- Today's inflation reading from the U.S. was in the market's spotlight before the scheduled tomorrow Fed decision and Jerome Powell speech at 7:30 PM GMT. The reading did not bring a significant surprise. Y/y inflation came in at 3.1% versus 3.1% forecast and 3.2% previously. On a monthly basis, it rose 0.1% despite an expected 0% growth rate, and core inflation pointed to 4% y/y, in line with forecasts

- 10-year treasuries yields are falling and the U.S. dollar is weakening today after the main macro reading. EURUSD is trading below 1.08, where strong supply has restarted.

- AUD and CAD are weakening against the USD, while the best performing of the G10 group is the Japanese yen

- U.S. Treasury Secretary and former Fed Chair Janet Yellen stated dovish that inflation expectations are under control and a rise in real interest rates could influence further Federal Reserve policy. Yellen currently sees no reason why inflation should miss its target, and stressed that the U.S. economy is on its way to a 'coveted' soft landing

- Indexes overseas are trading higher. The Nasdaq 100 gains 0.4%, the Dow Jones is trading 0.2% higher and the S&P 500 adds 0.25%. Apple shares are trading with modest gains. The latest iOS update is expected to make it easier for the company to combat product theft, at the point of sale

- Oracle (ORCL.US) shares are trading near a 12% sell-off, wiping out nearly $25 billion in market capitalization, after third-quarter results missed expectations, pointing to lower-than-forecast revenues, including in its cloud computing segment. The stock wasn't helped by a more than 40% year-on-year increase in net income and is now trading at its lowest since May, this year

- Stock indexes from Europe halted gains. Germany's DAX closed today in the region of its benchmark, as did London's FTSE100. The CAC40 lost 0.11%, and we saw larger declines on indexes in Spain or Portugal. Nevertheless, it seems far too early to think about a change in stock market sentiment, although a downward correction could occur at any time given the recent strong gains on European trading floors

- Germany's ZEW index rose to 12.8 on expectations of 8.7, with a previous reading of 9.8. The improvement, seen mainly in the outlook, may be related to expectations of faster rate cuts in the face of falling inflation

- Oil prices resumed declines on concerns about demand for crude, with both Brent and WTI losing more than 3%

- Precious metals are trading mixed, with gold and silver losing slightly in evening trading, while palladium and platinum are gaining more than 1%

- Cryptocurrencies are trading in mixed sentiment. Altcoins are doing better against Bitcoin, which is trading around $41,500. Record highs are being recorded by Cosmos, which is currently trading nearly 20% higher. The crypto market is evaluating a possible 'fight' scenario against the decentralized finance sector, following unfavorable comments from US Senator Elizabeth Warren to the industry

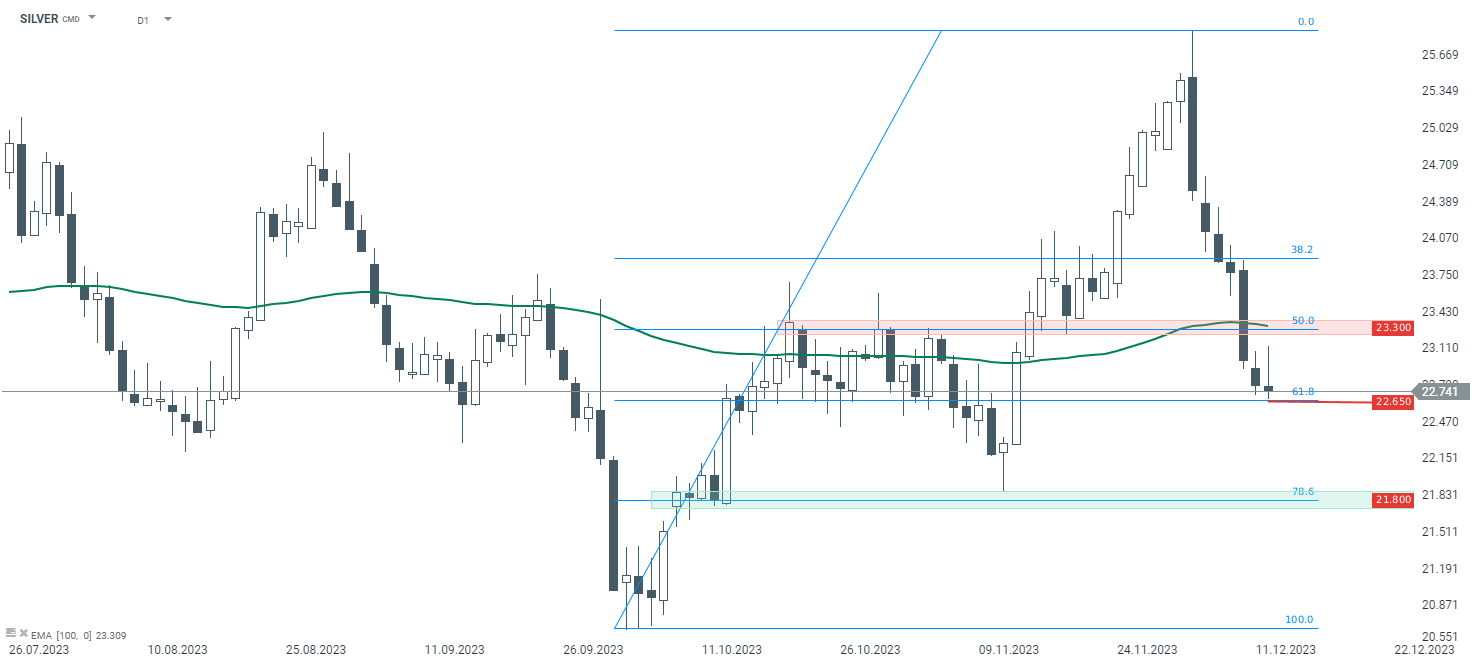

SILVER tests 61.8 Fibo support zone. In the case of falling below $22,65, we can see next critical support at $21.80. Source: xStation5

SILVER tests 61.8 Fibo support zone. In the case of falling below $22,65, we can see next critical support at $21.80. Source: xStation5

Economic calendar: US Non-Farm Payrolls and Supreme Court decision on tariffs in focus🗽

BREAKING: Weak macro data from Germany 🚨Norwegian CPI rises

Morning wrap (09.01.2026)

Daily summary: exceptionally low US trade deficit; dollar remains strong 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.