Activision Blizzard (ATVI.US), US video game company, is trading around 11% lower on the day after the UK regulator blocked planned takeover of the company by Microsoft. Activision decided to release its Q1 2023 earnings report today during the session, instead of tomorrow after market close as scheduled, in a likely response to the news earlier today. However, even as results turned out to be better-than-expected, they failed to lift sentiment towards the stock and the company's shares continue to trade at a deep loss today.

Activision Blizzard reported a 25% YoY jump in Q1 net bookings, a measure often seen as a form of adjusted revenue for video game companies, to $1.86 billion (exp. $1.79 billion). Earnings per share reached $0.60, also above $0.51 expected by the market. Net revenue was almost 35% YoY higher at $2.38 billion. Company noted that it has managed to achieve year-over-year growth in its key intellectual properties, with the Call of Duty franchise being the main driver of growth. Company said it had 368 monthly active users in Q1 2023, slightly lower than 372 million reported in Q1 2022.

Activision Blizzard said that it will work aggressively with Microsoft to appeal decision of the UK Competition and Markets Authority (CMA). According to Activision Blizzard, CMA's reasoning that the merger will result in higher prices and fewer choices for customers as well as decreased innovation is irrational and inconsistent with the evidence. Company continues to believe that a tie-up with Microsoft will be pro-competitive. Nevertheless, this has failed to lift investors' sentiment towards the stock as it continues to trade over 10% lower on the day, reflecting lower likelihood of completing merger deal that would see Activision Blizzard being took over at $95 per share.

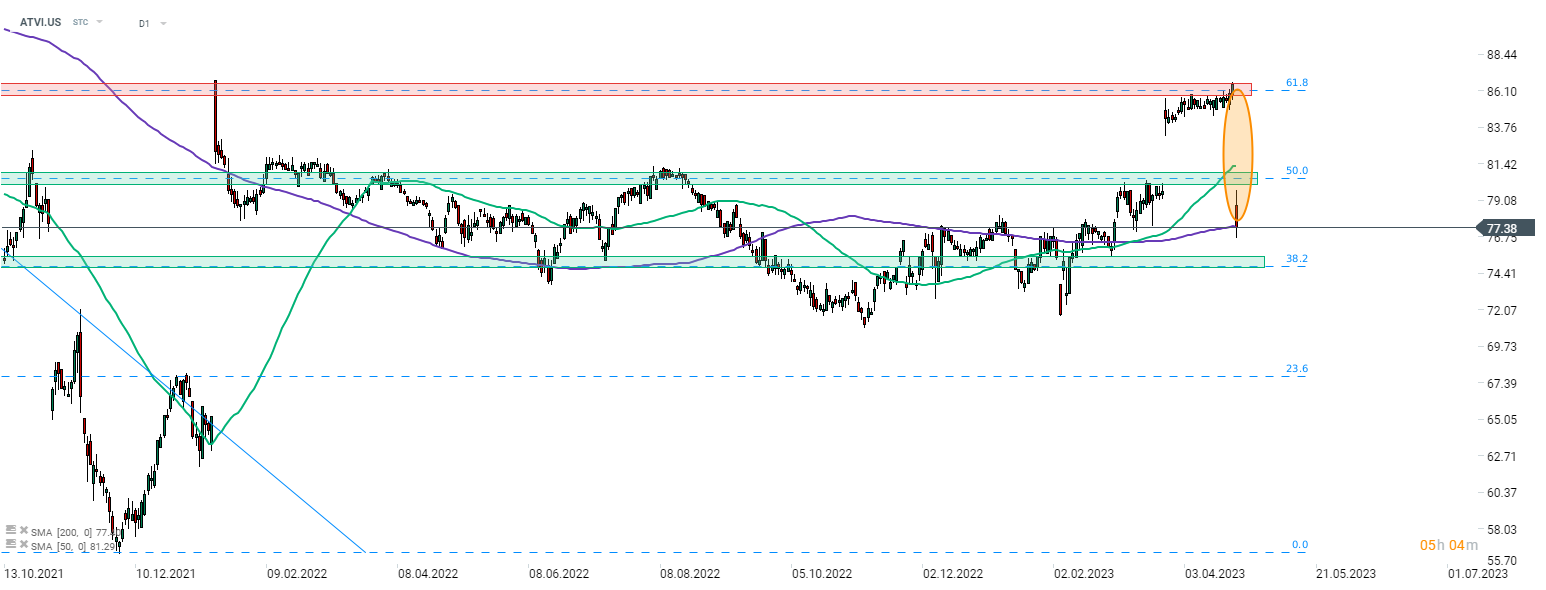

Activision Blizzard (ATVI.US) plunged today after UK CMA blocked takeover by Microsoft. Release of solid Q1 earnings during the session failed to lift the sentiment and bears are trying to push the stock below a 200-session moving average (purple line). Should they succeed, declines may deepen towards the next support to watch - a zone marked with 38.2% retracement of the downward move launched in early-2021. Source: xStation5

Activision Blizzard (ATVI.US) plunged today after UK CMA blocked takeover by Microsoft. Release of solid Q1 earnings during the session failed to lift the sentiment and bears are trying to push the stock below a 200-session moving average (purple line). Should they succeed, declines may deepen towards the next support to watch - a zone marked with 38.2% retracement of the downward move launched in early-2021. Source: xStation5

Apple shares down ahead of the earnings 📉Will iPhone support the company?

US Open🚨US100 slides almost 2% amid 11% Microsoft shares crash📉

Caterpillar gains after Q4 earnings 📈AI support industrials?

BigTech support US100📈Microsft, Tesla and Meta Platforms publish Q4 results!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.