasdaq 100 plunged 1.60% and 2.0%, respectively, as weak financial outlook from Walmart and Home Depot added to concerns that inflation and higher interest rates have started hurting the purchasing power of US consumers.

-

Additionally, fresh data supported the case for further central bank policy tightening, driving Treasury yields higher while putting pressure on tech and other growth stocks.

-

US PMI indices surprised very positively, showing that the economy is not heading towards recession. Manufacturing PMI rose to 47.8 points, while the services PMI returned to expansion territory at 50.5 points.

-

Rising geopolitical tensions also negatively affected market sentiment. President Putin suspended a nuclear arms control treaty and delivered a fresh set of threats to the West.

-

Inflation in Canada slows down more than expected to 5.9% YoY, which indicates that the BoC may have made a good decision to suspend hikes. CAD weakened after the release.

-

Energy commodities trade lower - Brent drops 0.8%, WTI trades 0.9% lower and US natural gas prices fell over 8.0% and is moving towards key support at $2.0.

-

The dollar index traded around 104 on Tuesday, holding near its highest levels in six weeks, while EURUSD pair fell to fresh session lows at 1.0640.

-

Precious metals trade mixed. Gold fell 0.60% and is approaching major support at $1830, while silver failed to break above psychological resistance at $22.00.

-

Bitcoin once again failed to stay above the $25,000 handle and pulled back to $24,500, while Ethereum oscillated around local support at $1670.

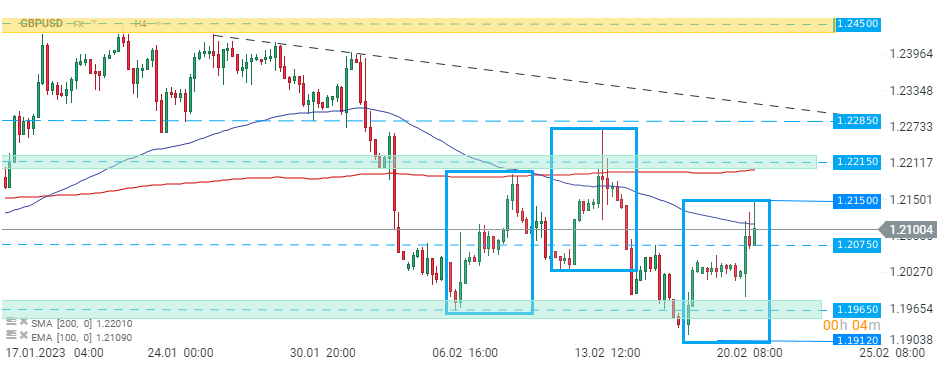

The British pound is the best performing G10 currency today. GBPUSD pair jumped above the 1.2100 level following better-than-expected UK PMI prints and prompted aggressive short-covering. Nevertheless, the price pulled back in the evening, as buyers failed to break above resistance at 1.2150, which is marked with the upper limit of the 1:1 structure. As long as the pair sits below this level, downward move may resume. Source: xStation5

The British pound is the best performing G10 currency today. GBPUSD pair jumped above the 1.2100 level following better-than-expected UK PMI prints and prompted aggressive short-covering. Nevertheless, the price pulled back in the evening, as buyers failed to break above resistance at 1.2150, which is marked with the upper limit of the 1:1 structure. As long as the pair sits below this level, downward move may resume. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.