EasyJet (EZJ.UK) announced today plans to cut thousands more flights during the July -September period due to capacity issues and labour shortages at Amsterdam and London Gatwick airports, which are major bases for the company. The British low-cost airline group now plans to reach 90% of its pre-pandemic capacity during the summer period, which represents a significant drop compared to last month's forecast of 97%, which would have been around 160,000 flights.

- Company's CEO Johan Lundgren believes reducing the schedule now would minimize last-minute cancellations that had a bigger impact on customers.

- "It is necessary to build further resilience into the flying schedule this summer by proactively cancelling a number of flights, providing customers with advanced notice and rebooking options," Lundgren said.

- Despite this negative news, global airlines are now expected to record a $9.7 billion loss in 2022, a significant improvement from a revised $42.1 billion loss in 2021, the International Air Transport Association (IATA) announced today, and may record some profits in 2023.

- Many of the major airlines struggle from high levels of debt and rising fuel prices which negatively affects profits. Willie Walsh, director general of IATA said confused government policies had worsened disruption seen particularly in Europe as flying restarted. "The cost of government mismanagement was substantial. It devastated economies, disrupted supply chains and destroyed jobs," Walsh said.

- During the pandemic, airlines and airports have been forced to lay off workers who are now finding another job, and many of them do not intend to return to their previous employer, resulting in labor shortages. The number of flight bookings in the coming months has increased, but the specter of recession and problems with employees make the future of this sector uncertain in the long term.

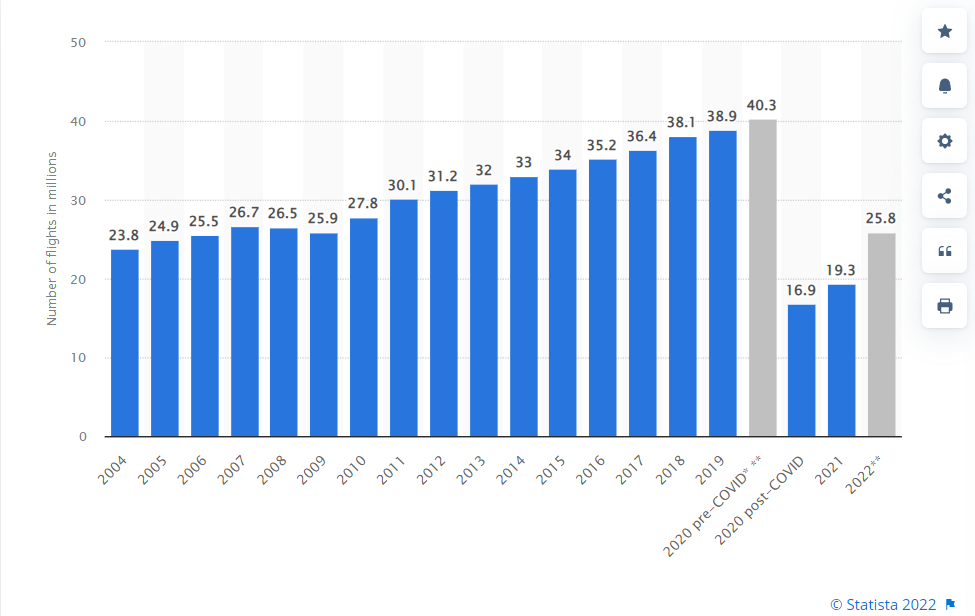

Number of flights is rising, however still remains well below pre-pandemic levels. Source: Statista.com

Number of flights is rising, however still remains well below pre-pandemic levels. Source: Statista.com

EasyJet (EZJ.UK) stock plunged to 20-month lows recently. On Monday price fell 3%, however sellers failed to break below major support at 4.18 and price launched a recovery move. Local downward trendline should act as the first line of resistance. Source: xStation5

EasyJet (EZJ.UK) stock plunged to 20-month lows recently. On Monday price fell 3%, however sellers failed to break below major support at 4.18 and price launched a recovery move. Local downward trendline should act as the first line of resistance. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.