Key highlights:

- The Fed is broadly expected to lift interest rate for the first time today

- Powell will suggest more tightening despite warrelated uncertainty

- The decision is at 6pm GMT, conference starts 30 minutes later

- We will provide LIVE coverage of the event in the “News” section

The decision

This is the “easy” part. The Fed communicated it so well that there are no doubts – interest rate will increase today by 25 basis points – the first post-pandemic rate increase. This has been long priced in by the markets and it’s not this decision that matter but what comes next.

Markets expect the Fed to increase rates at every meeting this year and see high odds of a “double” interest rate increase in May. Source: Bloomberg

Markets expect the Fed to increase rates at every meeting this year and see high odds of a “double” interest rate increase in May. Source: Bloomberg

What to watch for

The first thing to watch is the “dot-plot”, a chart where FOMC members reveal their expectations of future rates. In December they saw just 2 hikes for 2022, now the markets sees at least… 6! So the first question is, if the plot validates these expectations.

Second is balance sheet. There will be most likely no commitments today but during the conference president Powell will be asked about the starting point and the pace of balance sheet reduction. This is the opposite to the QE (“money printing”) that was so supportive for stocks so the sooner the reversal starts, the worse news this is for stock markets.

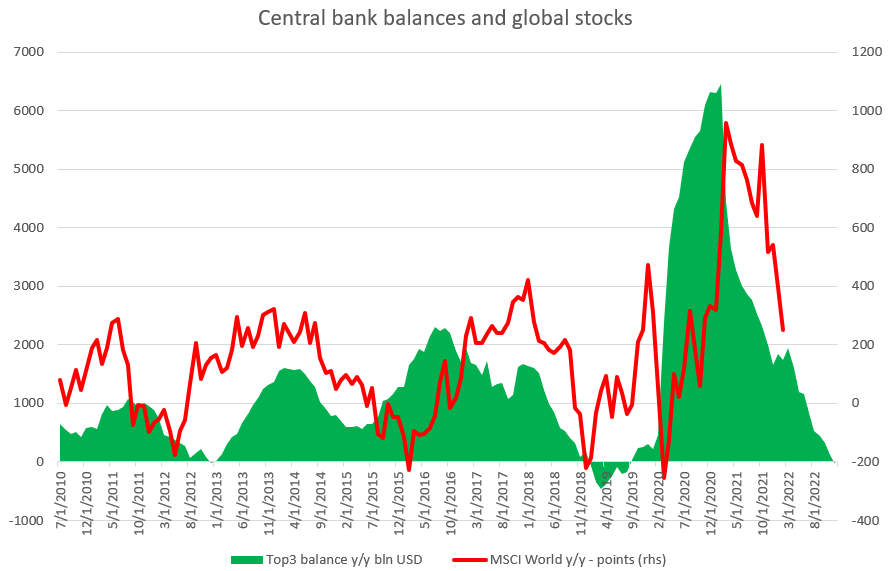

Higher rates are one thing but balance sheet shrinkage could be more important for stocks – there is clearly a correlation between annual balance sheet changes of the top central banks (Fed, ECB, BoJ – green area) and global stocks performance (red line). Source: XTB Research

Higher rates are one thing but balance sheet shrinkage could be more important for stocks – there is clearly a correlation between annual balance sheet changes of the top central banks (Fed, ECB, BoJ – green area) and global stocks performance (red line). Source: XTB Research

Key markets to watch

US100

The tech heavy index saw a major correction, mostly due to anticipated change in monetary policy. Tightening is negative but the market is oversold in the short run and the 13000 zone held up 3 times providing a basis for a possible short-term recovery – unless the Fed is very hawkish.

Gold

Gold

Gold prices have tested 2020 highs recently but are in a reversal as war-related fears abate somewhat. Here the rule is simple – the more hawkish Fed, the worse it is for Gold prices.

EURUSD

The pair remains in a strong downward trend and since the war is more negative for the euro in relative terms, this trend has gained even more traction. Hawkish Fed means stronger dollar but remember that market expectations are already high.

BOTTOM LINE: we expect the Fed to raise rates by 25 basis points. Expectations regarding future rate hikes are already high so the meeting must not be a “negative event” for the markets. However, future balance sheet shrinkage remains the biggest risk for stocks in 2022.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

BREAKING: Iran signals Europe will be 'a legitimate target' if EU joins war

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.